Sino-US Trade Flows Reveal The Next Market Crash Could Be Nearing

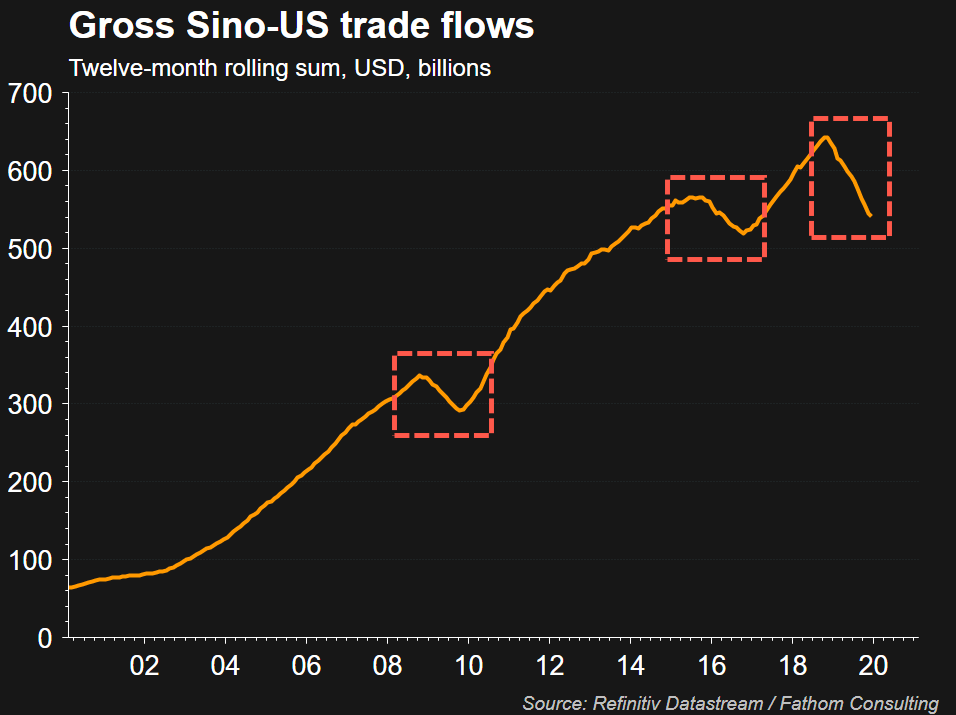

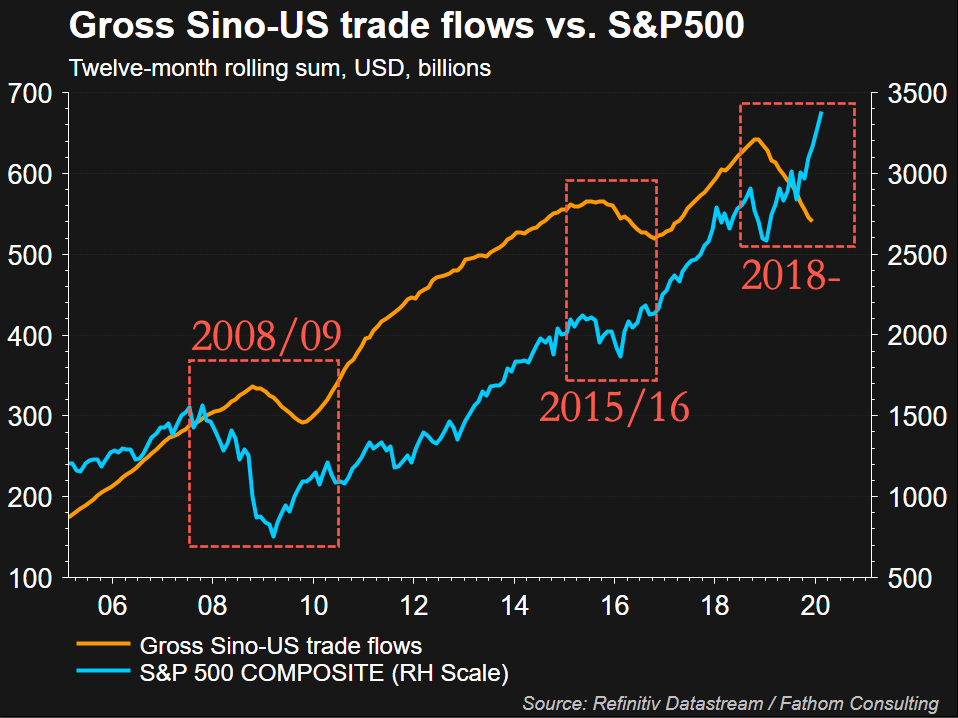

China and the US have enjoyed two decades of increasing trade flows that have jumped from $61 billion a year in 2000 to $540 billion in 2019. But the ugly end of globalization is starting to be realized, as trade flows have plunged from Nov 2018 of $635 billion to $540 billion in Dec 2019, or about a 15% drop.

The end of the cycle, or the end of decades of globalization, started around the time, President Trump’s protectionist trade policies went into effect against China.

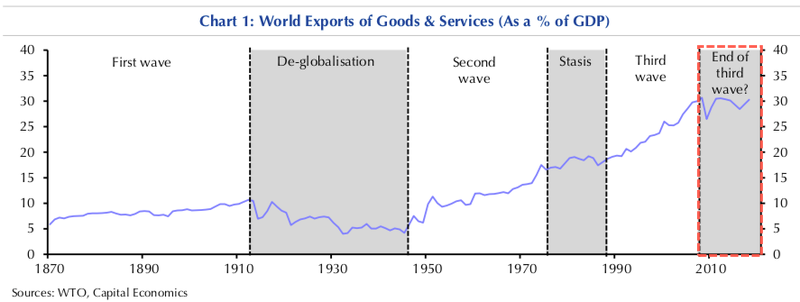

Capital Economics published a fascinating piece last Nov, detailing how the third wave of globalization began in the late 1980s, mostly driven by technological advancements and shifting labor and capital around the world to the most cost-effective regions (i.e., out of the US and into China).

Capital Economics indicates that the third wave of globalization has recently transformed into a corrective fourth wave, which has produced a period of de-globalization.

Trump’s trade war with China was one of the drivers behind de-globalization, as supply chains were moved out of China, to other Asia Pacific countries, along with a few factories returning to the US.

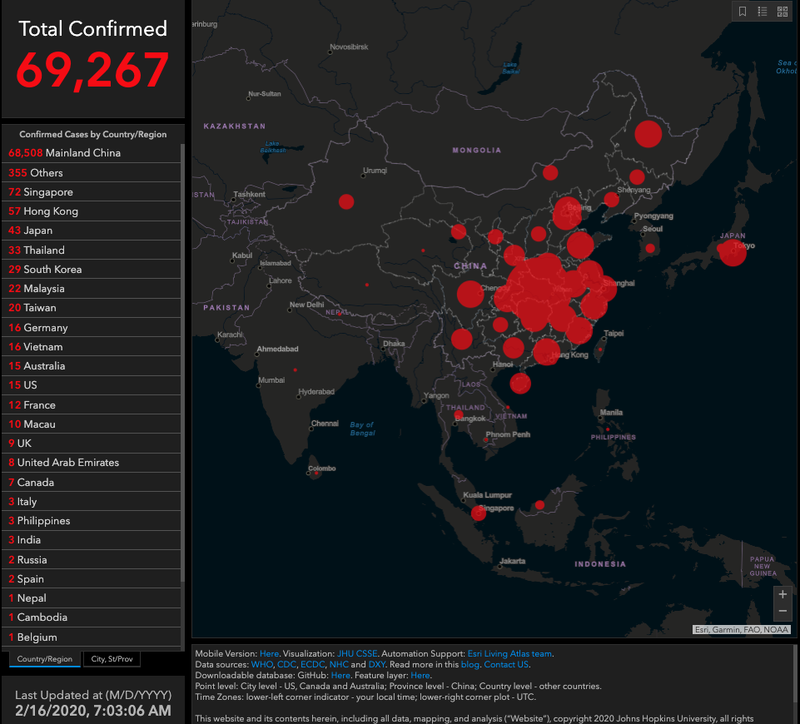

De-globalization looked chaotic under the trade war and certainly gained momentum in disrupting supply chains in 2018 through the end of 2019. Still, it has been the Covid-19 outbreak, that has sent de-globalization into hyperdrive and could trigger the next global recession.

Wall Street, drunk on excess liquidity from ‘Not QE’ and optimistic tweets from President Trump, has failed to recognize de-globalization is rapidly underway and will lead to increased volatility.

More importantly, Wall Street’s Ph.D.s are failing to notice the Covid-19 outbreak in China, which has already placed 400-750 million people under quarantine, leaving China’s economy in complete economic paralysis, will be a significant catalyst in driving further de-globalization trends as companies rush to protect their supply chains and or move them outside of China to avoid severing again. This will undoubtedly drive momentum in de-globalization, and produce a much deeper fourth corrective wave that Capital Economics was speaking about above.

A rapid shift in de-globalization, sparked by trade wars, and likely thrown into hyperdrive by the virus outbreak will produce a massive economic shock that is starting to be felt around the world and will devastate supply chains in Europe and maybe even in the US. This time, the pain inflicted on corporations can be no longer be shielded by central banks throwing free money at corporations to numb the pain, the damage will be severe and could cause a shock to the global economy in the near term.

With trade flows between China and the US plunging, complex supply chains in China severed, and now, factory shutdowns in other regions of the world, multinationals are going to realize that they were overly reliant on China for cheap things, like parts and chemicals. After the virus outbreak, and who knows when that will be, multinationals who source Chinese parts will want to re-source the same parts much closer to their factories. Again, the drive in de-globalization is about to be thrown into hyperdrive.

We noted earlier this month that several car factory plants in South Korea were crippled because they could no longer source parts from China.

On Friday, it was reported that a Fiat Chrysler Automobiles plant in Serbia was halted because it ran out of parts sourced from China.

It was also reported that General Motors (GM) could also see supply chain issues at US plants because it soon might not be able to receive parts from China.

Reworking supply chains out of China will weigh on global growth and produce a further decline in trade flows between China and the US. Such a shift will have a dramatic impact on many industries and limit demand for containerized goods transport and crimp world trade growth, thus strengthening de-globalization trends around the world.

The IMF, WEF, and UN have already warned that the global economy will continue to decelerate due to the trade war – now it appears the virus shock will send the world deeper into de-globalization that could lead to a financial crisis.

This won't end well... Central bankers need to keep pumping liqudiy into markets or a market crash could be nearing.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Yes, corporations were over reliant on efficiency! Inefficiency will hurt the world economy. We can only hope that the US is the only isolationist nation, and that Europe continues to grow trade with China. Otherwise Europe is in big trouble.