The Brexit Has Happened, Now Here’s How To Play It

The article originally was suppose to be “Why the UK must vote Brexit, and here’s how to play it,” but I’ve gotten so caught up preparing my own trades for this cataclysmic event that I didn’t have time to publish this article until 4am of the Brexit.

By now almost everyone knows what the Brexit is, but if for some wild reason you don’t I’ll sum it up in one sentence. It is the referendum put forth on whether the UK should leave the EU.

I have been following this very closely for months now. While I am an American, I pay a lot of attention to other political developments because I believe geopolitical developments have a great impact on my investments, and because they are usually very interesting.

Nigel Farage is the head of the United Kingdom Independence Party, and has been pushing for this referendum practically all of his political life.To see this referendum pass must be a dream come true for him. Farage is a huge Euroskeptic who has been fighting the centralized bureaucracy in Brussels for many years now. His brash and unapologetic style is refreshing and I have taken a liking to him over the past few months. His videos ranting in the EU Parliament are particularly amusing, once saying that the President of the EU had "all the charisma of a damp rag and the appearance of a low-grade bank clerk".

I truly believed that Brexit was going to happen because many of the people in the UK are fed up, and Mr. Farage has been actively campaigning garnering a lot of support. The Brexit voters were simply more determined than the Bremain voters. The torrential rain in the morning did not help the Bremain side, as many of the people voting to remain are millennials, and as we all know, millennials are inherently lazy. For the record I am for the Brexit, and if I were a UK citizen, I would have voted for it.

Here is why the UK had to vote Brexit in my view:

The remain camp continually said that 44% of their exports are tied to Europe so it's important they stay. That means 56% is outside the EU, and they don't have the same protections from Tariffs. While the EU is the world's largest common market, it only accounts for 17% of the world's GDP. That means that 83% of the world's GDP comes from outside the EU. Nigel Farage has it right that they will then be able to create new trade agreements with developing economies and their Commonwealth English-speaking allies like Canada, Australia, New Zealand, and then America.

With a net export status, the EU needs the UK more than they need them. No one is pretending it is going to be a magical transition. The first few years are going to be extremely difficult having to renegotiate trade, and the markets are going to react wildly. However, life is not about the short term, it's about the long term.

Immigration has increased tenfold in the last 30 years, and because of it, there is a lack of housing, and wages have been driven down. Decreasing both the number of incoming migrants and immigrants should reverse the trend of both wages and the availability of housing.

While immigration is currently controlled, migration is less closely monitored. With an EU passport, 500 million people can easily travel around Europe bringing all their troubles with them. After leaving the EU, it would be much harder to simply travel into the UK without proper identification, and a specific stated reason of business.

The simple argument of national sovereignty also comes to mind. Why shouldn't a country govern its own laws, instead of contracting them out to a European Court that regularly overrules the UK? I can tell you that the US would never allow such a thing and you see this by our lack of membership in the International Criminal Court.

There is also an idea that leaving the EU will cause a breakdown in security information sharing. It is absolutely preposterous that the intelligence community would stop sharing information. They would not punish the UK by refusing to share pertinent information on individuals relating to criminality or terrorism simply out of spite.

The US is not in an economic union with Europe, yet we some how communicate very well with the intelligence communities there. We also have extradition agreements with every country in Europe. To me, the creation of new extradition treaties is no different than the "European Arrest Warrant" that the Remain campaign has said would be completely at risk upon departure from the EU.

Some people point to how well the UK has done inside of the EU. I point to how poorly Portugal, Spain, Italy and Greece have done. The Mediterranean has absolutely been decimated by the Euro, and the continuation of membership in the EU will lead to further integration, and further trouble for the UK. Why would anyone want to stay on a sinking ship, I might add? The problem with the EU is that in times of a crisis, countries aren't able to individually lower interest rates or devalue their currency, or create economic stimulus without the approval of the EU. The adoption of the much stronger euro has destroyed the economies of much of the southern Mediterranean, and I suspect that they would all put up their own referendums for leaving in the near future, should the UK vote to leave in this referendum.

Many say that the UK needs the EU. I find that a laughable comment. How ever did the British survive without the EU for hundreds of years? Don’t forget that the British Empire was one of the most powerful empires the world has ever seen.

While the EU may have been good in theory, it was not viable in real life. The major problem with the EU is that it has shifted from an economic union to a political union. Many countries that are being admitted into the EU today are done so not because they will be mutually beneficial to their and all the member states economies, but because they are trying to "democratize" countries. Many of these countries simply bring nothing to the table, have very poor democratic histories, and have egregious human rights violations going on in their home countries, yet they are admitted anyway. The ridiculousness has continued offering EU status to countries that are only borderline European such as Turkey and the Ukraine.

This vote is not just about the UK, but a vote on whether to continue with the failed European Project or to end it in its entirety.

Now that we have finally gotten the political commentary out of the way, let's look at some investment options following the fallout. Many of these are going to be hard if you did not set these trades up beforehand believing there would be a Brexit, but regardless I believe they are still doable.

Short the Pound: This is the first and most obvious choice. The pound had made a nice little run up into the referendum as most people thought that the UK would choose to remain in the EU. It had rallied from 1.40 all the way up to 1.48, only to fall over 10% after the news broke of Brexit, down to 1.35. That’s the lowest the pound has been valued at in over 30 years! While I think this is something you had to be positioning yourself for, I think there is still some room to short the pound. The pound has already begin to move from 1.35 back up towards 1.37, but when the US markets open tomorrow, US investors may start dumping the pound like there’s no tomorrow. So in this case, the early bird really does get the worm, and you can still make some money if you're getting in your orders before everybody else.

Many Wall Street analysts have the pound falling below 1.2. While it looks like the pound is recovering for now I don’t think we can fully say that it has priced in the leave from the EU. Once more news emerges and the UK heads towards a possible (temporary) recession as it begins re-negotiating trade deals and figuring out legislation, I believe the pound will continue to fall. While the big move was from 1.48 to 1.35, the even bigger move could be from 1.37 to 1.2 or even lower. This trade definitely still has some legs, and getting in on it during the very brief relief rally in the pound may play out nicely for the more savvy investors.

Buy Precious Metals: In times of economic uncertainty people rush into precious metals. I suggest buying Gold (GLD) and Silver (SLV). People have already been buying up gold this year like it's going out of style, and I believe the trend is going to continue in a major way.

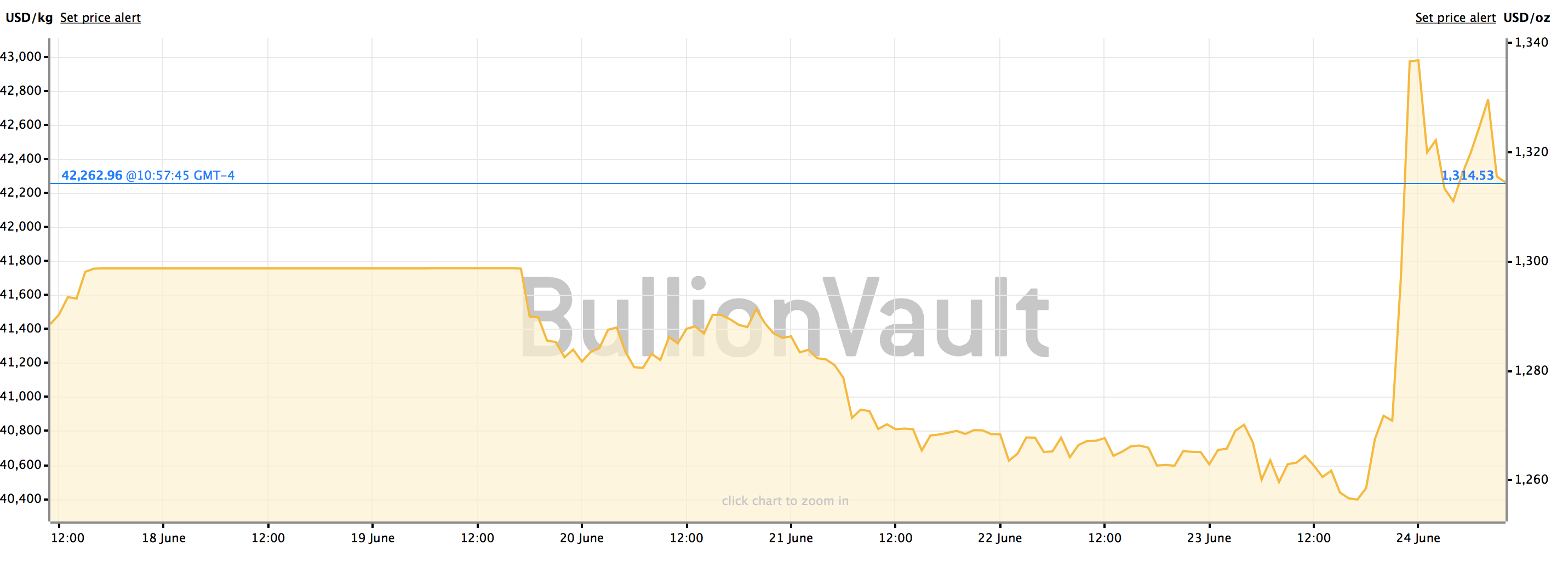

If you look at this week, there was a big dip in gold before it exploded on the “unexpected” Brexit news. I will zoom in on that for you. You can tell that Gold was not priced in for the Brexit. Many of the polls had Bremain winning, and so most investors put their money into equities expecting the broader market to rally once Bremain one. The aggressive short covering and rotation into gold resulted in the monster jump.

Buy the Dollar: The UK just left the EU and the pound is falling like crazy. Now, the certainty of the EU is in question and people will begin dumping Euros tomorrow as well. The safest currency in the world is probably US Dollars, and investors will probably begin buying up these safe haven assets as a hedge for what’s going on in their own country, because the economy in the US is still faring better than that of Europe, and because they expect other investors to pile in and are hoping to make money off of that. The Dollar index had hit a high of 100 a few months ago but has since retraced back into the low 90s. However, on news of the Brexit it shot up to 97. It has since fallen back into its comfort zone of around 95. I say comfort zone because this is the level it has liked to trade at the for the past few months give or take.

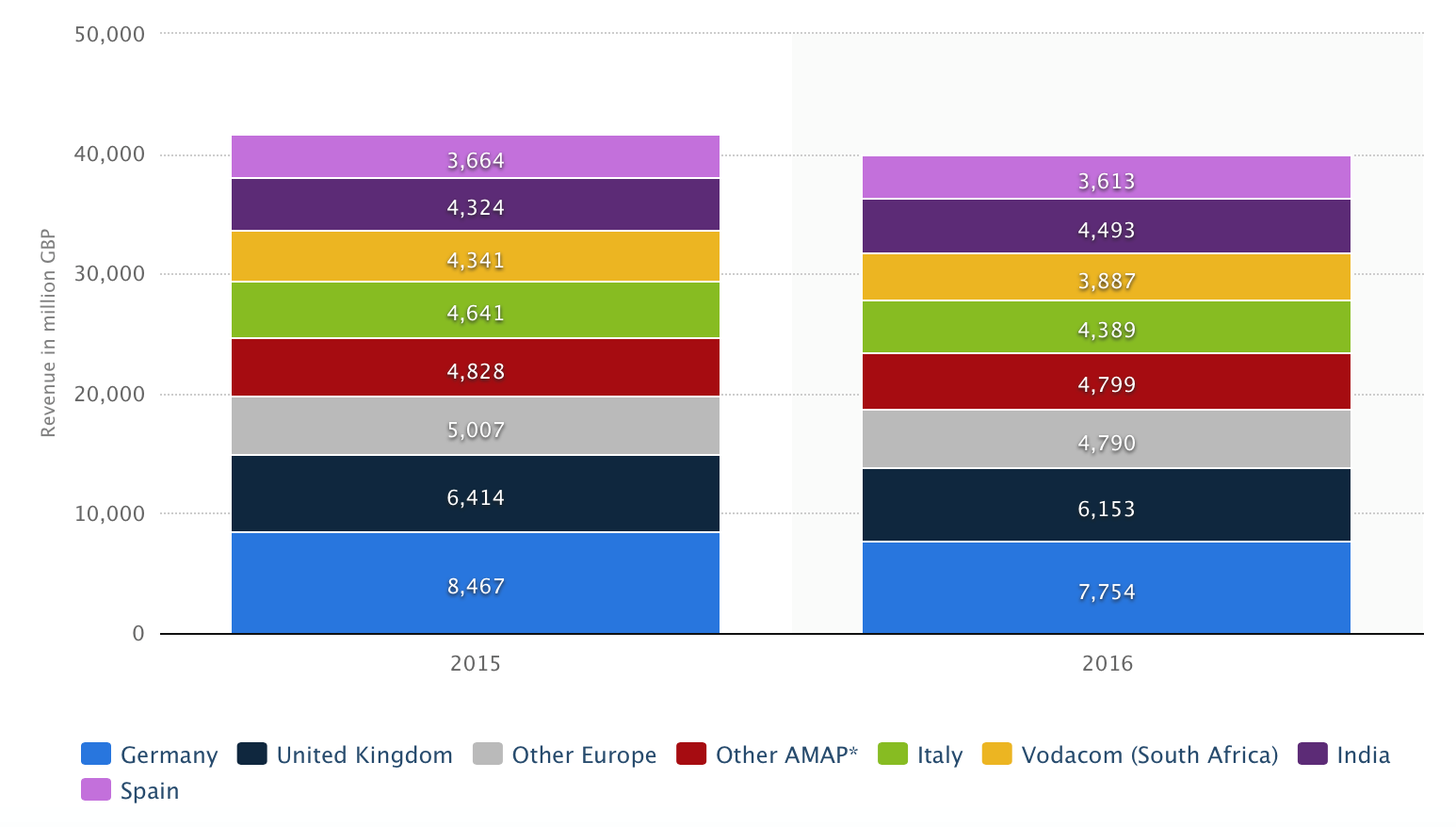

Buy Vodafone: This last pick seems like it’s coming out of nowhere, right? During these volatile markets, many have been turning to blue chip dividend stocks to weather the storm like AT&T (T) and Verizon (VZ), but another well run telecom is Vodafone (VOD) which I recently initiated a position in a few months ago. They have a lot going for them. They sold off the rest of their stake in Verizon Wireless a few years ago giving them a ton of cash. They are rolling out LTE across Europe which is much more advanced than most of the other cellular networks there. Its Indian unit, which is gigantic, is being ready to be IPO’d which should bring in a lot of money as well. Finally, Vodafone is merging its Dutch operations with Liberty Global’s (LBTYA) subsidiary in the Netherlands. The management just seems to be doing everything right, and the company seems to be firing on all cylinders. There was a slight drop in revenues due to foreign exchange movements, which as we talked about earlier has been a big theme this year. The good news is that most of Vodafone’s revenue comes from outside of the UK, so while the drop in the pound will have an effect on revenues, it won't be the be-all end-all. Regardless if revenue drops again the company is a great conservative pick, churning out a 5% dividend, with strong cash flow, and low debt. The company will trade down with the broader market in the morning, and you should use this as an opportunity to buy some shares.

Conclusion: You don’t need to fear financial collapses or market corrections, embrace them. There is always money to be made. The only thing you should be scared about is not having the proper game plan whether you’re a conservative investor or a professional trader / asset manager.

I am long T, VOD, GLD, SLV and the US Dollar, and short the British Pound