SPX, Bitcoin, Gold, Oil And G6 Targets For The Week Of March 16

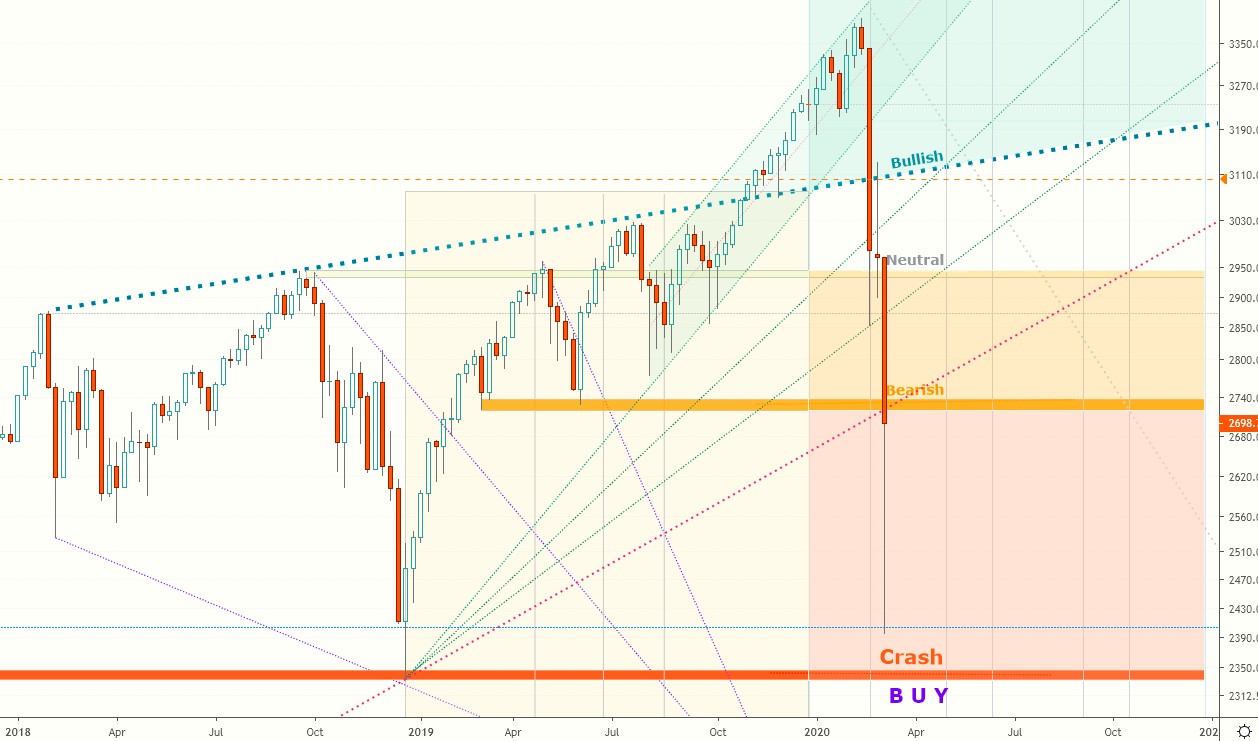

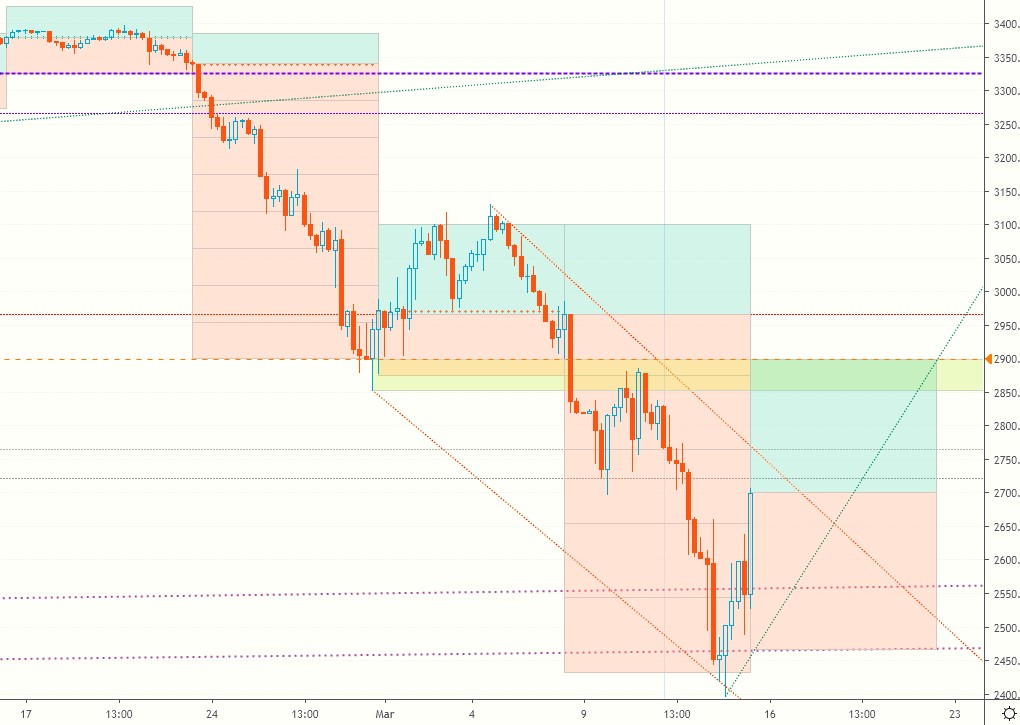

The SPX came to within 50 points of the yearly downside target before exploding into an epic 300 point upswing:

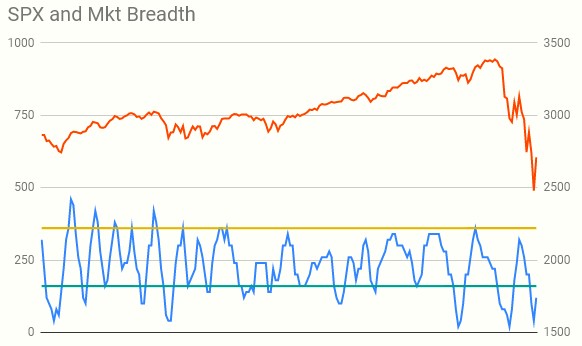

Market breadth bottomed out on schedule, and is rebounding from oversold levels:

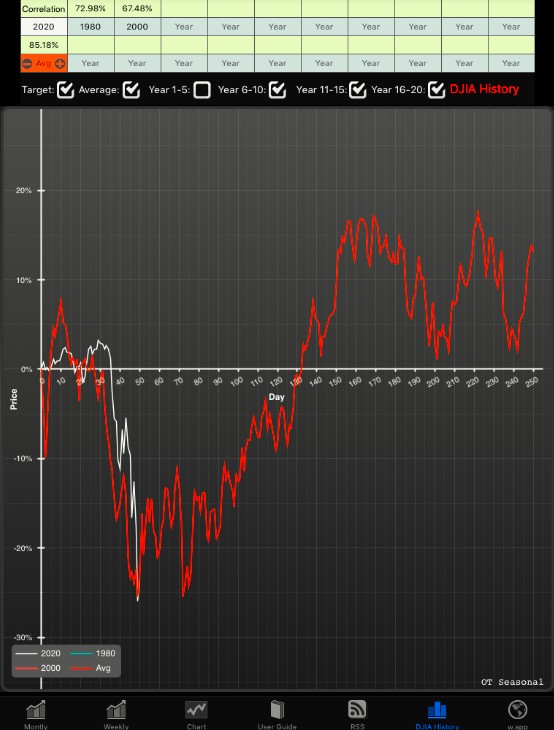

At any point in time, there are several cycles exerting their influence on the market. Currently, the SPX is tracking closely the 20 and 40 year cycle, and that can give us some ideas of what to expect next:

For a real show of continued strength, however, the SPX needs to break above 2880, which is a pretty tall order. Failure at the upside weekly range will signify that the correction hasn’t run its course yet:

OIL, GOLD and BTC are searching for a bottom, while the USD dollar index is surging. For OIL, GOLD, BTC and G6 weekly targets and Buy/Sell pivots, check the TV page which gets updated on Monday.

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals, targets and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money ...

more