South Korean Unemployment Falls, But Weak Private Hiring Still A Concern

Image Source: Pexels

South Korea’s unemployment rate fell unexpectedly to 2.5% in July, despite private sector hiring softening. Although weak domestic demand requires supportive macro policies, the BoK is likely to take a wait-and-see approach in August to see if property prices moderate.

Unemployment fell as labour force participation dropped

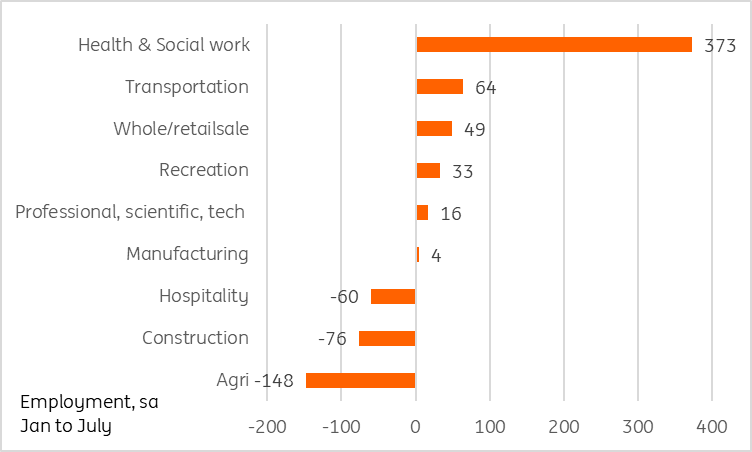

South Korea’s unemployment rate edged down to 2.5% in July, compared to 2.6% in June and market expectations. However, underlying indicators were less positive than the headline figure implies. The labour participation rate fell to 64.4%, marking its third consecutive monthly decline. Private sector hiring remained subdued. Manufacturing employment, meanwhile, decreased for the second month in a row. Construction has shed jobs in six of the past seven months in 2025. The sector is expected to be a significant drag on overall growth, with conditions potentially more challenging than we had previously thought.

This would add downside risk to our GDP growth forecast of 1.2% year on year for 2025. In the service sector, wholesale and retail (-23k) and accommodation/food services (-35k) lost jobs amid weak domestic activity, while health and social work (+51k) and transportation (+43k) saw gains. By category, self-employed jobs increased, while wage/salary workers declined, suggesting the labour market remains vulnerable. We believe that government measures to boost domestic demand may strengthen the labour market, albeit mostly in low-income/low-skilled jobs, in the coming months.

Government welfare programs created jobs while construction jobs lost throughout the year

Source: CEIC

The Bank of Korea will likely maintain its easing policy but continue to pause in August

Today's data indicates the economy requires supportive macro policies. Recent government measures are expected to boost domestic demand and potentially strengthen the labour market. The continued weakness in construction is also likely to weigh on overall growth throughout the year. The Bank of Korea is likely to maintain its current stance this month. While market opinion is divided on an August rate cut, we still prefer an October move, as property price moderation is not evident yet.

More By This Author:

Rates Spark: Steepening And Room For MoreDutch Inflation Drops In July

Limited US Tariff Impact Allows The Fed To Cut Rates From September

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more