The Continuously Revaluating US Dollar

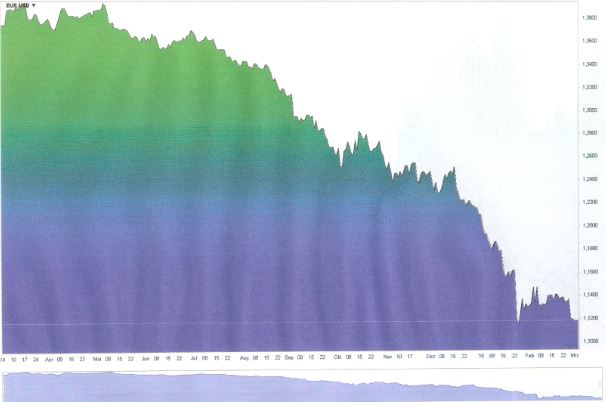

The longterm revaluation of the US dollar against the euro brings possible perspective of cheaper European goods on the American domestic markets.

On Friday, February 27, 2015, on the stock exchange in Frankfurt am Main the closing rate was 1 euro for 1.1190 US dollar, whereas the highest daily exchange rate jumped to the value of 1.1245 and the lowest daily exchange rate value declined to 1.1176. That means the exchange rate difference was minus 0.04 percent compared to last day´s trading value of 1.1195 dollar for 1 euro. Actually, the exchange rate value on Monday, March 2 was 0.42 percent higher than the day before in the amount of 1.1229 USD for 1 euro.

The common European currency quoted 1 month ago showed the closing value of 1.1372 USD for 1 euro, whereas the exchange rate loss of euro against the greenback in comparison to the exchange rate value of 1.2461 valid 3 months ago reached the value of minus 10.20%.

The devaluation of the euro against the US dollar in the period of the last 6 months reached the value of minus 15.19% with the closing exchange rate value of 1.3194 USD for 1 euro. Within the last year we've seen a closing exchange rate value of 1.3710 USD for 1 euro, which means the devaluation of euro against the greenback during the last year has been as high as minus 18.38%.

The closing exchange rate values on Friday, February 27 and on Thursday, February 26 with the values of 1.1190 USD and 1.1195 to the euro, respectively, remained relatively stable, but comparing the Friday with the closing trading value of 1.1364 on Wednesday, February 25 shows further revaluation of the dollar.

The above mentioned values show the continuous revaluation of the US dollar against the common European currency, which does not exclude the development towards euro-dollar parity. This development is good for European exporting companies, which will be probably more competitive on the US markets, but on the other hand is less favorable for the travellers from the euro-zone into the USA.

In contrast, the revaluation of the dollar against the euro means for US-based exporting companies some additional price disadvantages in competition in European markets.

One important reason for the euro devaluation was the decision of the European Central Bank (ECB) to purchase 1,140 billion euros in bonds. As of March 1 the ECB wants to pump 60 billions euros per month into the market until at least until September 2016. Such a strategy of the ECB in the form of euro-devaluation is to be understood as a measure for increasing of export competitiveness of euro-zone member countries.

Another reason for the devaluation of euro is the expansionary monetary policy of the European Central Bank. The lowest exchange rate value against the greenback of 1.10 was reached after the ECB's bond-purchase decision was announced.

The US dollar received recently support through positive US macroeconomic data, whereas the position of the euro is partly made more difficult through the non-acceptance of proposals about the extending of recovery credits to Greece.

However, the devaluation of the euro against the dollar is accompanied by euro revaluation against the Canadian dollar as a result of the unexpected lowering of the discount rate determined by the Canadian Central Bank. The main reason for this measure taken by Canadian central bankers was the falling price of crude oil.

Contrary to the revaluation of the US dollar against the euro, the current exchange rate of the greenback to the Swiss franc, at the value of 0.95 CHF for 1 USD, has remained relatively stable compared with the closing exchange rate from 1 month ago of 0.9723 CHF for 1 USD, a change of 2.9 percent.

Exchange rate development of the US dollar against Australian dollar

The exchange rates during the past week on the stock exchange in Frankfurt am Main trading the US dollar against the Australian dollar remained relatively stable with the daily closing trading values of 0.7827 USD for 1 AUD on Tuesday, February 24, 2015 and 0.7815 on Friday, February 27.. The daily closing exchange rate of these currencies 3 months ago was 0.8448 USD for 1 AUD, while 2 years ago it was 1 Australian dollar for 1.0221 USD ready for purchase, which makes exchange rate difference minus 23.88% in two years. The abovementioned price reductions of the Australian dollar have had a positive impact on the possibility of exports of Australian raw materials and agricultural products into the United States as well as increasing the attractiveness of Australia as a tourism destination for Americans.

I bought a house in Europe (cash) when the Euro was 1.33; just as about as expensive as it could get. I'm not too concerned as 1. it's paid for, et 2. I hope to keep for the rest of my life, however, it does kind of suck seeing the dollar value of my house go down.

The "commom European currency" is like a bunch of your neighbors (and sucker you) agreeing to support each other even though your approach to economics are completely different. Germany enforces its tax laws, Greece lets the wealthy 25% not pay and then wants the honest Germans to bail them out. Imagine if you had to pay for your neighbors new car because he couldn't. So your family cannot eat dinner...Tell them to sell the car. The Euro is a stupid idea, was before, is now and will forever be. Unless Europe agrees to a one government, one economy, one constitution the euro is toast and the world knows it. No wonder the $ is strong...what other global currency is there?

Agreed. It is not working and now they are kinda stuck with something extremely expensive to be undone! The future doesn't look very bright...