Strong Japanese Industrial Output And Accelerating Inflation Raise Chances Of December Rate Hike

Higher-than-expected Japanese inflation in October, together with improvements in production and retail sales, suggests growth is bottoming out toward quarter-end, while price pressures continue to intensify. The Bank of Japan may consider an earlier rate increase.

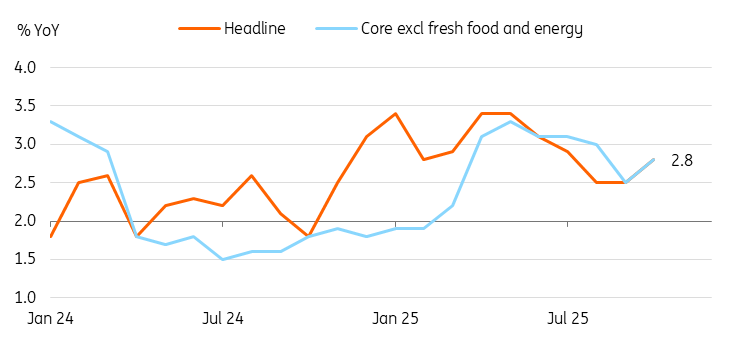

Tokyo CPI inflation beat expectations in October

Tokyo CPI inflation increased 2.8% year-on-year in October (vs 2.5% in September, 2.4% market consensus). October is typically the month when companies adjust prices. A 0.6% month-on-month, seasonally adjusted, increase suggests businesses are raising final prices in response to input price hikes. Prices increased for both goods (0.9%) and services (0.4%), with notable gains in labour-intensive sectors like transport, communication, and entertainment.

The Bank of Japan views this as evidence that sustainable wage growth is driving prices higher. Meanwhile, food prices rose, but at a slower pace. Utilities prices jumped as government subsidies ended. We expect core CPI to remain around 2.5% by the end of this year, backed by solid wage growth.

The Takaichi government plans to fight inflation by reducing the gasoline tax and offering temporary discounts on winter power and gas bills. This may lower headline inflation early next year.

Tokyo CPI rose stronger than expected in October

Source: CEIC

Industrial output rebounded stronger than expected 2.2% MoM sa in September, for the first time in three months

Industrial production decreased by 0.1% quarter-on-quarter in the third quarter, primarily due to reductions in output related to US tariffs. Transportation equipment and iron/steel output declined in September, likely due to the lingering effects of US tariffs. Still, the recent easing of tariff tensions in several countries should support Japan's production rebound in the coming months. Semiconductor equipment sales rose for a second consecutive month, suggesting that strong global chip demand continued. Meanwhile, retail sales rebounded 0.3% MoM in September, but missed the market consensus of 0.8%.

Both IP and retail sales fell in Q3, indicating a GDP contraction for 3Q25. However, a rebound in September points to a gradual economic recovery in the current quarter.

The BoJ cited trade uncertainty as the reason for pausing rate hikes yesterday. However, today’s data indicates a possible economic recovery that could support future rate hikes.

Today’s data supports our view that the BoJ is likely to hike rates in December.

More By This Author:

The Commodities Feed: OPEC+ Set For Another Supply IncreaseRates Spark: EUR Curve Wants To Steepen, But Faces Resistance

Florence Press Conference Confirms ECB Remains Comfortable In Its ‘Good Place’

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more