Stagnant U.K. Household Earnings To Fuel GBP/USD Weakness

Trading the News: U.K. Employment Change

In light of the market reaction to the U.K. Consumer Price Index (CPI), another batch of lackluster data prints may continue to rattle the near-term rebound in GBP/USD as it saps bets for higher interest rates.

Even though BoE Governor Mark Carney warns the central bank will deliver a rate-hike over the ‘coming months,’ the majority of the Monetary Policy Committee (MPC) may largely endorse a wait-and-see approach at the next meeting on November 2 as ‘it was too soon to judge whether stronger consumption growth would be sufficient to offset continuing weakness in business investment.’ In turn, the BoE may carry the record-low interest rate into 2018 as ‘the squeeze on households’ real income continued to weigh on consumption.’

Nevertheless, we may see a growing rift within the BoE as officials argue ‘a withdrawal of part of the stimulus that the Committee had injected in August last year would help to moderate the inflation overshoot while leaving monetary policy very supportive.’

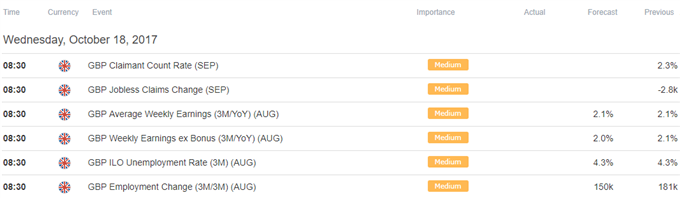

Impact that the U.K. Employment report has had on GBP/USD during the last release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

JUL 2017 |

09/13/2017 08:30:00 GMT |

150K |

180K |

-25 |

-88 |

July 2017 U.K. Employment Change

GBP/USD 5-Minute Chart

The U.K. added another 180K jobs in July, while the Unemployment Rate unexpectedly narrowed to an annualized 4.3% from 4.4% during the same period. Despite the ongoing improvement in the labor market, Average Weekly Earnings held steady at an annualized 2.1% amid forecasts for a 2.3% print, and signs of subdued wage growth may encourage the Bank of England (BoE) to further delay the normalization cycle especially as Brexit clouds the economic outlook with high uncertainty. The batch of mixed data prints weighed on the British Pound, with GBP/USD pulling back from the 1.3300 handle to end the day at 1.3208.

Bearish GBP Trade: U.K. Household Earnings Remains Subdued

- Need a red, five-minute candle following the release to favor a short GBP/USD trade.

- If market reaction favors a bearish Pound position, sell GBP/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish GBP Trade: Job, Wage Growth Exceeds Market Forecast

- Need a green, five-minute GBP/USD candle to favor a long Pound trade.

- Carry out the same setup as the bearish Sterling position, just in the opposite direction.

Potential Price Targets For The Release

GBP/USD Daily Chart

(Click on image to enlarge)

- Downside targets are back on the radar for GBP/USD as it comes off of the Fibonacci overlap around 1.3300 (100% expansion) to 1.3320 (38.2% retracement) and initiates a fresh series of lower highs & lows; Relative Strength Index (RSI) also highlights a similar dynamic as the oscillator turns ahead of trendline resistance.

- Break/close below the 1.3090 (38.2% retracement) to 1.3120 (78.6% retracement) region opens up the monthly-low (1.3027), with the next downside region of interest coming in around 1.2950 (23.6% expansion) to 1.2960 (78.6% expansion).

- Interim Resistance: 1.3460 (50% retracement) to 1.3481 (July 2016-high)

- Interim Support: 1.2630 (38.2% expansion) to 1.2680 (50% retracement)

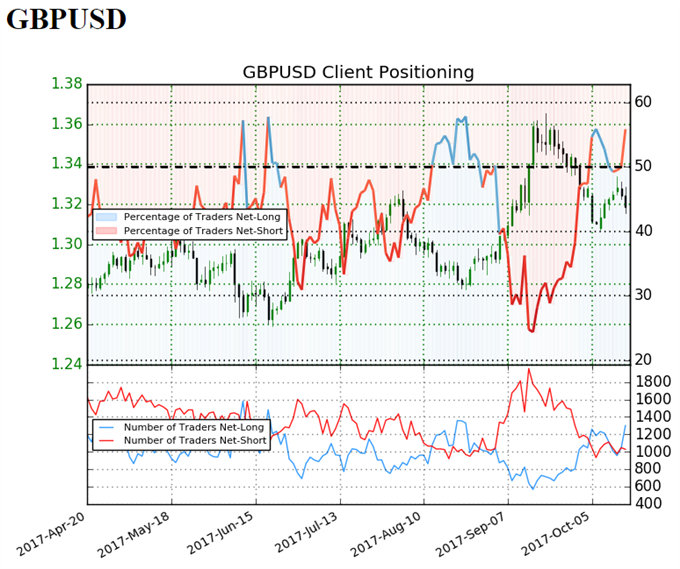

GBP/USD Retail Sentiment