Slower Japanese Inflation, Subdued Activity, Keep BoJ In Wait-And-See Mode

Government measures and base effects pulled down inflation

Tokyo's consumer inflation slowed to 1.5% year-on-year in January, dropping below 2% for the first time since October 2024. This was mainly due to lower food and energy prices. Utility subsidies and fuel tax cuts contributed to falling energy costs, while fresh food prices fell sharply by 7.9%, largely due to base effects. Core-core inflation, excluding fresh food and energy, eased to 2.4% as entertainment prices softened while housing prices rose.

Headline inflation is expected to decline for an extended period this year, but the BoJ should prioritise core-core and underlying inflation trends. If core-core inflation remains above 2% and wage growth is steady, a policy rate adjustment is likely.

Today's labour market data supports this outlook. The unemployment rate has held at 2.6% for five consecutive months. The job-to-application ratio increased slightly to 1.19, indicating tight labour market conditions.

We’ve argued that the Bank of Japan probably won’t be in a hurry to hike rates when inflation is decelerating. To do so, it needs strong evidence that underlying inflationary pressures are still firming. In that sense, the Shunto wage negotiation results and April CPI are quite important to watch. We expect another 5% increase in wage growth and a strong pick-up in April CPI. This could support the BoJ’s 25 bp hike in June.

Inflation is likely to decelerate throughout 2026 due to stablizing energy and food prices

Source: CEIC

Monthly activity softened, suggesting a modest rebound in 4Q25 GDP

Retail sales dropped more than expected in December by 2.0% month-on-month, seasonally-adjusted (vs revised 0.7% in November, -0.5% market consensus). The decline was across all major items except for an uptick in household machines. The recent decline in Chinese tourists may have contributed, yet after three consecutive months of gains, retail sales may simply be pausing. Compared to the third quarter of 2025, retail sales rose firmly by 1.1% quarter-on-quarter, from -1.8% in 3Q25. As such, it should contribute positively to overall growth.

Industrial production also shrank by 0.1% MoM (vs -2.7% in November, -0.4% market consensus). Despite a strong global chip cycle, chip-making equipment declined sharply, and other transportation equipment (such as aircraft & parts) also declined notably.

We expect a moderate recovery in fourth quarter GDP, projecting a 0.2% QoQ gain following the 0.6% decline in the third quarter. The rebound is expected to be driven primarily by private consumption and the services sector, while manufacturing activity is likely to remain subdued.

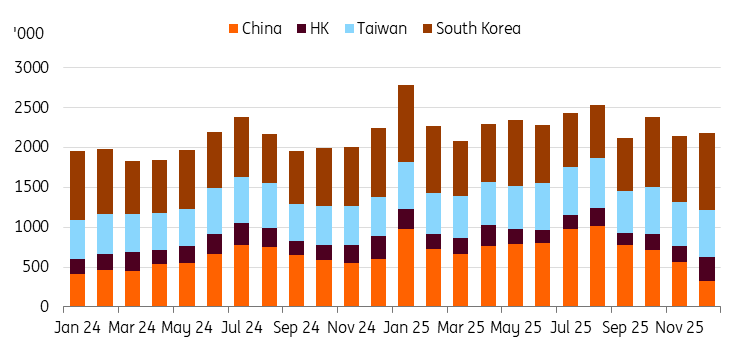

Chinese tourists dropped 45%YoY in December, might have hurt retail sales

Source: CEIC

More By This Author:

The Commodities Feed: Oil Increasingly Nervous About Potential US Action In IranRates Spark: ECB Outlook Getting More Complicated

Rates Spark: FX And Rates Doing Their Own Thing

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more