Taper Rejection: Mao Back On China’s Front Page

Chinese run media, the Global Times, blatantly tweeted an homage to China’s late leader Mao Zedong commemorating his 128th birthday. Fully understanding the storm of controversy this would create, with the Communist government’s full approval, such a provocation has been taken in the West as if just one more chess piece played in its geopolitical game against the United States in particular.

No. The Communists really mean it. Mao’s their guy again.

Let’s recall a warm and powerful smile on the 128th anniversary of the birth of late CPC leader #MaoZedong. pic.twitter.com/LNOwkTHr5r

— Global Times (@globaltimesnews) December 26, 2021

When Deng Xiaoping rescued China from the clutches of Mao’s madman aftermath in the late seventies (Mao died in September ’76 leaving no clear successor, and Deng outmaneuvered several rivals by 1978 to become de facto leader at the 3rd Plenary Session of the 11th Central Committee), he slowly came to the conclusion (with a huge assist from the smoldering rubble of the Soviet experience in the eighties) the Chinese Communists must turn their back on their first megalomaniacal leader.

Embracing a limited form of capitalism, Deng was as committed a communist as Mao had been but was able to more honestly and astutely see and appreciate the difference between theory (or plain stupidity, as in the Great Leap “Forward”) and practical reality. China had to grow itself into the wealthy society Karl Marx had long ago cautioned was the only kind of society “able” to transition to full-blown communism (Marx had argued against any pre-industrial system attempting this, yet those were the only types which fell for the “revolution” in the 20th century).

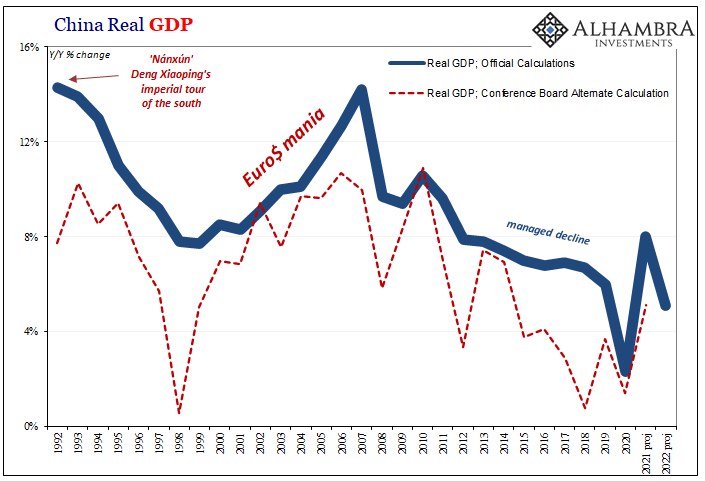

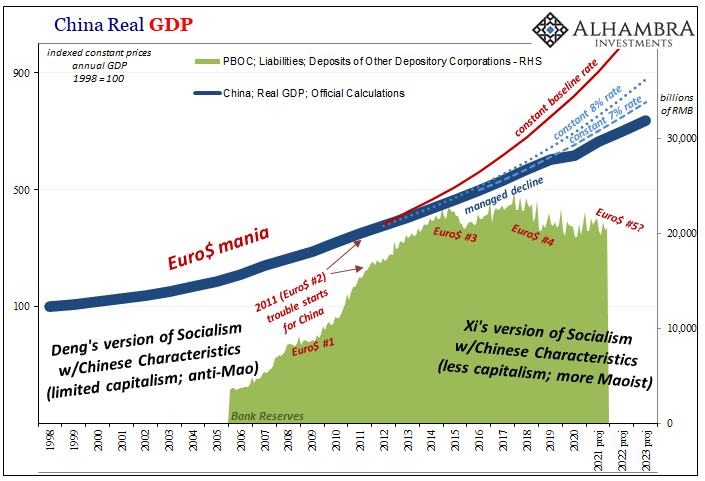

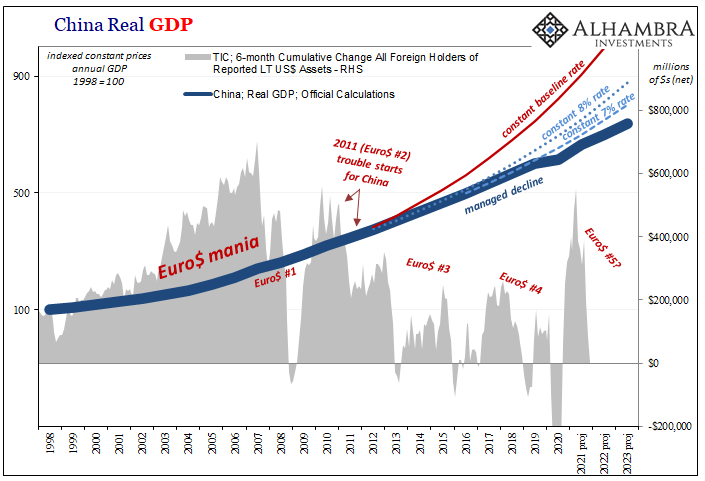

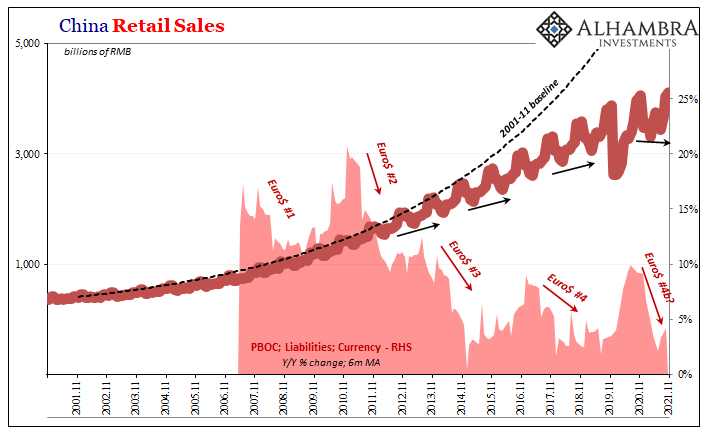

Not by luck or random coincidence, the Chinese especially following Deng’s 1992 (timing no coincidence) Southern Tour (Nánxún) embraced the eurodollar explosion then underway creating the most fertile conditions for the sweeping wave of globalization that China’s previously untapped mass of labor could most cheaply exploit. Oversimplifying a bit here, eurodollar expansion met Deng’s version of Socialism in a marriage made in hellish convenience; even China’s internal RMB monetary system would become totally dollar-ized!

It is unclear whether or not any one of Deng’s successors had anticipated a stop date, a terminal point for the experiment. What we do know today – not that any Western outlet seems to have figured this out despite how open the Chinese Communists have been about everything – is that Xi Jinping came to see his role as reversing course.

Earlier in March, Xi’s government took yet another authoritarian step whose only logical ends lay out this intended long march (double pun double intended). It is a punishable crime to slander China’s “heroes” or its “legends” such as Mao Zedong (and, obviously, Mr. Pooh himself).

China’s Communist Party has long policed dissent, severely restricting public discussion of topics it deems to be politically incorrect, from Tibet to the Tiananmen Square protests. The new law goes further. It has criminalized as slander topics that were once subjects of historical debate and research, including Mao’s rule itself up to a point. Since March, the law has been used at least 15 times to punish people who slight party history.

Under Xi, who took over in 2012 and has, like Mao, expertly manipulated his political power into de facto dictatorship using a purposefully cultivated Cult of Personality, first China’s economic trajectory followed by its political organization has been to move in determined, methodical fashion back in time toward Mao’s (dangerous) type of Socialism with Chinese Characteristics.

Eurodollar University’s Making Sense; Episode 14: LI V XI II (Li versus Xi, The Rematch)

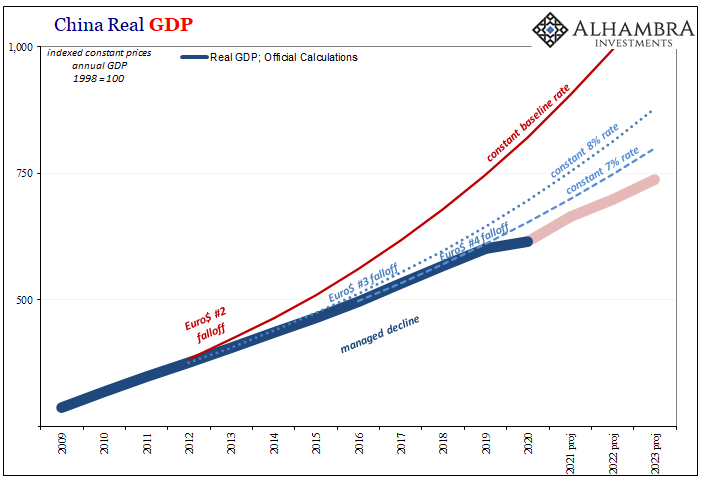

You can literally (sorry for the Millennial-speak, but I think it an appropriate use in this case) see the transition and its unfortunate timing – 2011. That was the year when Hu Jintao was supposedly preparing Li Keqiang to take over, a planned measure of stability that likely would have been dependent upon restarted globalization following the Great (and “somehow” global) “Recession.”

Instead, 2011 was another year of “unexpected” serious global monetary crisis the results of which in 2012 weren’t limited to just a European recession. China fell backward, too, hard, and suddenly Li was out and the hardcore military guy Xi fell right into the driver’s seat.

Then Document #9 slipped its way into the official stream of doctrine and dogma.

This all coalesced into what’s been called Document No. 9; an anodyne name given to what doesn’t really have an official title. It was simply the ninth paper to be published by the Party’s General Office in April 2013, but it was an unappreciated doozy which mapped out the direction China has eventually followed under Xi Jinping.

It enumerated “seven perils” that essentially targeted all forms of Western beliefs encompassing the neo-liberal trade and constitutional order we take for granted – and, at that time, it was widely believed the Chinese were still interested in incorporating more deeply to best position China as a further key partner in the global order. Up to then, it had been assumed – again, government intelligence – they’d become more like us.

When the dollars were flowing, they loved the dollars and us. Not that they aren’t, geopolitics has chilled to a decided Cold War temperature. Random coincidence?

No. Rate of change in economy goes down, rate of change in (geo)politics goes way up.

This isn’t just about the perilous position of Xi’s lusty, what-he-thinks necessarily jealous gaze toward Taiwan, or various other chess pieces being positioned around the board. There’s still the same economics (small “e”) here, too.

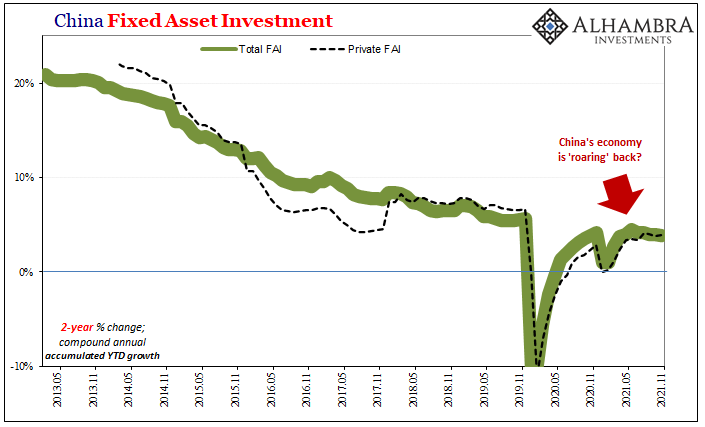

To start with, 2021 has been a total wipeout. The recession in 2020 was supposed to have led to a full recovery – haven’t you heard about the global inflationary boom? On the contrary, the Chinese economy was indeed hit hard but then failed to get much going afterward. Since around, oh, April and May this year it has taken another turn for the slow, not acceleration.

Stunned, officials around the Western world have refigured what they might be able to more plausibly expect from China’s economic system the world was told to expect would be able to bail everyone out of the coronavirus (overreaction) malaise.

For example, the World Bank last week rejiggered its (not useful) econometric models for the same sort of incorrect assumptions it had fallen victim to in 2012; again in 2015 and 2016; one more time in 2018 and 2019. As of these latest statistical simulations, real GDP in China (GDP as constant prices) is thought to rebound only 8.5% for the full year (rather than the double digits initially believed at its start) but then just 5.1% in 2022.

Ouch.

It wasn’t all that long ago when 8% real GDP growth was said to be China’s absolute bottom, its recession-line. And then it was 7%. Now…

Combine 2020 with 2021 plus that five in 2022, and that’s three years with way, way less Chinese economic expansion than the world had thought back when the world was preoccupied with figuring out how to live with less than eight.

Despite all of this – from the lack of post-COVID real recovery to the onrushing politics of Xi-hearts-Mao – here’s the World Bank’s favored punchline at the end of its China downgrade:

Though growth is projected to slow next year, we expect momentum to pick up, aided by a more supportive fiscal stance.

Was that a joke, an uncomfortable attempt at humor given how uncomfortable this has all become? How much more does Xi have to do, all out in the open, for this Keynesian nonsense to die? Like all the myths about the Federal Reserve and central bank “stimulus”, it is just taken for granted that everyone already does and always will follow the same standard neo-Keynesian format (while simultaneously assuming it actually works).

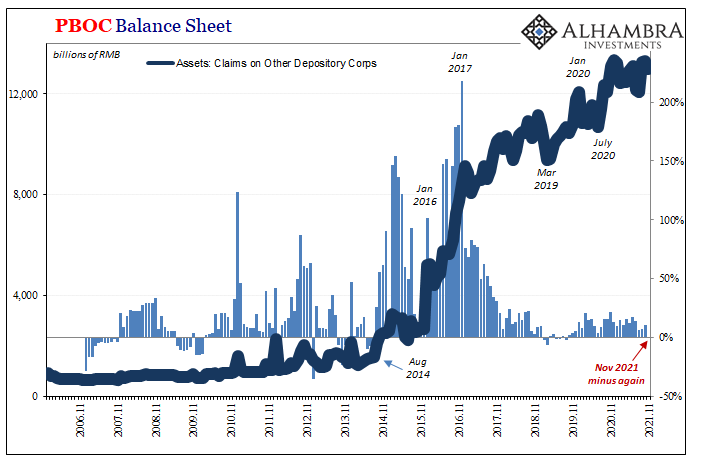

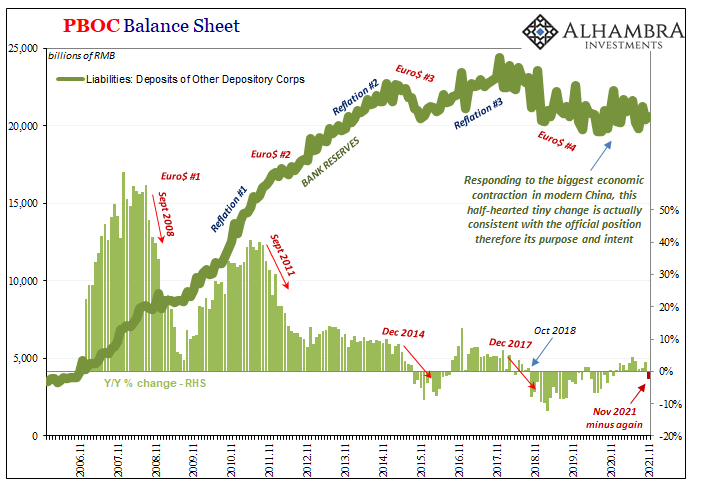

Speaking of central banks, Xi’s is likewise busy at work being conspicuously unworked up about Evergrande and all the same downside economic risks (“growth scare”) now clearly emerging across its monetary face. The PBOC isn’t going to be riding to the rest of the world’s rescue, either.

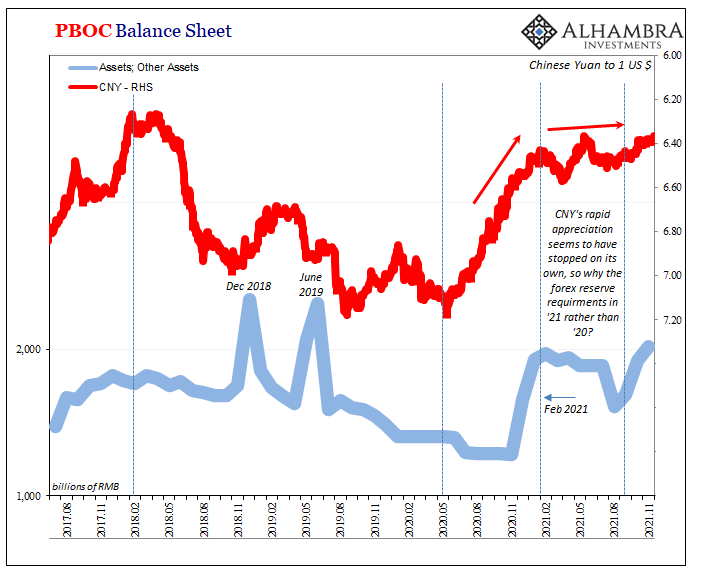

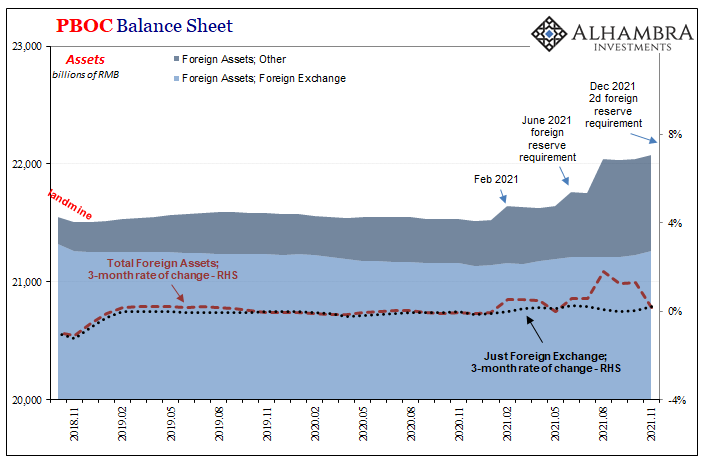

And that’s not all, monetarily speaking, as there are increasing signs and warning sounds coming from the PBOC or from its direction which indicate even more of those, behaving even more intensely (I’ll have to save them for another day; it has to do with CNY, possibly CNH, and almost certainly one or both of the “others”).

When the eurodollar system was working, or, at least it appeared to be, globalization opened the door for China to shake off its Maoist madness and narrowly (something happened in 1989, though in China you’re not allowed to say, type, or think what it was) avoid joining the Soviets in their highly deserved fate. The dollars disappeared first in ’08 and then for good in ’11 despite repeated monumental QE’s (what floods?), globalization became a bad word, and today Mao is back on the theoretical throne right next to Emperor Xi.

But inflation, right?

What’s even more comical is how the same Global Times which tweeted the provocative Mao lovefest shown at the outset had right before it tweeted another (immediately above) which played into these same Western economic conceits. The Communists are better at Economics than Economists, though neither has much to offer real economies.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more