Surprise Hungarian Budget Surplus In July

The budget posted a surplus in July, despite some extraordinary spending. Though this looks like a clear positive, it might be a sign that inflation in July was much stronger than we anticipated.

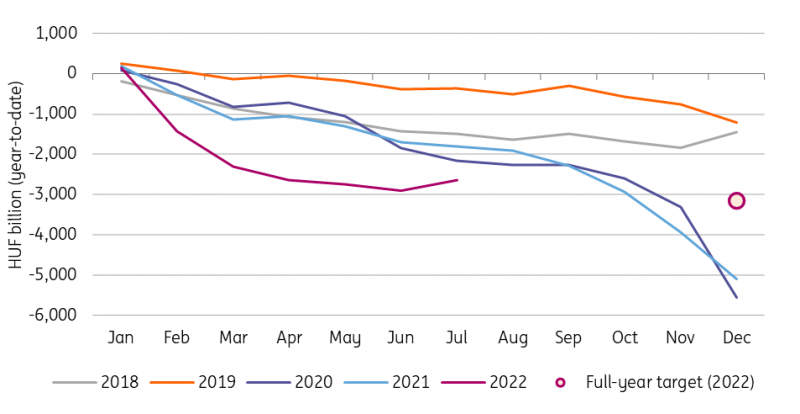

Hungary's budget posted a HUF 255.7bn surplus in the month of July - a major upside surprise. In the past couple of years, the budget accumulated a shortfall in July, but not this year. But this is not the only reason the result came as a surprise. The government made an extraordinary pension adjustment (due to high inflation) in July worth roughly HUF 200bn. With this positive development, the cash flow-based year-to-date budget deficit improved to HUF 2.636.5tn. This amount is equal to 84% of the full-year target.

Cash flow-based year-to-date central budget balance

Source: Ministry of Finance, ING

Despite the improvement in July, the big picture still looks bad. But the second half of the year will bring a lot of change. In June, the government decided to cut the budget’s expenditure side by roughly HUF 1.200tn. Moreover, measures were introduced on the revenue side, including raising the public health product tax and excise duty as well as imposing special taxes on specific sectors (“windfall taxes”). In all, these will generate roughly HUF 800-900bn of extra revenue in the budget in the coming month.

But there is more. The government decided on further changes in July which will impact the budget in the second half of the year. With the revised small taxpayers’ itemized tax (KATA), the government could generate an additional HUF 200-300bn income. The change in the utility bill support scheme will also give some relief on the expenditure side, improving the balance by roughly HUF 500-600bn, according to our rough estimation. The measures will be more than enough to cover the previously identified budget gap to meet this year’s deficit target.

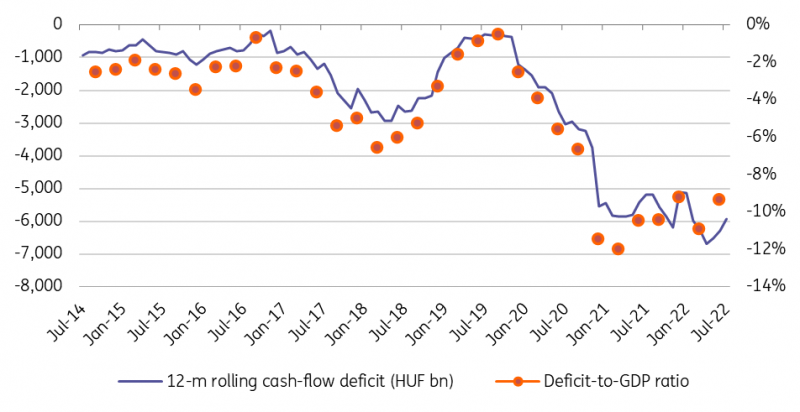

Besides these measures, the government will enjoy the benefits of rising inflation as well. The ballooning revenue side has a lot to do with the 9.4% average inflation during January and June, while the surprisingly strong July budget performance might be a sign that the July inflation reading was even higher than we initially estimated (our call is 13.3% year-on-year for the 9 August data release), boosting revenues further.

12-month rolling cash flow budget balance

Source: Ministry of Finance, ING

Looking ahead, there are still upside and downside risks in the budget for 2022, but the measures taken will give more than enough wriggle room for decision-makers to meet this year’s 4.9% of GDP deficit target. Because of the expected strong nominal GDP growth (due to the good start of the year in real terms and still rising inflation), the 2022 debt reduction plan is not in jeopardy. When it comes to next year though, the biggest looming question is the Rule of Law debate and its budgetary implications. Our base case scenario sees an agreement struck between Budapest and Brussels, probably in September or October, which will open the way for significant revenue transfers from the EU and take a heavy burden off the 2023 budget.

More By This Author:

FX Daily: Fairly Priced

Asia Week Ahead: Regional Trade Figures And China’s Inflation Report

Bank Of England Raises Rates As Recession Looms

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more