Swiss National Bank Unexpectedly Kicks Off The Rate Cutting Cycle

The Swiss National Bank is the first major central bank in the developed world to cut rates in this cycle, lowering its main key rate from 1.75% to 1.50%. This came as a surprise, as the status quo was expected by the consensus.

Inflation forecasts sharply revised downwards

At its March meeting, the Swiss National Bank – known for its sometimes unexpected decisions – once again decided to take everyone by surprise and cut its key rate by 25bp to 1.5% from 1.75%. To justify this decision, the SNB points to the sharp fall in inflation in Switzerland, which has been below 2% since June 2023 and is therefore in line with the central bank's target. In February, inflation in Switzerland stood at 1.2%.

In addition, the SNB's new conditional forecasts have been sharply revised downwards. At its last meeting in December, it was expecting inflation to average 1.9% in 2024 and 1.6% in 2025, but is now forecasting inflation to average 1.4% in 2024, 1.2% in 2025 and 1.1% in 2026, despite the cut in the key interest rate. For each quarter, the inflation forecasts have been cut by 0.5 to 0.6 points, providing ample justification for the lower rates. The SNB justifies its lower forecasts by lower-than-expected inflation for certain goods and a downward revision of second-round effects.

The rise in the value of the Swiss franc over the past year (which has helped to limit inflation but is now weighing heavily on the competitiveness of Swiss companies) and the need to support growth also played a role in the decision, according to the SNB.

Further rate cuts to come

Looking ahead, the SNB stated "we will adjust our monetary policy again if necessary to ensure inflation remains within the range consistent with price stability over the medium term". Unless there is a very nasty surprise in the international economic environment that causes inflationary pressures to rise sharply again, the SNB's tone today and the huge downward revision to inflation forecasts suggest that a further cut is very likely in June to bring the key rate down to 1.25%. A further rate cut in September is also likely, but will obviously depend on the central bank's inflation forecasts at that time.

Stronger franc resonates with the SNB

Notably, the SNB’s policy statement made two important references to the strength of the real Swiss franc. This has appreciated around 7% year-on-year and, as Chairman of the Governing Board Thomas Jordan acknowledged in a speech in January, has materially contributed to lower inflation.

In effect, the years 2022 and 2023 - when the SNB actively sought a stronger nominal Swiss franc to fight inflation – have been the exception for the SNB. Typically, the central bank has been fighting franc strength for decades. But in 2022 and 2023, it sold CHF22bn and CHF133bn of FX respectively in order to generate nominal CHF appreciation. We suspect that story has changed this year, and that 2024's first quarter FX intervention data may show the SNB returning to the more typical trend of an FX buyer when it is released late June.

EUR/CHF is understandably higher on today’s surprise cut. It is unclear how much further it needs to rise from here (0.97/98) since attention will now turn to the European Central Bank (ECB) and how quickly it follows suit.

That said, the market is now pricing over 90bp of ECB rate cuts this year, while our team expect only 75bp. As such, there could be some more room for widening of the two year EUR:CHF swap differential – which has been a key driver of EUR/CHF since last October. A further widening here – say to last October’s wides of around 222bp – could be worth another couple of big figures to EUR/CHF upside.

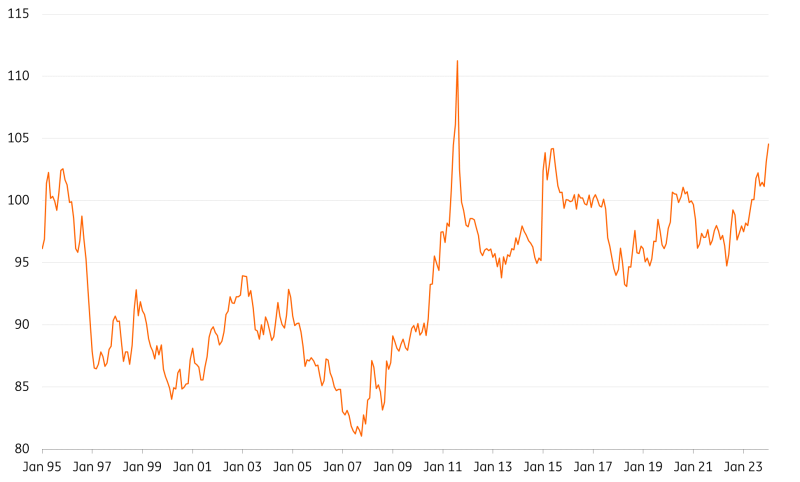

Real trade-weighted CHF testing multi-year highs

Bank of International Settlements

More By This Author:

FX Daily: Fed Fires Up The Soft Landing StoryFrench Business Sentiment Points To A Slow Recovery In Activity

Rates Spark: Unchanged 2024 Fed Dot, BoE To Sit Tight

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more