The Best ETFs Of 2014 And Potential Winners Of 2015

Many ETFs had a great year and 2015 will likely produce winners that outpace the broad indexes.

There was plenty of money to be made from investing in ETFs during 2014. While many investors avoided ETFs, out of concern that the weaker-performing stocks could offset the gains made by the stellar stocks, many ETFs made shocking advances during 2014.

There is now over $2 trillion invested in exchange traded products (exchange traded funds and exchange traded notes). In terms of popularity, the original ETF, the SPDR S&P 500 ETF (SPY) is still number one while the least popular ETFs for 2014 were emerging markets and gold as the iShares MSCI Emerging Markets ETF (EEM) and the SPDR Gold ETF (GLD) experienced the most-significant outflows.

December’s big surprise was the amount of money flowing into the Energy Select Sector SPDR ETF (XLE) which amounted to nearly $2 billion. Investors saw the oil companies’ stocks as bargains, with the price of crude below $60 per barrel. Die-hard oil bulls insist that 2015 will bring huge gains for the sector, as oil prices reach $80 per barrel.

As the Shanghai Composite Index continues to reach levels not seen in five years, investors have also demonstrated a great interest in ETFs which focus on “A shares” (or stocks traded in Shanghai, rather than Hong Kong). The Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (ASHR) has experienced over $300 million of inflows during the past two months. During 2014, the share price for the ASHR ETF skyrocketed 51.32 percent.

Other ETFs which invest at least 80 percent of their assets in securities which comprise the basis of the CSI 300 Index or the MSCI China A International Index have enjoyed similar gains. The share price for the Market Vectors ChinaAMC A-Share ETF (PEK) soared 44.62 percent during 2014. The KraneShares Bosera MSCI China A ETF (KBA) booked a 59.99 percent gain during the second half of 2014. (The KBA ETF was just created in March.)

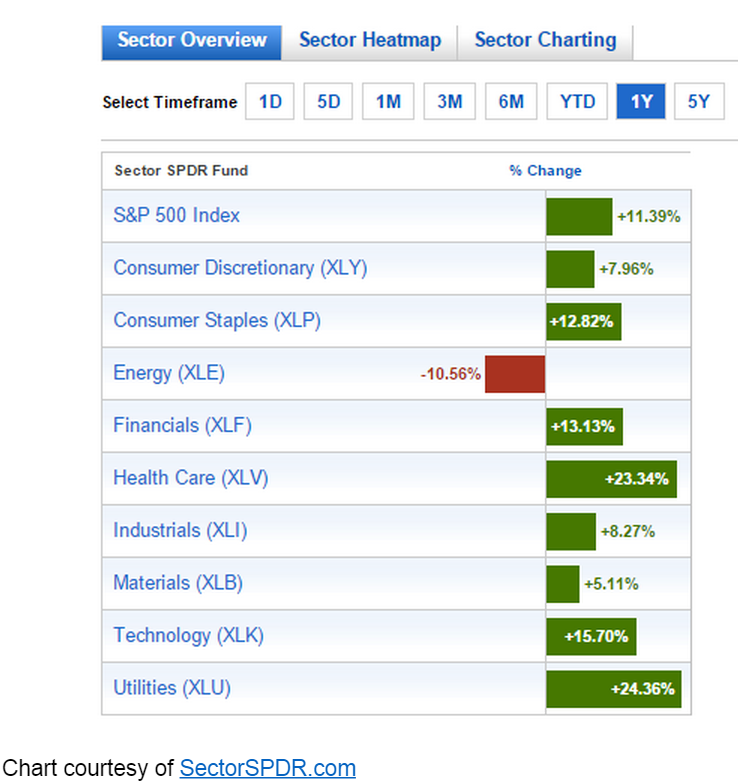

Investors who thought they were just playing it safe by investing in the “defensive” Utilities Select Sector SPDR ETF (XLU) found themselves enjoying a 24.36 percent gain at year’s end. XLU turned out to be the top-performing SPDR Select Sector ETF. On the other hand, investors who chased beta by investing in the iShares MSCI USA Momentum Factor ETF (MTUM) ended the year with a less-impressive, 14.61 percent gain.

Looking ahead to 2015, value investors are looking at the energy sector while others think the Russell 2000 (IWM) could outperform after a relatively mediocre performance in 2014. High risk plays could be found in Russia (RSX), and European ETFs like Germany’s Index (EWG) could get a boost if Mario Draghi and the ECB finally step up to quantitative easing and are successful in staving off recession and deflation in Europe.

Looking at the S&P sectors for 2014, we see that five sectors outperformed the S&P 500 while four underperformed.

Clearly, energy could be the best long term value play while Utilities have very likely advanced too far, too fast. January is the season for stock market forecasting and opinions run the gamut from stock market crash to a new leg up in the ongoing bull market. I don’t try to guess what is going to happen next but instead count on technical analysis to help identify what sectors could lead the way for 2015.

Disclosure: None.