South Korean Exports Rise On Strong Chip Demand, But Slowdown Looms

Image Source: Pexels

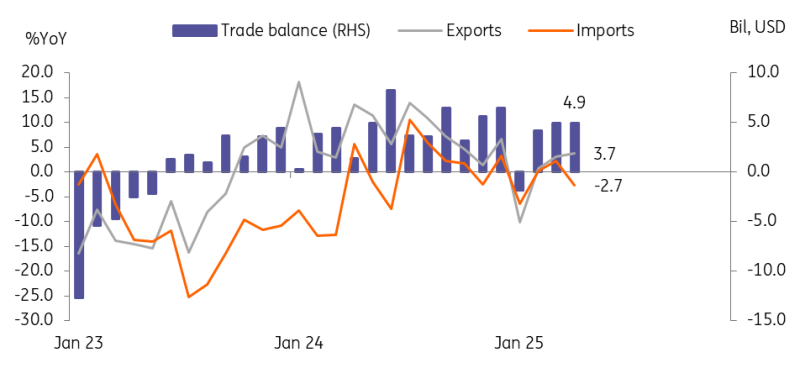

Korean exports rose in April thanks to strong chip demand

Source: CEIC

South Korean exports unexpectedly rose to 3.7% year on year in April (vs revised 3.0% in March, -2.0% market consensus) amid strong demand for chips. Exports were also partly boosted by favourable calendar effects. Adjusting for workday effects -- April 2025 had one day more than April 2024 -- the average daily exports dropped 0.7% in April (vs 5.3% in March). Thus, export momentum is clearly weakening.

Korean export data shows US tariff are biting

By category, chips and mobile devices gained notably by 17.2% and 26.5%, respectively. DRAM prices rebounded, with High Bandwidth Memory (HBM) exports showing particular strength. Chips are exempt from the US tariffs, but strong demand for artificial intelligence (AI) technology also helped power April gains. By contrast, car exports declined 3.8%. Combustion vehicles and electronic vehicles fell, while hybrid vehicles have risen 14 months in a row.

By destination, exports to the US dropped 6.8% in April, with notable declines in cars and general machinery. Cars are subject to 25% tariffs from April; other items to 10% tariffs. Meanwhile, exports to China rebounded 3.9%, the first jump in four months, led by strong chip exports.

Import data suggests rebound in equipment investment in current quarter

Imports dropped 2.7% YoY in April, mainly due to falling global commodity prices. Energy imports were down 20.1%, yet non-energy imports, including chipmaking equipment, rose 2.4%.

GDP outlook

With the contraction of first-quarter GDP, which fell 0.2% quarter on quarter, we lowered our 2025 annual GDP forecast to 0.4% YoY. For the near-term growth, we expect 2Q25 GDP to rebound 0.2% QoQ, seasonally adjusted, avoiding a technical recession.

We expect domestic components rather than external demand to be the main driver of the recovery. Easing political uncertainty at home and more assertive fiscal spending will help domestic growth. Today’s strong data on equipment imports supports our view that equipment investment will rebound in the second quarter. Global demand for chips (particularly high-end chips) has been stronger than expected. This partly reflects the tariff exemption. Demand will remain strong for a while, given expansionary AI investment plans. Thus, this is likely to offset some of the negative impact of the US tariffs. We expect exports to decline in the current quarter. But the trade balance will remain in surplus as imports decline faster than exports. Depending on the US-Korea trade deal and the size of the supplementary budget, our GDP forecasts risks are open for both sides.

More By This Author:

U.S. Economy Shrinks On Import SurgeLower Polish Inflation Opens The Door To Deeper Rate Cuts Next Week

FX Daily: Dollar Can Survive A Negative GDP Print

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more