Southern Europe To Feel The Most Lingering Pain This Year From ECB Rate Hikes

Image Source: Pexels

The impact of last year's ECB rate hikes is set to have a bigger impact on southern than northern Eurozone countries in 2024, according to our research. Asset prices and investments in the south have outperformed those in the north. But rapidly declining borrowing now suggests that that's about to change, not least because debt is rising rapidly.

Southern Eurozone countries have largely defied the impact of ECB rate hikes up to now

While expectations initially were that southern European countries would face significant problems if the European Central Bank were to raise rates aggressively, this has yet to materialise. In fact, it seems to be the other way around: several indicators point to a stronger transmission of tighter monetary policy on northern and not southern European countries.

Take the stock market, where performances in northern European main indices have been weaker than in the south. The Euro Stoxx 50 turned down in December 2021 as long-term yields started to increase globally. Since then, the German and French main indices have been up 5%, and the Dutch AEX is down 1.4%. But in Spain, Italy, Greece, and Portugal, the main indices have surged by 16, 11, 45, and 15%.

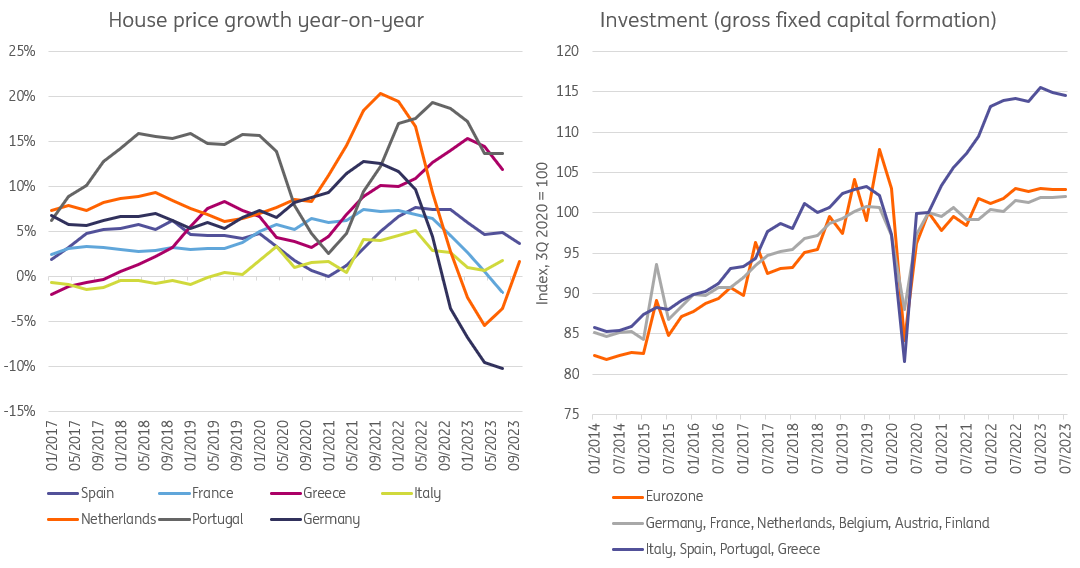

Price developments in the housing market also point to a larger impact in northern Europe. Germany, Netherlands and France have seen house prices fall below their recent highs, while Italy, Spain, Portugal and Greece still experience increasing house prices, according to the latest available data.

The surge in investments in Southern European countries is remarkable. Admittedly, there is more to investment than just interest rates; think of the impact of the Recovery and Resilience Fund and possibly the delayed impact of low interest rates and the search for yield, as well as successful structural reforms. Still, investments in Southern European countries increased by some 15% since late 2020, while investments in core countries increased by less than 5% in the same period.

We think a change is on the cards.

Investment and house prices have outperformed in southern Europe

Source: Macrobond, Eurostat, ING Research

Differences in transmission are starting to show

As we argued in this recent piece, the pain of monetary tightening is likely to be felt more in 2024 than last year due to the long and variable legs of monetary policy transmission. It just takes a while before the impact of tightening really impacts the economy. There is increasing evidence that the transmission of monetary policy in 2024 will be less favourable for southern European economies.

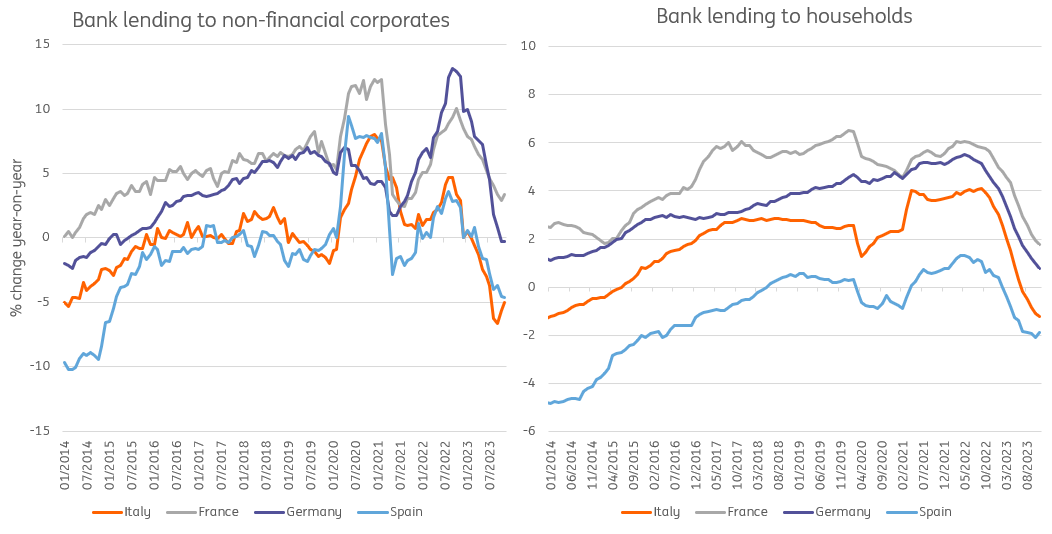

Take the most recent lending data. Lending volumes are currently falling in most southern European economies. In Italy, it's looking really rather serious as the 6% year-on-year fall of borrowing by non-financial corporates is worse than during the Global Financial and euro crises. Spain, Portugal and Italy see declining borrowing volumes for both households and corporates, while northern European economies are still seeing year-on-year growth in borrowing. Belgium and France do particularly well among larger markets, while Germany and Netherlands see stagnation. The differences in lending do not stem from differences in bank rates for new loans, as these don’t diverge materially.

Bank lending growth is diverging quickly, likely resulting in weaker periphery investment

Source: ECB, ING Research

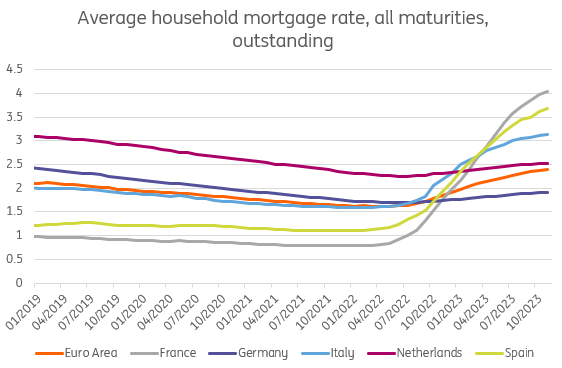

However, while interest rates on corporate loans do not differ significantly across Eurozone countries, interest rates on mortgages do. In countries with more variable mortgage rates, average mortgage rates have increased almost in tandem with the rates for new loans. In the Netherlands and Germany, where fixed-rate mortgages are the norm, average mortgage rates have so far barely increased. In the Netherlands, they’ve gone up from 2.3 to 2.5%, while in France, they increased from 0.8 to 4%.

The impact of higher mortgage burdens could play out through adjustments in the housing market – transactions are already way down in Spain by 15% year-on-year in November, as we also discuss in this more detailed piece on the Spanish housing market. They could also result in weakened consumption as they reduce the opportunity for disposable spending elsewhere.

And there is another transmission channel through which higher mortgage rates will affect economies: redemptions on mortgage loans have increased markedly in Italy and Spain since higher rates have kicked in. This essentially means that higher rates have kicked off a process of household deleveraging in the south, which will weigh on consumption and economic activity.

Average mortgage rates have risen far faster in southern Eurozone markets and France

Source: ECB, ING Research

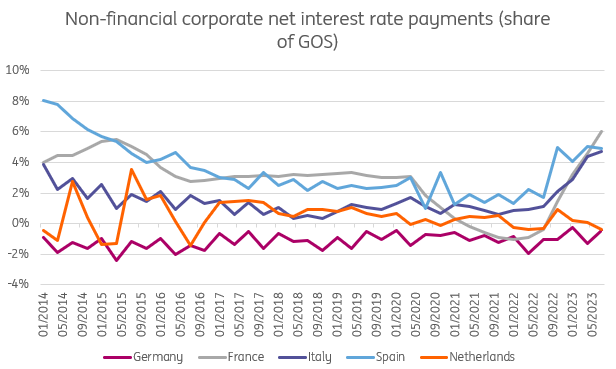

The differences also hold when looking at how debt burdens are developing. So far, the impact has been small, but differences between countries are visible when looking at government, non-financial corporate and household interest payment developments. When looking at net interest rate payments for corporates, we see that German and Dutch companies have yet to see any impact so far. This could also be because they hold more cash reserves, which have started to generate positive interest flows. In Spain, Italy and France, net interest payments have risen to the highest level in more than seven years.

Net interest rate payments for corporates are increasing faster in the periphery and France

Source: Eurostat, ING Research calculations

For governments, the same holds true. While most countries have lengthened the average maturity on their debt, higher rates are starting to result in higher interest payments. We note that the increase has been fastest in Italy, where net interest rate payments have returned to 2015 levels. France has also seen a jump, but at much lower levels, while Spain has so far managed to stave off a runup in interest rate payments.

Overall, expect the gap to widen as more debt gets rolled over. This will cause discussions about austerity to become more pressing. Then again, at this point, it is clearly Germany that leads the way in terms of belt-tightening, so we don’t see austerity efforts moving along the traditional north-south lines in 2024.

The impact of tightening on the periphery now looks worse than for the north

Even if ECB rates have peaked, and we might even see rate cuts later this year, 2024 will still be one where the full impact of monetary policy tightening of the last 18 months will unfold. While southern Eurozone countries surprisingly seemed to defy the adverse impact of monetary policy tightening last year, we fear we'll not see something similar in 2024.

More By This Author:

Between Doomsaying And Reality: There’s Still No Rush For Chinese Cars In GermanyMinutes Of December Meeting Show ECB Still Not Spelling Out Rate Cuts

Eurozone: Still Caught Between Stagnation, Transition And Geopolitics

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more