South Africa: A Refreshing Budget But Challenges Lie Ahead

Despite some good news in the 2021 budget, challenges in restoring debt sustainability remain ahead of us, notably in tackling public sector wages, Eskom's weak operational and financial state, and low growth potential.

Source: Shutterstock

Finance Minister Tito Mboweni delivers the budget statement, Cape Town, South Africa

Summary:

- South Africa is among the most negatively impacted emerging market economies by Covid-19 with a GDP growth contraction of 7.2% and a 14% of GDP budget deficit, lifting government gross debt by 17ppt to 80.3% of GDP by March 2021.

- The budget deficit is expected to narrow to 6.3% of GDP by FY2023/24, debt will stabilize at 89% of GDP by 2025/26 and a primary surplus will be reached a year earlier.

- The National Treasury doubles down again on fiscal consolidation plans, however, challenges lie ahead and we identify upcoming wage negotiations, the state of Eskom, and economic reforms as the key ones.

- Markets initially reacted positively to the 2021 budget as it marks an improvement vs the October 2020 Medium-Term Budget Policy Statement (MTBPS) in terms of revenue collection, government borrowing, and planned tax measures, however, South African risk assets are among the most vulnerable to shifts in EM sentiment.

- ZAR strength this year has surprised us but the currency is on the front line of any broad-based sell-off in EM FX. We have an end-year USD/ZAR forecast of 16.00.

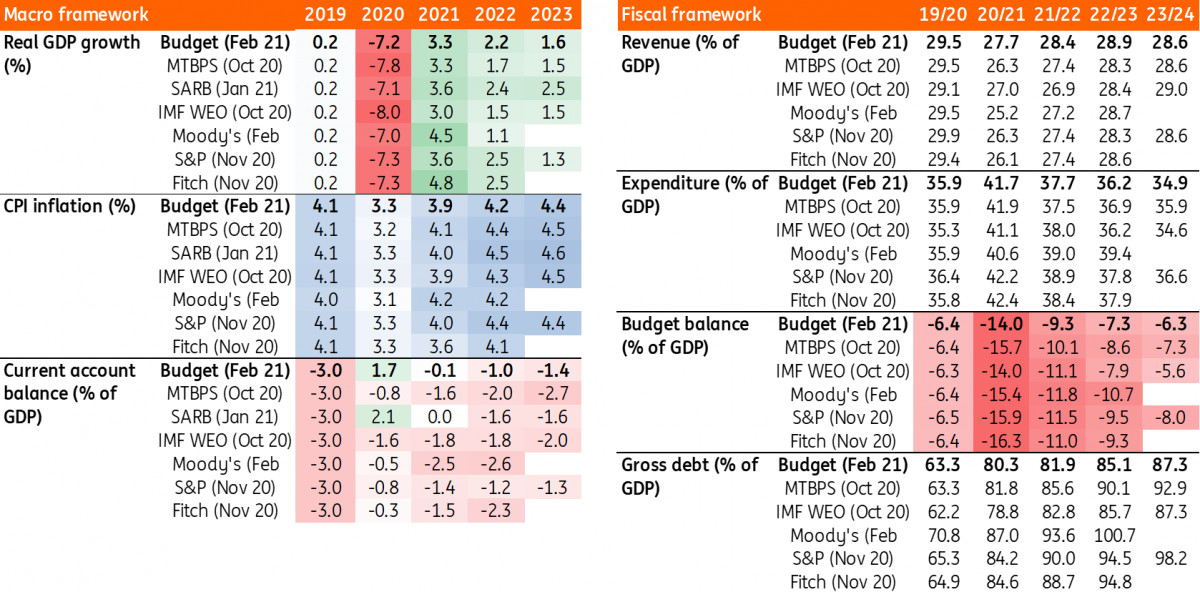

National Treasury vs SARB, IMF and rating agencies macro and fiscal projection

Source: National Treasury (consolidated fiscal framework), SARB, IMF, Moody’s, S&P, Fitch, ING - * Moody’s gross debt figures include guarantees on Eskom and SANRAL

Budget shows better tax revenues and reaffirms spending cut plans

In a broader EM context, the fiscal damage caused by Covid-19 has been among the largest in South Africa, with the National Treasury forecasting a budget deficit of 14.0% of GDP for 2020/21, lifting gross debt to 80.3% of GDP (vs 63.3% in March 2020).

However, when we compare the new estimates to those made by the National Treasury only four months ago, things don’t look as bad anymore (the MTBPS foresaw a 15.7% of GDP budget deficit bringing gross debt to 81.8% of GDP). On the economic front, the GDP contraction has turned out slightly shallower at -7.2% (vs -7.8% in the MTBPS). On the fiscal side, tax revenue collection came in ZAR100bn above the MTBPS estimate. And with the Labour Appeal Court having reaffirmed the National Treasury’s decision not to implement the 2020/21 wage increase, upside risks on expenditures were contained.

The National Treasury has also become a bit more optimistic on the medium-term outlook, affirming its 2021 growth forecast at +3.3% but slightly lifting its expectations for 2022 and 2023 upwards (to +2.2% and +1.6% vs +1.7% and +1.5% in the MTBPS).

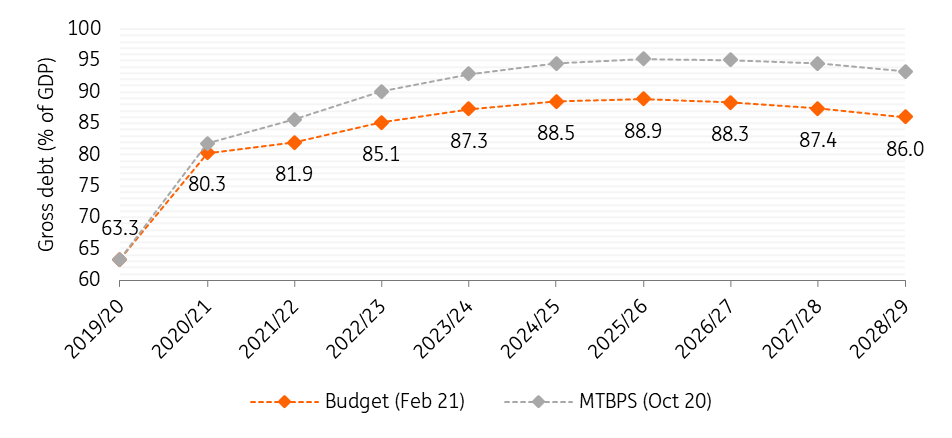

Budget deficits over the next three years are seen 1ppt lower each year on average compared to the MTBPS but remain high at 9.3% in the upcoming fiscal year (2021/22) before falling to 7.3% in 2022/23 and 6.3% and 2023/24. With the primary surplus being achieved earlier than previously anticipated (in 2024/25) and gross debt/GDP still stabilizing a year later but at a lower level of 89% (vs 95% in the MTBPS), Finance Minister Mboweni was also able to present some wins.

Gross debt outlook under February 2021 budget vs October 2020 MTBPS (% of GDP)

Source: National Treasury, ING

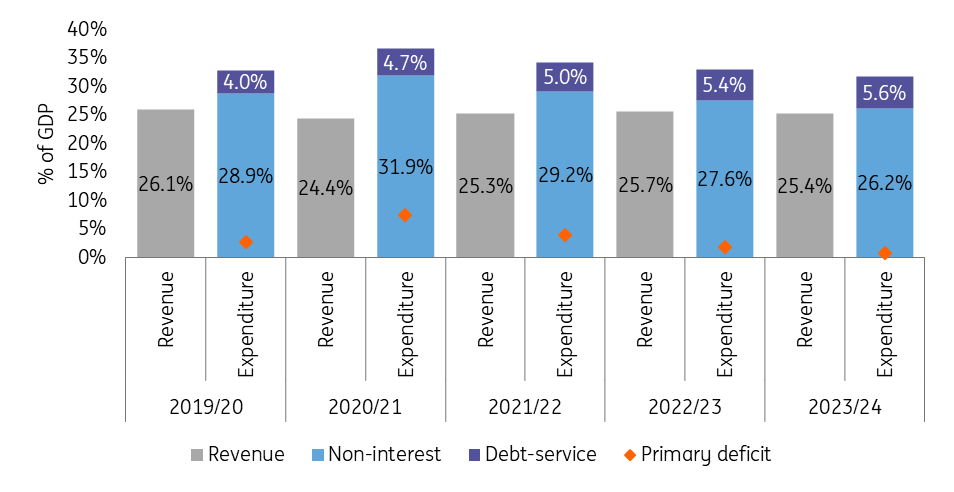

- On the revenue side, better than expected performance since October has allowed the National Treasury to scrap its previous plans to raise ZAR40bn in additional tax revenues and instead come up with some relief through an above-inflation increase in the personal income tax brackets (by 5%). The estimated ZAR2.2bn of foregone revenues are expected to be offset through an increase in indirect taxes (excise duties and export tax on scrap metal). In the budget statement, Finance Minister Mboweni also announced a 1ppt reduction in corporate income tax to 27% from April 2022. All in all, the main budget revenue is expected to recover somewhat, averaging around 25.5% of GDP in the medium term (see chart below).

- On the spending side, while there are some additional outlays in the 2021 budget primarily for the vaccine rollout and Covid-19 measures, the baseline for the main budget non-interest expenditure over the medium-term has been reduced by ZAR265 on a net basis since last year’s budget. Achieving this remains contingent on wage talks with unions later this year (the 2020 budget foresaw compensation reductions of ZAR160bn for 2020/21 to 2022/23 and the MTBPS proposed a further ZAR143bn downward adjustment between 2021/22 and 2023/24). All in all, this would yield a reduction in the share of the main budget non-interest spending by nearly 6ppt over the medium-term to 26.2% of GDP in 2023/24 (see chart below). However, debt service costs rise unabatedly over the next years to 5.6% of GDP or 22.2% of revenues by 2023/24 (from 4.7% and 19.4% in 2020/21, respectively).

Main budget revenues vs spending (% of GDP)

Source: National Treasury, ING

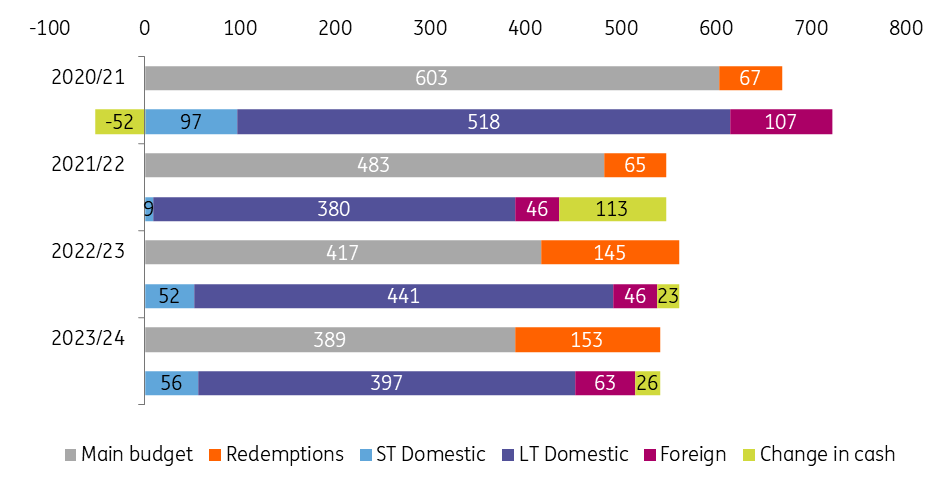

- Gross borrowing needs are set to fall after a record ZAR670bn in 2020/21, reaching ZAR548bn in the upcoming fiscal year (see chart below). They are set to remain in the ZAR540-560bn area in the medium-term, marking a permanent increase to pre-pandemic fiscal years (ZAR416bn in 2019/20). For investors, the good news is that the government’s borrowing spree has resulted in an increase in the cash balance (by ZAR59bn) which will be used in upcoming years and reduce debt issuance. In international markets, the government plans to raise US$10bn over the medium-term (US$3bn in 2021/22 and 2022/23 each, and US$4bn in 2023/24). Finance Minister Mboweni also indicated a preference for lower-cost funding from international financing institutions and said that loan talks with the World Bank remain ongoing.

Gross borrowing requirement and financing (ZARbn)

Source: National Treasury, ING

After the budget celebrations, fiscal reality awaits again

The 2021 budget intends to capitalize on the good news in recent months in order for the government to provide some measured tax relief without having to compromise on its fiscal consolidation commitment. Indeed, the medium-term outlook appears better than it did in the October 2020 MTBPS, with debt stabilizing below 90% of GDP. Good news also comes on the funding side with a reduction in domestic debt issuance going forward thanks to higher cash buffers and decreasing borrowing needs.

However, the 2021 budget does little to change the debt sustainability picture, the key challenges ahead are the following:

1

The National Treasury’s main consolidation effort singles out public sector wages as the key area but unions are starkly opposed to last year’s proposal to freeze wages up to 2023/24. Moreover, this issue could also test the alliance between the ruling African National Congress (ANC) and the Congress of South African Trade Unions (Cosatu). With wage talks expected to start soon, the following months could shape up as consequential for budget viability.

2

When it comes to Eskom, no new funding has been announced (the government provided ZAR56bn to Eskom in 2020/21 and ZAR32bn has been allocated for 2021/22). Around the time of last year’s budget, the government presented plans to separate Eskom into three units and allow independent power producers and there have been proposals by unions and business groups to tackle Eskom’s financial viability (ZAR464bn of debt in September 2020 or c.9% of GDP).

In the budget, the National Treasury announced that the transmission unit will become self-standing by the end of this year, with the generation and distribution units to follow a year later. On the debt side, we have seen revived momentum recently, but any meaningful progress remains elusive.

Fixing Eskom is imperative because it would not only reduce contingent liabilities (with the government providing guarantees on ZAR327bn of debt in 2019/20), but also because of insufficient electricity availability (with 52 days of power cuts in 2020, the highest since 2015). In that regard, the announcement of successful bids from Independent Power Producers (IPPs) for emergency power in the amount of 2,000MW by end-March marks an important first step (albeit it will take at least another year for the projects to provide electricity).

3

Above all, however, lifting the economic growth outlook remains the key priority. The National Treasury expects GDP growth of 3.3% this year (thanks to favorable base effects) but the pandemic continues to pose near-term risks. Growth is expected to moderate to 1.6% by 2023, marred by high unemployment (hitting a record high of 32.5% in end-2020), power outages, and fragile business and consumer confidence.

President Ramaphosa presented an economic recovery plan targeting 3% average growth over the next decade with a focus on infrastructure and job creation although implementation will take time and face obstacles.

Other developments we're following on the domestic landscape:

- We will closely look at the inflation picture and implications for the Reserve Bank (SARB). January CPI (3.2% YoY) remained at the lower bound of the SARB’s 3-6% inflation target range. However, the SARB is expecting 2021 average inflation at 4.0%, above the current repo rate of 3.5%. Amid weak growth, SARB policymaking will likely remain accommodative and the central bank might be willing to accept modestly negative real rates if inflation levels remain controlled.

- On the political landscape, we are monitoring developments within the ANC ahead of municipal elections (sometime between August and November) which will be a test on the Ramaphosa government. The anti-graft fight has seen some high-profile charges over the last months, notably against ANC Secretary-General Ace Magashule who has however denied wrongdoing and defied calls to step down, with the next court hearing scheduled for August. The matter could result in signs of more factionalism at the ANC’s National General Council (NGC) which is likely to take place in May.

Rating agencies don’t take the bait from better budget execution

South Africa has gone through an accelerated downgrade cycle in 2020, with a total of five downgrades across the three major rating agencies. The ratings at Moody’s (Ba2) and Fitch (BB-) remain on negative outlook on doubts that the government can stabilize its debt burden amid weak growth and elevated fiscal deficits. Moreover, rating agencies are monitoring financing conditions (access, interest rates, and capital flows) given increasing borrowing needs and costs.

While we don’t expect negative rating actions in response to the 2021 budget, rating agencies are not buying into the National Treasury’s improved fiscal outlook:

- Fitch said that “severe challenges to the government’s ability to implement consolidation persists”, notably when it comes to the planned 2% of GDP cut in non-interest expenditures vs pre-pandemic levels. Thus, Fitch maintains “more conservative assumptions than the government about the pace of fiscal consolidation.” Risks are seen coming from the weak medium-term growth prospects amid already high unemployment and social inequality, as well as from the potential need for further financial assistance to state-owned enterprises.

- Moody’s said that it has revised down its deficit forecasts in response to the 2020/21 budget outcome but expects “a slower pace of fiscal consolidation and wider deficits than the government” on higher primary and interest spending. The rating agency now expects debt/GDP to reach 100% by 2024/25 (previously 110%) but includes government guarantees to Eskom and SANRAL in debt estimates. Risks for a significant deterioration remain elevated amid the pandemic and contingent liabilities from Eskom and other SOEs. When it comes to public sector wages, Moody’s base case already incorporates stronger growth than envisaged in the budget, so risks to the ratings are more limited.

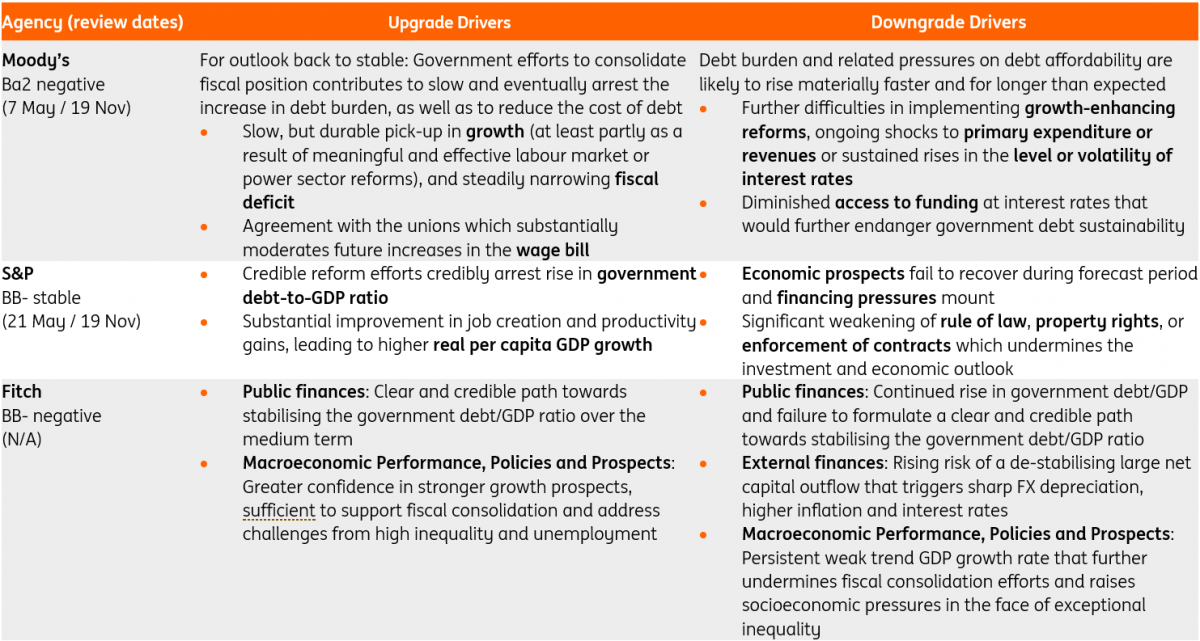

Rating drivers/Factors that could lead to an upgrade or downgrade

Source: Moody's, S&P, Fitch Ratings, ING

ZAR: Holding its own, but vulnerable to broad-based sell-off in EM FX

Strength in the South African rand this year has surprised us. Despite a more than 50bp increase in US 10-year yields since the start of the year, the ZAR has held up well against the dollar in 2021.

Driving that ZAR strength have been three main inputs, in our opinion. The first is the surprisingly resilient external environment favoring inflows into EM. South African local currency bonds offer some of the highest yields in the EM space, now near 9%. A low volatility environment had also seen the ZAR do well with its implied yields of near 5% through the 3m forward.

Secondly, the collapse in domestic demand in 2020 generated South Africa’s largest trade surplus since records began. And on a related topic, thirdly the commodity boom means that South Africa’s terms of trade are roughly 60% higher on a year-on-year basis, delivering a much-needed positive income shock for the economy.

We don’t see the commodity story turning anytime soon, although we presume a recovery in domestic demand will erode the trade surplus. As a high beta, EM currency, however, we would see the ZAR on the front lines of any broad-based sell-off in EM FX (which remains the risk into 2Q).

Currently, we have an end-year USD/ZAR forecast of 16.00 and suspect that real policy interest rates in South Africa of close to zero are not quite high enough to prevent the ZAR being hit if the mood turns against it. As such, we see no need to change that 16.00 target.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does ...

more