Stocks Reverse 2% Overnight Loss, Turn Green As Oil Nears $100

Global stocks and US futures have staged a remarkable recovery and erased overnight losses of as much as 2.2% as investors bet that the surge in geopolitical tensions will mean a less hawkish Fed and as investors clung to hopes that Moscow's deployment of troops to two breakaway regions in eastern Ukraine will be as far Russia goes. S&P 500 futures were fractionally in the green at 715am ET after earlier sinking 2.2% and eyeing correction territory; European stocks trimmed losses as investors weighed the risk of geopolitical tensions in Ukraine. Benchmark Treasury yields pared their decline to trade at 1.92% and gold slipped.

(Click on image to enlarge)

The spectre of war on Europe's eastern flank had flared on Monday, sending oil prices to a seven-year high, less than a $1 away from $100, after Russian President Vladimir Putin ordered troops into the Donetsk and Luhansk regions of Ukraine.

(Click on image to enlarge)

On Monday, Russian President Vladimir Putin recognized two self-proclaimed separatist republics in eastern Ukraine and ordered the Defense Ministry to send what he called “peacekeeping forces” to the breakaway regions. In response, the United States and its European allies started to announce harsh new sanctions in response, with German Chancellor Olaf Scholz warning that the Nord Stream 2 gas pipeline would now be denied certification to begin operating.

The prospect of a major European war had prompted investors to dump shares and other riskier assets while Brent crude jumped more than $3 to top $99 at one point for its highest since September 2014, reflecting fears that Russia's energy exports could be disrupted by any conflict.

"We can be pretty confident that this will put upward pressure on oil markets and will be watching gas prices pretty nervously as we wait to see what sanctions are introduced," said Kit Juckes, macro strategist at Societe Generale

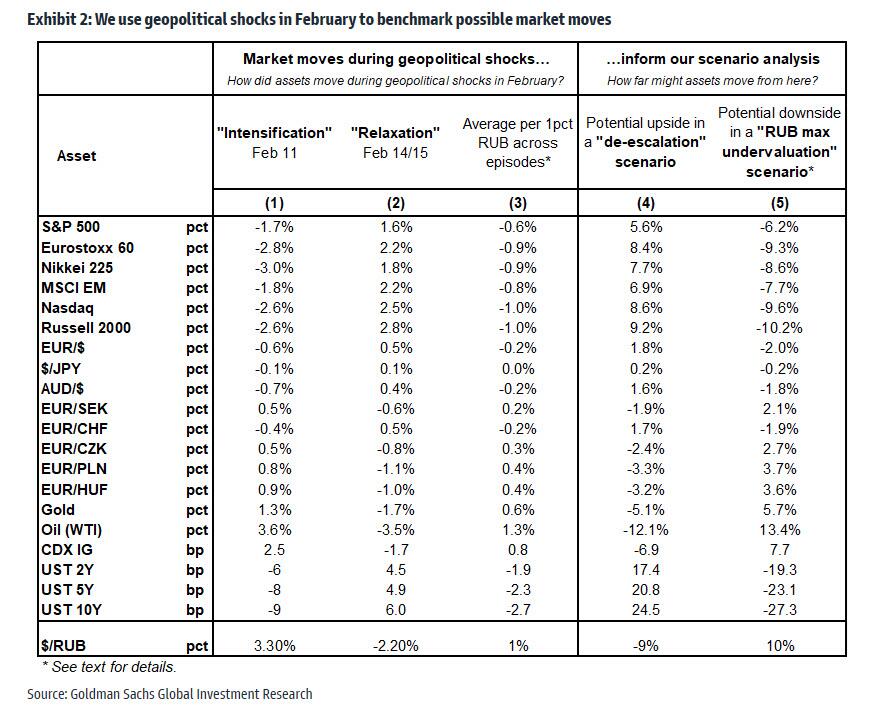

However, after US equity futures plunged on thin volumes during Monday's holiday, sentiment has turned more positive as traders wager that the unfolding scenario has already been priced into stocks. If the situation de-escalates, a quick 5% rally in U.S. stock markets is possible, according to Morgan Stanley strategists, while Goldman calculated that a de-escalation would lead to a 5.6% jump in the S&P.

(Click on image to enlarge)

"We are not in the clear, but that gives a path to de-escalation," said Trium Capital fund manager Peter Kisler, referring to the news on Ukraine border recognition.

As usual, Nasdaq futures are hit more than their S&P peers - due to the added threat of a hawkish Fed and higher rates - dropping 0.5% and also recovering a much bigger earlier loss. Major names were trading off their lows of the session: shares in iPhone maker Apple -0.8% premarket, Microsoft -1%, Amazon.com -1%, Meta Platforms -1.4%, Google-owner Alphabet -0.4%, and Nvidia -2.1%. Tesla fells 1.6% premarket, poised to worsen 19% drop YTD and on the verge of a bear market, however major names were trading off their lows of the session. Here are some of the biggest U.S. movers today:

- Oil and gas companies are among the few gainers in U.S. premarket trading, as oil price nears $100 amid worsening tension over Ukraine. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) is trading above triple-top resistance relative to the SPY.

- U.S.-listed Chinese stocks declined in premarket trading as concerns resurfaced over Beijing’s regulation of the technology sector. Alibaba Group (BABA) fell 4.3% following a report that Chinese authorities told banks and state-owned companies to report their financial exposure to Ant Group Co.

- Megacap U.S. tech stocks trimmed earlier drops as investors evaluated the impact from growing tensions between Russia and the West over Ukraine. Apple (AAPL) -0.5%, Microsoft (MSFT) -0.7%, Meta Platforms (FB) -1%.

- Cryptocurrency-linked stocks slump as bitcoin stays near a more than two-week low. Marathon Digital (MARA) -5.4, Bit Digital (BTBT) -6%.

- Watch U.S. cybersecurity stocks amid escalating Ukraine tensions and worries over potential cyberattacks. Watch shares in Palo Alto Networks (PANW US), Crowdstrike (CRWD), Zscaler (ZS).

- Yandex, which operates an Internet search engine and web portal in Russia, plunge 18% in U.S. premarket trading amid intensifying tension between the West and Russia over Ukraine.

- Celanese gets its only negative analyst rating as Piper Sandler cuts to underweight after the chemicals company announced on Friday a deal to buy the mobility and materials arm of Dupont de Nemours.

In Europe, the Stoxx 600 Index also turned green after falling as much as 2% earlier. European stocks with exposure to Ukraine and Russia slumped again on Tuesday as tensions intensified, after Russian President Vladimir Putin recognized two self-proclaimed separatist republics in eastern Ukraine and Western nations threatened new sanctions. Companies involved with the controversial Nord Stream 2 pipeline linking Russia to Germany dropped amid concerns that sanctions could target the suspension of the pipeline. BASF, Uniper and Engie declined, while Shell - which is also linked to the pipeline - rose on soaring oil prices. Here are some of the other stocks moving in the rest of Europe:

- Other energy companies exposed to the region, including Austrian oilfield services company Petro Welt Technologies, and miners with assets in Ukraine or Russia, including London-listed Ferrexpo and London-listed Russian gold-miner Petropavlovsk all dropped.

- Polish-listed Ukranian agriculture companies were mixed, with Astarta, Ovostar and Industrial Milk lower while Kernel rose.

- Banks including Austria-based Raiffeisen Bank, which had almost 14 billion euros in loans outstanding in the two countries at the end of last year -- equivalent to 90% of its equity capital -- fell.

- Hungary’s OTP Bank, France’s Societe Generale and Italy’s UniCredit also declined, reflecting the lenders’ loan exposure to the region.

- Consumer companies including bottling company Coca Cola HBC, beer stocks Carlsberg and Heineken, grocery company Metro AG and Polish fashion retailer LPP dropped.

- Event organizer Hyve Group, which gets about 30% of its revenue from Russia, slumped as much as 8.2%.

The threat of new Russian sanctions and disrupted supply kept energy prices elevated, with natural gas prices soaring more than 13%. The ruble climbed after dropping the most since March 2020 the previous day.

"Europe is in a very, very uncomfortable situation," said Michael Hewson at CMC Markets. "What you're getting is a classic risk-off play here."

Earlier in the session, Asian stocks traded negative. The ASX 200 declined as the geopolitical concerns sunk most sectors although energy and gold miners bucked the trend after oil prices advanced on the geopolitical risk premium and with the precious metal underpinned by haven demand. Nikkei 225 was pressured as detrimental currency flows added to the headwinds for the index. KOSPI suffered after daily COVID-19 cases topped 100k for a third consecutive day Hang Seng and Shanghai Comp. conformed to the glum mood with notable weakness in the tech sector after China told banks and state firms to report their exposure to Alibaba affiliate Ant and with Tencent also subdued by recent concerns of a crackdown, while Rusal shares dropped nearly 20% on geopolitical tensions and looming Russian sanctions

Japanese equities fell for the sixth time in seven sessions as tensions between the West and Russia over Ukraine again intensified. Electronics and auto makers were the biggest drags on the Topix, which fell 1.6%, with all but three of its 33 industry groups in the red. Tokyo Electron and Fast Retailing were the largest contributors to a 1.7% loss in the Nikkei 225. Russian President Vladimir Putin recognized self-proclaimed separatist republics in eastern Ukraine and ordered the Defense Ministry to send what he called “peacekeeping forces” to the regions. Western leaders condemned the moves, and the U.S. prepared to announce new sanctions against Russia. The U.S. has warned of a possible Russian invasion of Ukraine, a claim the Kremlin has repeatedly rejected. “Points to watch include what kind of economic sanctions the U.S. would be implementing and how much that would affect inflation or the economic situation,” said Shogo Maekawa, global market strategist at JP Morgan Asset Management. Comments from Federal Reserve officials also bear watching, “whether it be about rate increases this year or about Ukraine.”

Australian stocks dropped to the lowest in two years, with the S&P/ASX 200 index falling 1% to 7,161.30, its lowest close Feb. 7, as banks weighed. The benchmark tumbled alongside regional peers amid intensifying tension between the West and Russia over Ukraine. Nanosonics was the worst performer in Australia following the company’s 1H results. Cochlear was the biggest gainer after reaffirming its full-year profit forecast. In New Zealand, the S&P/NZX 50 index fell 0.3% to 12,114.63

In rates, treasury futures erased Asia session gains as U.S. stock futures rebound and risk-off move on Ukraine developments takes a breather. U.S. yields were cheaper by 6.5bp to 1bp across the curve with front- end led losses flattening 2s10s, 5s30s spreads by 5bp and 3bp; 10-year yields around 1.945%, cheaper by 1.5bp vs. Friday close -- bunds and gilts both 1bp cheaper in the sector vs. Treasuries. Yields were cheaper across the curve, led by front-end, flattening spreads. U.S. session’s focus is also on auctions, which start with $52b 2-year note sale at 1pm eastern time. German government bond yields hit their lowest level since Feb. 4 while U.S. Treasuries rallied.

In FX, the Bloomberg Dollar Spot Index eased as the greenback weakened against most of its Group-of-10 peers; the Treasury curve flattened as front-end yields rose by up to 4bps and the 10-year yield remained lower. Scandinavian currencies were the best performers as risk sensitive currencies advanced. The euro snapped three days of losses to rise over $1.1350 and bunds erased early gains. The pound fell, reversing Monday’s gains. The Japanese yen erased early gains that took it close to a three-week high of 114.48 per dollar while the Swiss franc held steady near the previous day's one-month high.

The rouble, which has been hammered by the rising tensions in recent weeks, swept higher in FX markets while German equities - seen as more vulnerable because of the country's heavy reliance on Russian gas - also erased losses of more than 2% to trade flat. The rouble has lost 12% on prospects of a Ukraine invasion, with Russian equities down by a third.

In commodities, WTI and Brent were underpinned on geopolitics, with Brent soaring to a high of $99.50/bbl although the benchmarks are off best levels at present. Saudi Arabia, Kuwait and Iraq would struggle to cover the shortfall in crude supply created by a blanket ban on Russian energy exports as they have already allocated their annual term supplies, according to Argus sources. Qatar's Emir has received a letter from Russian President Putin regarding supporting and strengthening bilateral relations. Spot gold lies below USD 1900/oz, as havens given up recent gains as officials are yet to label the Russia situation as a full-scale invasion.

Fears of supply disruption from Russia sent London-traded aluminium to a more than 13-year high of $3,350 a tonne while benchmark nickel hit its highest since August 2011. Shanghai-traded nickel hit a record high .

Looking at the day ahead now, data releases include the German Ifo business climate indicator for February, whilst from the US there’s the FHFA house price index for December, the flash PMIs for February and the Conference Board’s consumer confidence measure for February. Central bank speakers include Atlanta Fed President Bostic and BoE Deputy Governor Ramsden. Finally, earnings releases include Home Depot and Medtronic.

Market Snapshot

- S&P 500 futures down 0.1% to 4,340.50

- STOXX Europe 600 down 0.7% to 451.82

- MXAP down 1.4% to 185.33

- MXAPJ down 1.4% to 610.18

- Nikkei down 1.7% to 26,449.61

- Topix down 1.5% to 1,881.08

- Hang Seng Index down 2.7% to 23,520.00

- Shanghai Composite down 1.0% to 3,457.15

- Sensex down 0.8% to 57,230.48

- Australia S&P/ASX 200 down 1.0% to 7,161.28

- Kospi down 1.3% to 2,706.79

- German 10Y yield little changed at 0.20%

- Euro up 0.2% to $1.1333

- Brent Futures up 3.9% to $99.14/bbl

- Gold spot down 0.2% to $1,901.67

- U.S. Dollar Index little changed at 95.99

Top Overnight News from Bloomberg

- U.S. and European governments threatened new sanctions after Russian President Vladimir Putin recognized two self-proclaimed separatist republics in eastern Ukraine and ordered troops sent to them in the latest escalation of Moscow’s standoff with the West

- Stocks erased losses as investors bet that markets can recover from the latest imbroglio between the West and Russia over Ukraine, and a flight to havens eased

- The U.K. recorded its first fiscal surplus since the start of the pandemic, setting Chancellor of the Exchequer Rishi Sunak on course for an almost 18 billion-pound ($24 billion) budget windfall.

- German companies grew more confident in February as the country moved past the worst of its latest Covid-19 outbreak. A business-expectations gauge compiled by the Munich-based Ifo Institute rose to 99.2, significantly above economist estimates and the highest reading since July

A more detailed look at global markets courtesy of Newsqsuawk

Asia-Pac stocks traded negative as focus remained on geopolitics after Russian President Putin announced Russia is to recognise LPR and DPR as independent states and ordered a ‘peacekeeping’ operation in the two breakaway regions ASX 200 declined as the geopolitical concerns sunk most sectors although energy and gold miners bucked the trend after oil prices advanced on the geopolitical risk premium and with the precious metal underpinned by haven demand. Nikkei 225 was pressured as detrimental currency flows added to the headwinds for the index. KOSPI suffered after daily COVID-19 cases topped 100k for a third consecutive day Hang Seng and Shanghai Comp. conformed to the glum mood with notable weakness in the tech sector after China told banks and state firms to report their exposure to Alibaba affiliate Ant and with Tencent also subdued by recent concerns of a crackdown, while Rusal shares dropped nearly 20% on geopolitical tensions and looming Russian sanctions.

Top Asian News

- ThaiBev Is Said to Revive Unit’s $2 Billion Singapore IPO

- China Broadens Real Estate Lending Support to Bigger Cities

- Zhenro Seeks More Time to Pay $1 Billion in Bonds Coming Due

- Hong Kong Virus Outbreak Builds as City Braces for More Curbs

European bourses have experienced a marked recovery throughout the session, Euro Stoxx 50 Unch., with the FTSE 100 (+0.4%) the marginal outperformer given its crude exposure. A recovery that comes amid numerous geopolitical developments and was seemingly led by oil upside and as we await clarity/insight into any Russian sanctions and as Ukraine's President remains confident that there will not be a war. Stateside, futures remain negative but have also experienced a marked pick-up; bringing the ES, for instance, to within 10-points of unchanged.

Top European News

- Traders Delay Bets on First ECB Rate Hike in 2022 to December

- Energy Prices Surge on Ukraine With Oil Closing In on $100

- HSBC Says It’s Under Investigation in U.S. Over WhatsApp Use

- HSBC Boosts Bonuses 31% in ‘Extraordinarily Competitive’ Market

In fixed income, Core debt avidly in demand in early EU trade before falling from grace as Russia/Ukraine risk aversion wanes. US Treasuries retain flatter curve profile in the run-up to Usd 52 bln 2 year supply. Bunds also dragged back down in wake of an upbeat German Ifo survey.

In commodities, WTI and Brent are underpinned on geopolitics, Brent Apr soared to a high of USD 99.50/bbl (vs low USD 96.50

/bbl). Albeit, the benchmarks are off best levels at present; note, there was no settlement yesterday amid the US holiday. Saudi Arabia, Kuwait and Iraq would struggle to cover the shortfall in crude supply created by a blanket ban on Russian energy exports as they have already allocated their annual term supplies, according to Argus sources. Qatar's Emir has received a letter from Russian President Putin regarding supporting and strengthening bilateral relations. Spot gold lies below USD 1900/oz, as havens given up recent gains as officials are yet to label the Russia situation as a full-scale invasion.

In FX, roller coaster ride for the Rouble after Russia recognises independent regions in Eastern Ukraine but only enters to keep the peace and reportedly rejects wider separatist claims. USD/RUB reaches circa 80.9275 before recoiling to sub-79.000 lows. Dollar unwinds safe haven gains around 96.000 in DXY terms as risk sentiment improves from an initial state of pronounced aversion.

Kiwi holds firm on the 0.6700 handle awaiting RBNZ rate verdict amidst expectations for a 25bp hike, but outside bets of half point.

Crude currencies underpinned by Brent hitting USD 99.50/bbl and WTI nearing USD 95.00/bbl.

Geopolitical update

- Russian President Putin said Russia will recognize the independence of Donbas LPR and DPR separatists, while he ordered a peacekeeping operation involving Russian troops being sent to eastern Ukraine's two breakaway regions.

- In response, Ukraine said their border remains unchanged.

- The DPR and LPR parliaments subsequently ratified the cooperation/friendship agreements with Russia; since then, Russia's Lower Parliamentary House has voted in favour of the treaty.

- US President Biden signed an executive order prohibiting new investment, trade and financing to the DNR and LNR regions of Ukraine, while the US will announce fresh sanctions against Russia on Tuesday in which it will coordinate with allies on the announcement.

- US Secretary of State Blinken said recognition of Donetsk and Luhansk People's Republics as independent requires a swift and firm response, while he added that they will take appropriate steps in coordination with partners.

- US Ambassador to the UN said Russian recognition of eastern Ukraine is clearly the basis for an attempt to create a pretext for a further invasion.

- EU's Von Der Leyen said the recognition of the two separatist territories in Ukraine is a blatant violation of international law, the territorial integrity of Ukraine and the Minsk agreements.

- Russian Foreign Minister Lavrov says Ukraine does not have a right to sovereignty, according to Interfax. Appears to be speaking in relation to the DPR/LPR updates

- Russian Foreign Ministry says that establishing Russian bases in Eastern Ukraine is not being discussed at the moment, according to Tass; however, steps could be taken if required

US Event Calendar

- 9am: Dec. S&P Case Shiller Composite-20 YoY, est. 18.00%, prior 18.29%

- Dec. S&P/Case-Shiller US HPI YoY, prior 18.81%

- Dec. S&P/CS 20 City MoM SA, est. 1.10%, prior 1.18%

- 9am: Dec. FHFA House Price Index MoM, est. 1.0%, prior 1.1%

- 9:45am: Feb. Markit US Services PMI, est. 53.0, prior 51.2

- 9:45am: Feb. Markit US Composite PMI, prior 51.1

- 9:45am: Feb. Markit US Manufacturing PMI, est. 56.0, prior 55.5

- 10am: Feb. Conf. Board Present Situation, prior 148.2

- Feb. Conf. Board Expectations, prior 90.8

- Feb. Conf. Board Consumer Confidenc, est. 110.0, prior 113.8

- 10am: Feb. Richmond Fed Index, est. 10, prior 8

DB's Jim Reid concludes the overnight wrap

The growing geopolitical tensions over Ukraine ratcheted up further yesterday, leading to a slump in global equities and a complete rout amongst Russian assets as investors became increasingly fearful about the prospect of conflict in some form or another. With the US off on holiday the truncated trading session was bad enough, but things got worse in a bit of a market vacuum after Europe closed as Putin made a televised address and signed a decree recognising two separatist regions in the east of Ukraine, whose leaders had called on Putin to recognise their independence and provide them with support against their descriptions of Ukrainian aggression.

On the news, the risk assets that were trading fell fairly sharply and oil spiked a dollar or so to eventually close up +3.16% (flattish overnight). The Russian Ruble fell a further percent or so to close -3.2% - the worst day in two years. S&P futures, that were already down -1.24% at the European close, have fallen an additional -0.34% overnight with Nasdaq futures down -2.17% as I type (covering 2 days). Spot gold, in contrast, has touched a new six-month high of $1910.56. 10yr US treasuries have rallied -6.2bps to 1.866% after being closed yesterday and 2s10s is 4.5bps flatter.

The Nikkei and Hang Seng have fallen over -2.0% while the Shanghai Composite, CSI and Kospi are down more than -1.0%. Meanwhile, Chinese technology stocks have declined for a third consecutive session on mounting concerns of a new wave of tech crackdowns by the authorities.

I can't pretend to be a geopolitical expert but it seems that the next point of interest will be what sanctions the West puts on Russia after this news and whether the US/UK response is coordinated with the EU one. Europe has more to lose economically so this will be very interesting. Most countries have come out overnight and have said they will be placing sanctions on Russian imminently. Also we will be watching carefully to see what Russian military involvement is in the newly recognised regions.

Even before Putin's address moves were big yesterday, especially for Russian markets. The MOEX Russia equity index (-10.50%) suffered its worst day since March 2014 during the Crimean annexation, and that comes on top of declines of more than -3% on each of Thursday and Friday. Furthermore, Russia’s 10yr bonds were up a massive +79bps in their biggest daily move higher since December 2014. This volatility also saw Russia’s finance ministry cancel today’s government bond auction that had been planned.

The negative headlines incrementally grew yesterday and meant that any optimism yesterday morning about a potential Putin-Biden summit was swiftly knocked back, not least as a Kremlin spokesman said that there were “no concrete plans” for a leaders’ summit. And matters escalated further just after midday in London as Russia claimed they’d destroyed two Ukrainian military vehicles on Russian territory, with five Ukrainian soldiers killed, whereas Ukraine’s military said these border violation claims were fake.

The main action took place in Europe as the STOXX 600 fell -1.30% to its lowest level since early October. It was a broad-based decline and every single sector in the index moved lower on the day, albeit with cyclical sectors underperforming in particular. Other indices in Europe including the DAX (-2.07%), the CAC 40 (-2.04%) and the FTSE 100 (-0.39%) all lost ground as well, with those indices in Eastern Europe seeing outsized declines in particular.

Sovereign bonds struggled to gain much flight to quality benefit, with yields on 10yr bunds (+1.5bps), OATs (+3.2bps) and gilts (+3.0bps) all moving higher, albeit closing before the worst news of the day. Notably, there was yet another widening in peripheral spreads, with the gap between both Italian and Spanish 10yr yields over German bunds reaching their widest closing levels since June 2020, at 170bps and 104bps respectively. And similar moves were seen in credit too, with Itraxx Crossover widening +6.7bps to 352bps, its widest since November 2020, and Itraxx Main was +1.1bps wider at 72bps, the widest since June 2020.

This backdrop of rising geopolitical risk and tightening financial conditions led to a further reappraisal of the likelihood of ECB rate hikes in 2022 yesterday. By the close, overnight index swaps were pricing in just 36bps worth of ECB hikes by the December meeting, which is the lowest amount since their much more hawkish than anticipated meeting at the start of the month. Bear in mind that after the last meeting and the US CPI report, over 50bps worth of hikes had been priced by year-end, which implied a potential end to negative rates given their -0.5% deposit rate. So these darkening clouds over the outlook have made investors quite a bit more cautious as to whether central banks will follow through on some of their more hawkish rhetoric over recent days.

For commodities, growing tensions led to a fresh rise in oil as discussed at the top. That said, even as markets more broadly are pricing in an increasing risk of a conflict, oil hasn't broken out above levels seen 10 days ago when Biden made his negative statement before the previous weekend. In addition, natural gas futures in Europe actually fell -2.45% as well to €71.96 per megawatt-hour, although there was a noticeable spike higher intraday after Russia’s claims that five Ukrainian soldiers had been killed, before it pared back those gains later in the session.

The geopolitical turmoil outweighed some very strong numbers in the flash PMIs for February, which came in stronger than expected across Europe. The Euro Area composite PMI rose to 55.8 (vs. 52.9 expected), coming off an 11-month low back in January to reach a 5-month high in February. On a country-by-country basis as well, France’s composite measure rose to 57.4 (vs. 53.0 expected), Germany’s rose to 56.2 (vs. 54.5 expected), and the UK’s hit 60.2 (vs. 55.3 expected) in its fastest pace of expansion since last June. The US numbers aren’t out until later today given yesterday’s holiday.

Finally on the pandemic, UK Prime Minister Johnson confirmed the much-previewed announcement that all legal Covid-19 restrictions would be ending in England, as part of a transition to “living with Covid”. In terms of the changes, from Thursday those who test positive won’t be legally required to self-isolate following a positive test, but will instead be advised to stay at home and avoid contact with others. And from April 1, the government will also no longer be providing free universal testing for the general public in England. It comes as case rates in the UK have been continuing to fall since the Omicron wave over Christmas, and the weekly average of cases is now roughly back in line with its pre-Omicron levels, with hospitalisations and deaths also declining.

To the day ahead now, and data releases include the German Ifo business climate indicator for February, whilst from the US there’s the FHFA house price index for December, the flash PMIs for February and the Conference Board’s consumer confidence measure for February. Central bank speakers include Atlanta Fed President Bostic and BoE Deputy Governor Ramsden. Finally, earnings releases include Home Depot and Medtronic.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more