Strong Polish Data Suggests The Pause In Rate Cuts Will Continue

Image Source: Pixabay

December data gives the National Bank of Poland grounds to continue its pause in the monetary easing cycle, as wage growth accelerated, while activity growth in industry and construction came in well above market expectations. Policymakers should resume rate cuts in March as new projections are expected to point towards low inflation pressure ahead

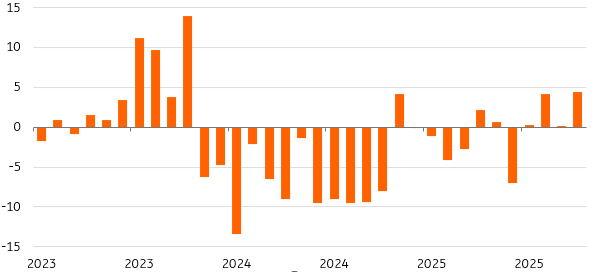

Wage growth accelerated

StatOffice data showed a solid picture in the labour market at the end of 2025. Wage growth, which had been slowing in recent months, bounced back to 8.6% year-on-year from 7.1% YoY amid strong wage dynamics in manufacturing. The strong reading was boosted by annual bonuses. The decline in employment eased to 0.7% YoY from 0.8% YoY in November. The number of jobs fell by nearly 4K compared with a drop of 9K in December 2024.

Wage growth accelerated in December

Average wage in enterprise sector, %YoY

Source: GUS.

Industrial output surged

Industrial output increased by 7.3 YoY in December, reaching the highest annual growth rate since September. Strong growth in the manufacture of investment goods bodes well for fixed investment performance in 4Q25. At the same time, PPI deflation deepened to 2.4% YoY from 2.3% YoY in the previous month. Rapidly rising imports of cheap goods from China is putting pressure on tradable goods prices and competes strongly with many domestic sectors, like the manufacture of textiles, furniture, electronics and electrical equipment.

Industry finished 2025 on a strong footing

Industrial ouput, 2021=100 (SA)

Source: GUS.

Construction also solid

Construction output jumped up by 4.5% YoY after an increase of 0.2% YoY in the previous month. Double-digit growth in specialised works (23.0% YoY) and building construction (13.3% YoY) was accompanied by a drop in civil engineering (-7.2 YoY). The final quarter of 2025 saw construction activity bounce back after two consecutive quarters of annual declines. We expect a gradual recovery of this sector amid a surge in EU money (including the Recovery and Resilient Fund) and lower interest rates, but the beginning of 2026 may be difficult due to harsh weather conditions (frost and heavy snowfall).

Specialised works and building construction strong in December

Construction output, %YoY

Source: GUS.

Policymakers may extend pause in monetary easing

Strong activity in the real economy in December and the acceleration of wage growth suggest that policymakers may stick to their wait-and-see approach in February. In December, the MPC decided to pause its cutting cycle in order to assess the impact of 175bp of cuts delivered in 2025. Policy rates remained unchanged in January, but some market participants speculated that the NBP could resume cuts as soon as February as the tone of central bank governor Adam Glapiński was perceived as dovish.

Our baseline scenario still assumes that rate setters may cut rates in March, as the new macroeconomic projections should make them more confident in the sustainability of low inflation, which was already below the central bank's target of 2.5% in December. Since the risk of undershooting the target is rising over the medium term as well, we expect three rate cuts this year and see the target rate at 3.25%.

More By This Author:

FX Daily: Davos Relief Can Bring Focus Back To Macro And FedThe Commodities Feed: US Natural Gas Surges Amid Freezing Conditions

UK Inflation Likely To Fall To 2% In April Despite Latest Uptick

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more