SPX, Gold, Oil And G6 Targets For The Week Of January 27

Last week we pointed out that despite the overextended nature of the current SPX trend, momentum remained strong, and was supportive of higher prices. The index made a new high on Tuesday, and lower highs on Wednesday and Thursday, before selling prevailed on Friday, and the SPX printed an outside reversal pattern.

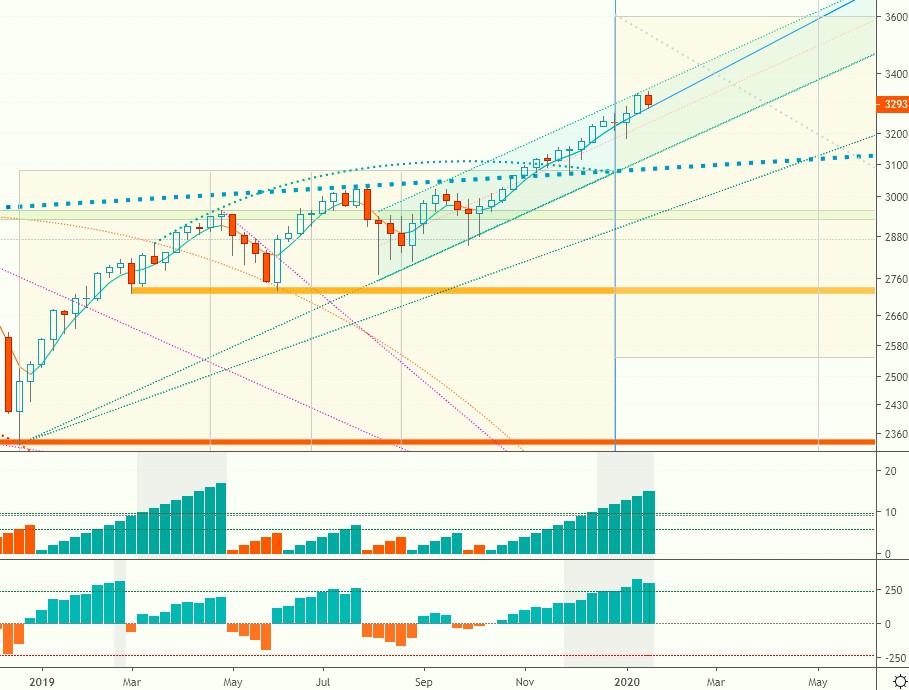

As a result, we start the new week with a mixed technical outlook. The daily pattern turned bearish, while the weekly trend remains unchanged. Therefore, a lot will depend on how the week starts, and whether selling pressure continues to intensify and the index drops below support at the weekly pivot line at 3280. If the weekly trend turns bearish, one can expect on average three to four weeks of selling action. As long as the index doesn’t drop more than 5-6%, such bearish action should be viewed as an overdue and timely correction, since the uptrend which started in July ’19 will remain intact:

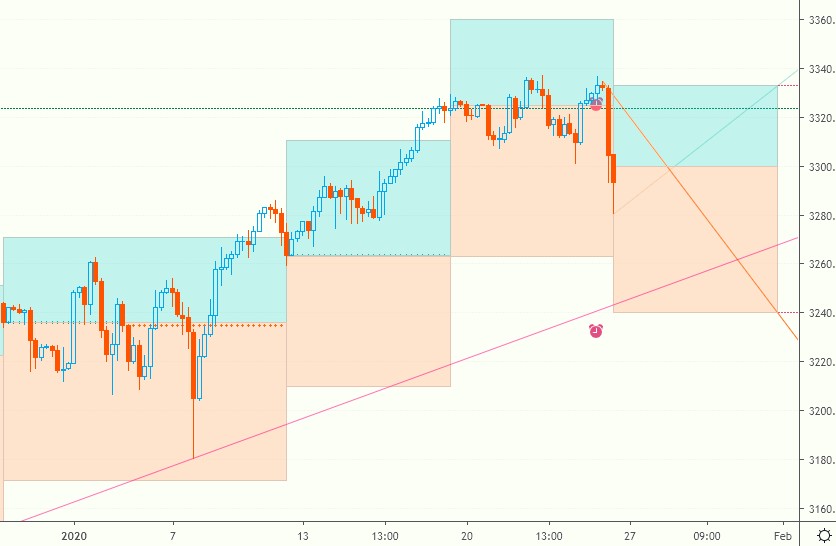

Going forward, we’ll make a slight change in the way we present the weekly targets, and will use the daily pivot to split the range, in order to better highlight the bullish and bearish zones:

Current signals: Daily Short, Weekly Hold*

The projected trading range for the SPX is 3240 - 3333.

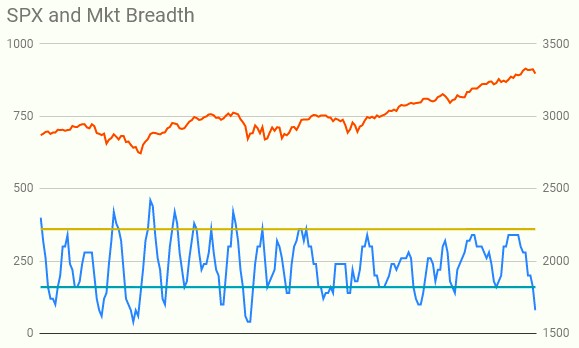

And last but not least, it should be noted that market breadth has reached oversold levels, which usually precedes sharp upside moves. Mid-week is the likely period for such a move to occur:

For Oil, Gold and G6 weekly targets and Buy/Sell pivots, check the TV page which gets updated on Monday.

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money ...

more

How do you think the spreading #coronavirus will affect all this?

In due time this should provide a great long entry opportunity

I keep going back and forth over how serious this virus is. On the one hand, it's really isolated to China for the most part. But then I read some real fear mongering articles that make it sound like the end of the world. That uncertainty makes me hesitant to invest in anything right now.

There's no point in trying to pick a top or bottom; wait for a reversal.