Small EU Firms Hold Mountain Of Debt, Could Be Next Major Headache For Banks

The European Union is doing the same as they did in 2008-09, extend and pretend, dishing out cheap loans to businesses and hoping for a recovery.

What's worrying today is that excessive optimism comes as European governments invest in the recovery by increasing public spending as the central bank keeps rates low and floods capital markets with liquidity.

The problem is that banks have high exposure to small business loans, which is the backbone of the continent's economy. If these businesses fail, another round of economic pain is dead ahead.

WSJ interviews Miguel Ríos, who operates four karaoke bars in Barcelona, said the pandemic and resulting government shutdown of his businesses forced him to borrow nearly $100k and put ten of his employees on a government wage-support program. He said his bars had been shuttered for almost one year as he is on the brink of financial disaster, with piles of insurmountable debt.

"We are resisting thanks to savings and bank loans, but we can't keep like this much longer," Ríos said.

Many small and medium-sized enterprise operators like Ríos are barely surviving through the pandemic thanks to cheap bank loans. Regional banks across the continent have loaned $2.43 trillion to them, approximately 40% of their entire loan portfolio.

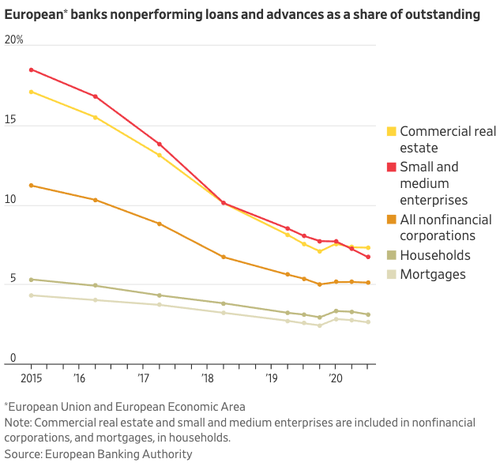

Many lenders have cleaned up their loan portfolios since the last financial crisis, but many have struggled to turn profits in a negative-rates environment.

WSJ spots a big problem for banks: the likely rise of non-performing loans for small and medium enterprises could be nearing.

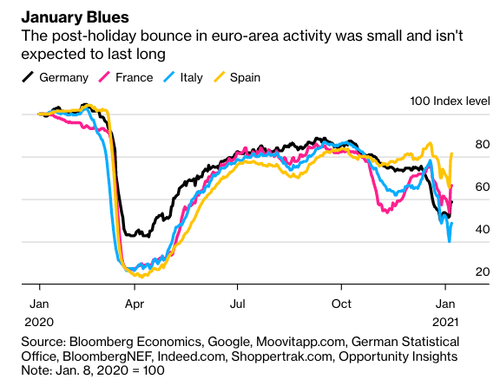

Bank regulators fear a wave of defaults could trigger another European banking crisis, mostly since the economy is set to shrink again amid the resurgent pandemic.

Analysts at banks including JPMorgan Chase & Co. and UBS Group AG have already downgraded the euro-area economy for the start of the year thanks to increased lockdowns and a new mutant coronavirus running rampant in the region.

Andrea Enria, the head of banking supervision at the European Central Bank, warned non-performing loans could exceed $1.7 trillion, which is more than the last financial crisis.

Similar to the US, small businesses in Europe overwhelmingly power the economy. Companies with 250 employees account for 99.8% of all firms and two-thirds of all private-sector jobs on the continent.

Small firms have massive economic weight on the continent, and with many under pressure, this spells bad news for a robust recovery.

As explained by Daniel Lacalle, the chief economist for Tressis SV, a couple of factors suggest 2021 recovery could be rather dismal.

-

With $26 trillion injected by central banks, massive liquidity injections have been used mostly to perpetuate elevated government spending, fundamentally current spending, and fund public debt.

-

The second is that corporate balance sheets have been damaged to a level that will make it difficult to see significant investment growth above depreciation. SP Global expects global capital expenditure to remain weak in 2021.

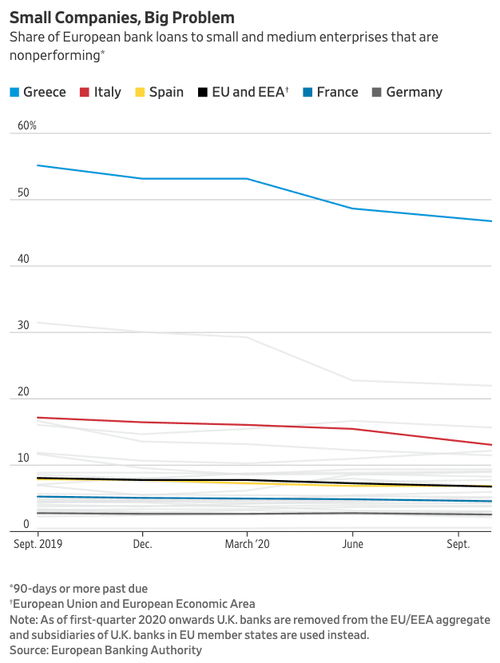

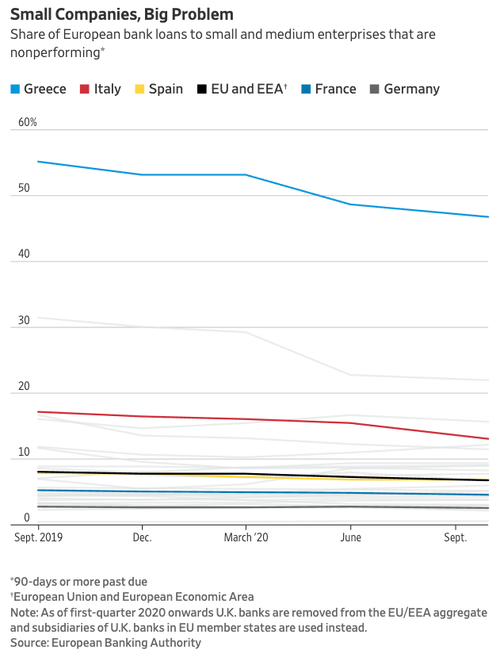

Non-performing loan ratios for small and medium-sized firms remain stubbornly high for European banks.

The latest European Banking Authority survey shows loans for small and medium-sized firms may deteriorate over the next 12 months.

While lockdowns and slow vaccinations aren't helping the recovery, it's estimated that 25% of eurozone companies are likely to face cash-flow problems this year with rising insolvency risks if government support doesn't continue.

Small and medium-sized firm troubles have yet to be completely shifted to banks due to a series of programs rolled out across the continent.

"These include moratoria on loan repayments, public guarantees on loans and wage subsidies to keep people in jobs. But regulators and analysts say those are just postponing problems," WSJ notes.

Cristina Paradisi, who owns two clothing shops, said she is always worried about the future. Her shops are located in the northern Italian province of Pesaro e Urbino where strict lockdowns and government restrictions have limited customers. Sales have dropped, her loan payments placed under a moratorium, as she may risk insolvency if sales don't increase this year.

"Just by opening the doors of our shops, we lose money," Paradisi said.

While many European banks in recent years increased their exposure to small businesses due to negative rates, which forced them to search for higher yields, a debt tsunami could be nearing as recovery hopes dim.

"We have set up an SOS line and we are getting calls from people who are desperate and don't know how to go on," said Giuseppe Palmisano, president of an organization that represents small companies and entrepreneurs in Italy. "People cry on the phone, I even fear some are thinking about suicide."

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Credit will have to be extended even further. Small biz going out of business will hurt society in the long run.