The Bank Of Korea Has Now Joined The Global Easing Bandwagon

Image source: Pixabay

The Bank of Korea is entering an easing cycle, but at a glacial pace

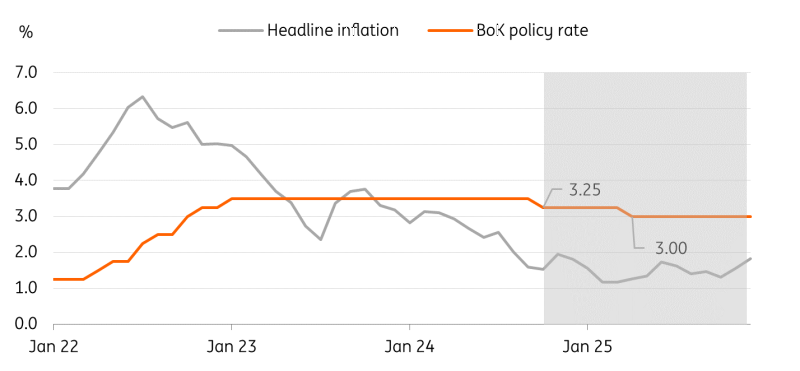

As widely expected, the BoK cut its policy rate by 25bp to 3.25%, in line with our expectations. Today's decision was not unanimous as there was one dissenting vote (Mr. Chang Yongsung) in favour of keeping the policy rate at 3.5%. For the outlook for the next 3 months, five out of six members would like to maintain policy rates at 3.25% as the BoK needs to monitor the impact of today’s rate cut, the US election results, and geopolitical risks. The other member remains open to further rate cuts. The government’s macroprudential measures are likely to stabilise the housing market so policy should focus on supporting domestic growth. Governor Rhee even said himself that it was “fine to see today’s decision as a hawkish cut”.

Macro conditions support the policy pivot

Inflation eased to 1.6% YoY in September, below the BoK’s 2% target for the first time since March 2021. The housing market in the Seoul metropolitan area seems to be gradually cooling down thanks to tighter mortgage rules and other home purchase measures. Meanwhile, domestic growth - construction and private consumption - have deteriorated in recent months. As a result, we believe that the BoK's policy focus should shift from containing inflation to supporting growth.

The BoK seems more confident about further inflation stabilisation as inflation is projected to be slightly lower than their August forecast of 2.5% YoY for 2024. However, the Bank of Korea still faces significant challenges to further easing. Signs of cooling in the housing market are still weak, and a rate cut by the BoK could trigger the risk of rising household debt. We also believe that the pace of the Fed's rate cuts will play a key role in determining the BoK's rate cuts in the future.

BoK watch

Analyzing Governor Rhee's comments and statement, a November cut is off the table and we see March as the likely time for the next cut. Inflation is expected to stay below 2% from now on due to a high base last year and lower demand-side pressures. The BoK seems to be well aware of the risks of rate cuts in the face of rising housing debt. Therefore, it will be a while before the BoK takes further easing steps. However, if the housing market stabilises, the timing of the next cut may come a bit earlier than March. However, we believe that the final rate of this cycle of cuts should be 2.75% - 3.00%. The BoK will set its policy rates relative to the Fed's federal funds rate, so there is limited room for the BoK to cut in the future.

The BoK's easing will be gradual

Source: CEIC, BoK, ING estimates

More By This Author:

Asia Morning Bites For Friday, Oct 11Hungarian Inflation Reaches Target After 44 Months

ECB Minutes Show What Difference A Few Weeks Can Make

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more