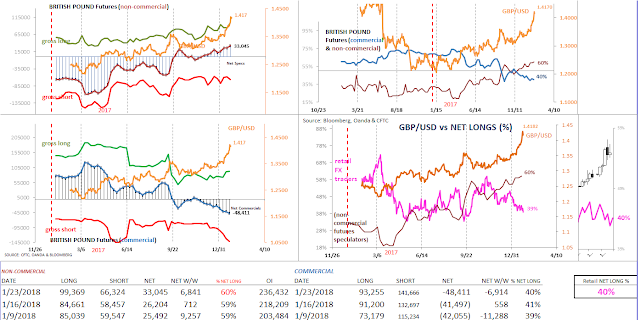

Speculators Continue To Favor Dollar Weakness

According to the latest Commitment of Traders (COT) report, large speculators continue to expect a weaker dollar, favoring commodities and the commodity currencies. Equity markets, meanwhile continue to climb to fresh all-time highs amid record overbought conditions. Elsewhere, Japanese yen traders appear to be caught wrong-footed, EUR/USD futures speculation reaches yet again another bullish extreme, and retail FX traders continue to fight dollar weakness in anticipation of a turn for the beleaguered greenback.

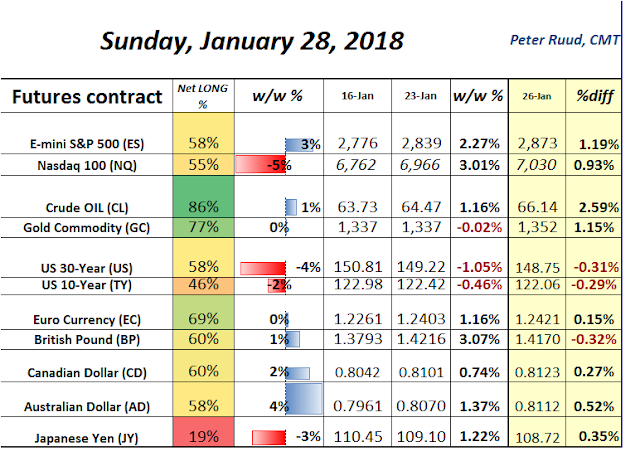

The Japanese yen is in a precarious situation, typically, whenever the retail population reaches an extreme, futures traders are normally on the exact opposite extreme. This, however, is not the case as both remained positioned for the yen to weaken. The latest COT report revealed that as of this past Tuesday, yen speculators had increased short positions and decreased long contracts, leaving an extremely (net) short stance that continues to hover near the largest (net) short position in years vs the USD.

Meanwhile, the retail population which had been selling JPY since the start of 2018, accelerated their bearishness last week to reach a new low in yen optimism. This suggests that there's plenty of room for speculators to buy, given less than 20% of the total (non-commercial) contracts outstanding are long.

That said, while retail sentiment (for the yen) may have broken down, it does resemble a capitulation of some sort, which tends to portend a turn in sentiment. As such, once price-action in the USD/JPY reaches a key level of support, which in this case would be near the Y108 handle, there should be some sort of reprieve for the dollar, at least in the short-term.

Unfortunately, for dollar bulls, however, while price-action remains south of the key Y110.87 mark, technically there's a high probability of testing the 105.58/106.63 area once key support at Y108 has cleanly been broken.

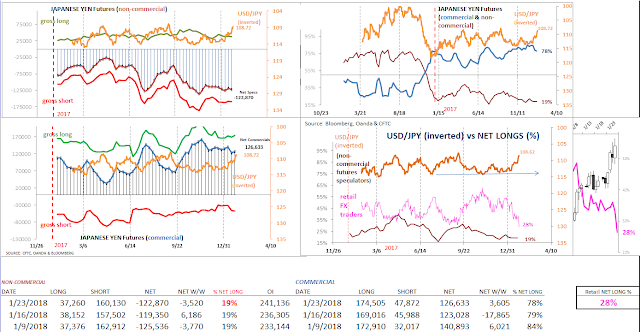

The latest COT report revealed once again that speculative euro positioning by non-commercial traders reached another record net long position.This demonstrates that speculators remain extremely optimistic despite being involved in one of the most overcrowded trades. According to recent retail trading data, the retail population continues to sell the EUR/USD into strength, seemingly forming a ceiling in euro sentiment near the 40% threshold.

While this portends further strength for the euro and speculative gross long positions continue to trend higher, the EUR/USD may have one stop on its perceived path towards 1.30. A key trendline, which originates from the all-time highs is quietly nearing current price-action. The 1.2617/33 region is where it is currently projected to be tested and coincidentally it also lines-up with two key Fibonacci measurements. That said, while the 1.23 handle and/or the 10-day moving average remain supportive, momentum is clearly against the dollar.

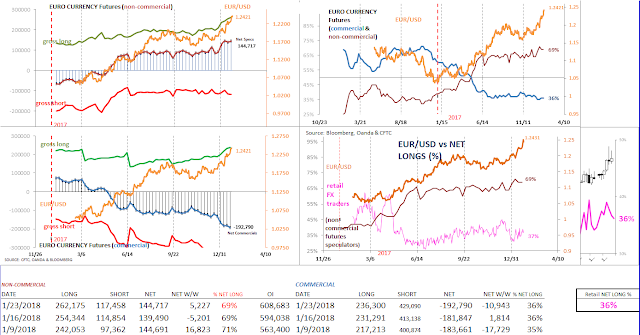

The most recent COT report highlighted that the overall (net long) position in British pound futures continues to trend higher. The retail FX population, however, has started to scale back their bearishness towards the sterling, which could allow the GBP/USD to settle back into a range for a bit while overbought conditions unwind. Moreover, the 1.4325 region, which was tested last week and held, remains technically significant, as it represents the key midpoint of the bear campaign from 2014 to 2016. That said, dollar weakness seems here to stay (for the moment) and while price-action remains north of 1.3872/1.3900, the 1.50 could be exposed once 1.4325 is fully cleared to the topside.

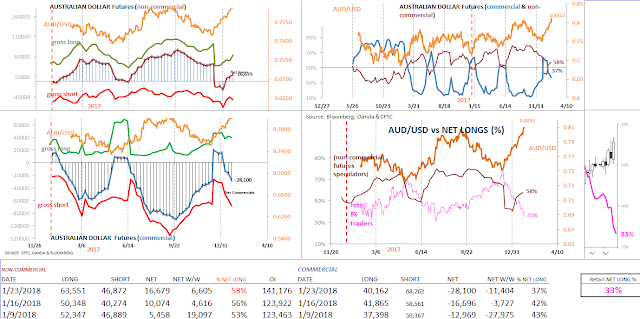

Speculative sentiment in Australian dollar (futures) has made a nice come-back recently. After seeing a rather sharp adjustment in (net long) positioning heading into the year-end (2017), bullish sentiment for large traders has improved the first three weeks of the new year. The Aussie, meanwhile has enjoyed more than 7 weeks of uninterrupted gains, with a large part due to broad based dollar weakness.

With little room to go for this trend in retail sentiment and the AUD/USD bumping-up against the 2017 highs at .8125 last week, there's a high probability for a temporary pause. That said, while price-action remains north of the .7900 handle, the .8177/.8200 region is likely to be tested next.

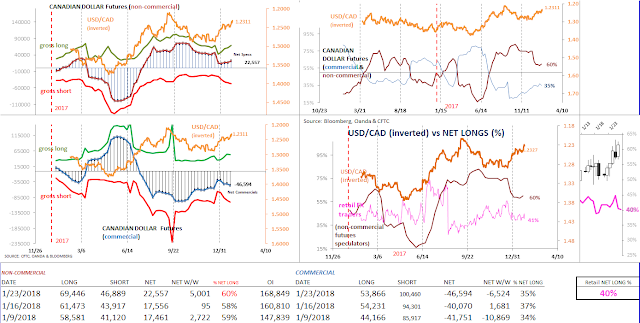

Canadian dollar futures (bullish) speculation has stabilized as of late, since falling from last October's 5-year peak. According to recent FX positioning data, the retail population, which had been stabilized selling the CAD vs the USD recently, looks to have re-asserted selling late week. If this trends in sentiment do indeed continue, it could quickly expose the USD/CAD to last year's lows in the 1.21 region. If, however, the 1.2487/1.2500 region is reclaimed to the upside, then dollar bulls could make a play for 1.26.

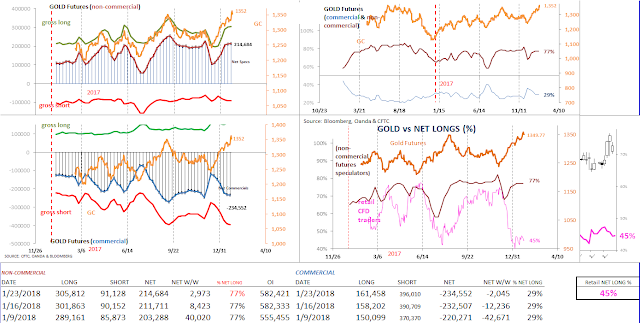

Gold futures (bullish) sentiment continues to improve since early-December's modest correction. According to the latest COT report, the number of (gross) long contracts increased slightly, but was mostly tempered by a modest bump in gross short contracts. As a result, net longs remained at 77% (as of January 23rd) for the 3rd straight week. Meanwhile, Gold futures have continued to rally on the back of a weaker dollar advancing for the 6th week over the past 7 weeks. The rally in gold futures has taken place coincidentally as the retail population has continued to sell the yellow metal uninterruptedly in the same time span.

Although, retail optimism has stabilized as of late, it appears that they resumed selling late last week. The problem, however, is that retail sentiment is near an extreme low and the price of gold is bumping-up against last year's high near 1360. This hints of a temporary pause or a period of consolidation. That said, while 1333 is maintained to the downside, the 2016 high at 1374 is likely exposed upon the clearance of 1360.

Crude oil futures speculative sentiment remains near extremes, as positioning by futures traders (into January 23rd) inched up to 86%. The net long position (total) also continues to hover near record highs, as the short covering trend has continued as of late. Meanwhile, Crude oil prices have thrusted to fresh cycle highs after briefly consolidating near the 64 handle, putting the 70 handle within reach in the near-term. At this juncture, only a clean break below the 65 handle would trigger a brief correction of the extreme (long) positioning by speculators and potentially re-open the 62.80 region to the downside.

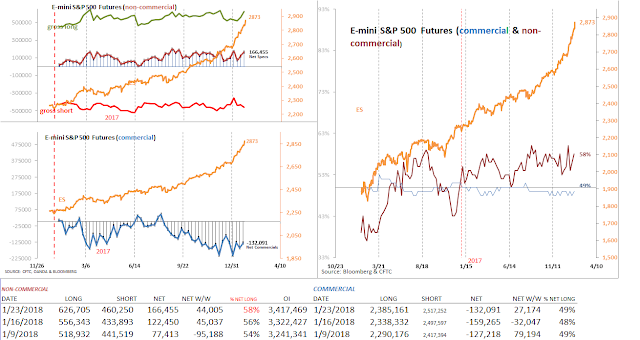

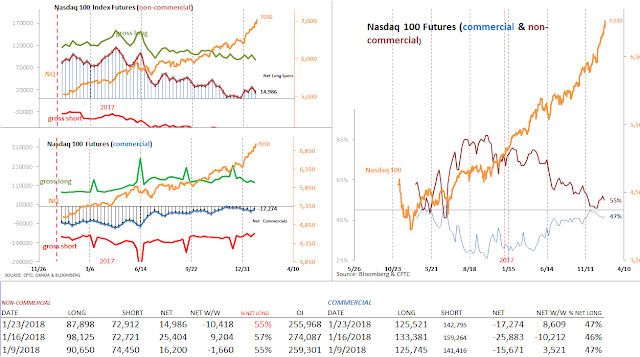

E-mini S&P 500 futures continue to mark fresh all-time highs despite extremely (weekly) overbought conditions. In the latest COT report, futures speculators significantly added long positions, allowing for the net long percentage to jump to 58% from 56%. Price-action in S&P 500 futures, has accelerated since breaking-out of the mild correction that took place in the final weeks of 2017.

The breakout advance in equities suggests that a blowout phase is occurring, which typically ends in a wide ranging day accompanied with huge volume, both of which have not been seen yet. As such, equities are likely to climb the proverbial wall of worry, sprinkled in with short bouts of corrective dips, until evidence of a topping phase has materially formed. That said, a daily & weekly bull exhaustion was observed at the end of last week and merit consideration to begin the new week.

Disclosure: None.

Good read, thanks.