Softbank's Results Beat Analysts’ Expectations

Yesterday, the Japanese multinational Softbank Group Corporation (SFTBY) published their results.

The quarterly report showed that its revenue was higher than had been forecasted. This higher revenue resulted in a positive Earnings per Share of 407.86 yen, compared to the expected loss of 52.95 yen.

However, despite performing better than analysts had predicted, the company is still failing to convince investors.

Bearish pressure on stocks and poor outlook on the company's future have been commonplace since mid-March 2021. The company is suffering retaliation from the Chinese government over the technology sector, which is affecting the holdings of its investment fund, the Vision Fund.

As a result Softbank has decided to reduce and/or halt its investments in China.

The pressure exerted by the Chinese government against the country's tech giants includes:

- The fine of 18.23 billion Yuan imposed on Alibaba (BABA) for abuse of a dominant position.

- Retailers can no longer use the Didi app to place their orders. Didi is known as "the Chinese Uber".

- New regulations on the use of technology in the education sector

- Obligation to Meituan, a company similar to Deliveroo in China, to improve the working conditions of its workers/riders.

- Pressure on the video game industry, described as "spiritual opium", causing a serious impact on companies like Tencent.

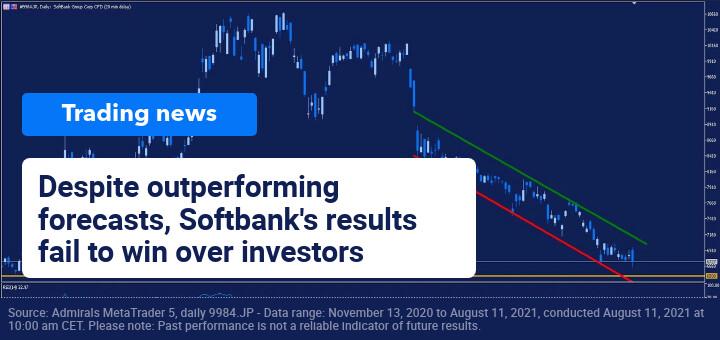

Source: Admirals MetaTrader 5, daily 9984.JP - Data range: November 13, 2020 to August 11, 2021, conducted August 11, 2021 at 10:00 am CET. Please note: Past performance is not a reliable indicator of future results.

The chart above shows the evolution of Softbank Group Corporation's share price since 13 November 2020 on a daily basis.

In this chart you can clearly see the bearish channel with a width of approximately 700 yen, through which the stock has moved in the last quarter, after the sharp fall that occurred at the beginning of the Chinese Government’s retaliation on the giants of the technology sector.

It is interesting to see how well the RSI indicator has performed on this value, acting as a buy signal for traders in the oversold area.

Currently, the stock stands at 6700 yen, close to a support level at 6500 yen and the RSI indicator is at 33 points, very close to the 30-point oversold zone.

It would be interesting to take this support as a reference, since it is a historical level, which has been used on numerous occasions by traders to re-enter the market, especially during the last quarter of 2020.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more