Silver: “Reset” Underway In A Frozen Market

Image Source: Pixabay

Late Friday morning, October 10th, I received a phone call from a friend who had worked her entire career in a subsidiary of a major precious metals group.

This friend received an email Friday morning from her former employer asking her to suspend all silver purchases, regardless of quantity.

Surprised by such a directive — a first to her knowledge — she immediately contacted the group's headquarters for confirmation and explanations.

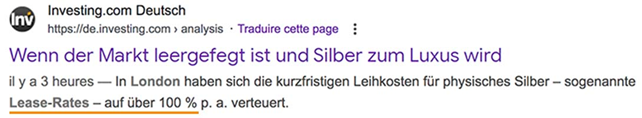

By Friday morning, the London Lease Rates for silver had crossed the exceptional threshold of 125% — UNPRECEDENTED!

When a trader of this group buys metal, it is leased at the official London Lease Rates until it is resold.

My friend then contacted her counterparts in the market: they had all received a similar order to suspend their silver purchases at the same time on Friday.

I had confirmation of this by surfing on internet: other refiners had also suspended all silver purchases.

The market was therefore completely frozen.

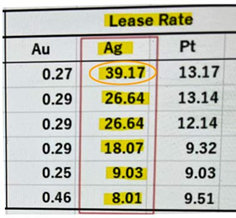

Normally, lease rates for silver, like those for gold, are around 0.25%.

On Thursday, October 9, silver rates reached 39.17%:

Before soaring to more than 125% on Friday 10th...

This move could indicate that some traders sought to exploit the sharp rise in London silver prices by short selling — that is, selling metal they did not own. The near-universal refusal to lend silver, except at rates approximately 600 times above the average, suggests the occurrence of a major short squeeze.

On Friday, the London spot market remained stable around $50, while COMEX futures contracts in New York corrected slightly. As of Monday, October 13, silver prices in New York and Shanghai now appear to have aligned again with those in the London spot market.

More facts...

Whatever you may have read from financial analysts over the past three days, remember these indisputable facts:

1. Chinese government instructions to develop gold and silver mining dated June 23, 2025

- Promote a new round of strategic actions to achieve exploration breakthroughs;

- Promote exploration in deep and marginal areas of existing large- and medium-sized mines;

- Promote the expansion of operating mine capacity, the production of mines under construction, and the construction of new mines;

- Strengthen the comprehensive utilization of low-grade, difficult-to-process, and coexisting resources;

- Improve the recovery rate of gold, silver, and associated precious metals;

- Encourage the development of secondary resources in gold tailings ponds;

- Promote the recycling of gold and silver, such as scrap electrical and electronic products;

- Improve the gold recycling market system;

- Strengthen the coordination and cooperation of fiscal, financial, investment, import, and export policies with industrial policies;

- Use existing financing channels to support the development of key technologies in the gold and silver sector;

In other words, this would involve raising the price of gold and silver to make all of these operations economically justifiable.

When the price of silver reaches a sufficiently high level, investors will turn massively to geological prospecting, the recommissioning of old mines that were previously unprofitable, the opening of new extraction sites, as well as the development of recycling and, potentially, the exploitation of underwater deposits, if prices allow this new sector to be profitable.

2. Donald Trump's Executive Order of March 20, 2025, to revive mining and its financing

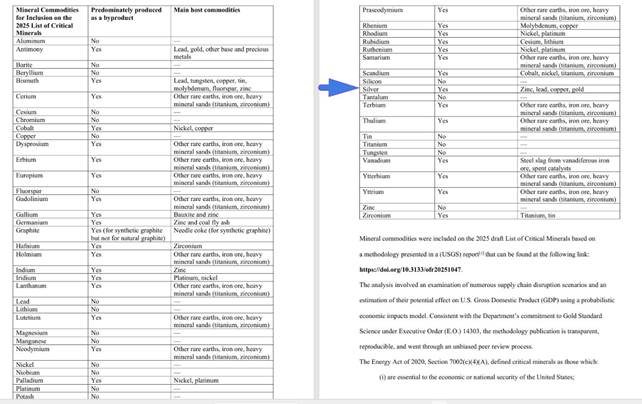

In 2025, the USGS (United States Geological Survey) added silver to its list of "essential critical minerals":

This list, published by the USGS on August 26, 2025, includes copper, lead, silver, and zinc. It should be remembered that nearly 70% of the world's silver production actually comes from copper, lead, and zinc mines.

3. The G7 directives dated June 17, 2025, to develop mines for "critical minerals essential to the digital and energy economies"

There is therefore an international agreement aimed at developing the exploitation of these critical minerals, whose deposits are tending to be depleted.

Without silver, it is simply impossible to manufacture photovoltaic panels or advance artificial intelligence.

As our article on mining industry cycles points out, it takes an average of ten years between the discovery of a deposit and the start of production at a new mine.

Between the government directives mentioned above and the arrival on the market of the volumes of silver needed for digital and energy projects, a phase of worsening shortages seems inevitable. This could last several years, leading to a very sharp rise in the price of an ounce of silver.

An extremely bullish trend

I've been following Michael Oliver, the president of Momentum Structural Analysis, for over ten years. He's a measured man, passionate only about studying trends (momentum). He even developed his own software to refine his analyses. He's a wise, calm, and above all reliable man.

In his latest MSA assessment, dated September 28th and sent to his subscribers, Michael Oliver significantly revised upwards his forecast for silver over the coming months and the first quarter of next year. The report highlights price structure and long-term dynamics as harbingers of a vertical acceleration phase.

This movement, described as "massive and brutal", reflects a profound revaluation of silver, both as a monetary asset and as an industrial metal.

Note that the scale used here is logarithmic — look at the one on the right of the graph.

The interval between 1 and 10 is the same as the interval between 10 and 100, or 100 and 1,000.

In other words, between 1975 and 2007, changes were measured in tenths of a dollar before the price increased by a single dollar.

Since 2007, the price of silver has accelerated significantly, increasing tenfold in total. It has risen from $11 in 2020 to nearly $50 in recent days. In the coming months, a new phase of acceleration could occur, eventually crossing the $100 threshold.

Since December 23, 2013, we have known that the application of Rule 589 will allow the price of silver to rise bu $12 per day, or approximately $60 per week. Starting from a level of $100, this would mean that in the space of about fifteen weeks — barely three and a half months — the price of silver could reach $1,000.

$1,000 per ounce — the objective I had already mentioned in various forms in my book thirteen years ago.

A totally opaque silver market

As of September, the LBMA reported inventories of 790 Moz, or 24,581 tonnes of silver. However, over 20,000 tonnes are held by ETFs, leaving only about 4,300 tonnes of notional free float. A key question remains: how much of this free float is actually held by the LBMA's Chinese member banks, which hold their reserves in their own vaults, approved by the organization?

How much of the SLV fund's official stock, 496.5 Moz, is silver held outright — in other words, not leased to J.P. Morgan?

Does J.P. Morgan's notional stock actually belong to the bank, or is it held on behalf of the U.S. Treasury — or even the People's Bank of China?

Remember what the CME, the parent company of COMEX, wrote in February 2021 to the CFTC, the regulator of the precious metals market:

"The market, in an effort to represent a realistic deliverable supply of what could be readily available for delivery, decided to reduce its deliverable supply estimate by 50% of its declared eligible silver." (Source: CME archives)

At that time, the COMEX's so-called "eligible" stocks represented 240 Moz. In other words, approximately 120 Moz of silver on the COMEX was not intended for the market: it was metal owned by individuals, industrialists, or funds, stored in COMEX-approved secure warehouses, or did not meet the quality criteria required by the market.

These are stocks belonging to individuals, industrialists, or investment funds, which are simply stored in secure, COMEX-approved warehouses, or which do not have the silver quality required by the market. It is clear that, despite this admission, the stocks declared by COMEX have never been adjusted.

Since 2019, the silver market has officially recorded six consecutive years of deficit. According to the Silver Institute these cumulative imbalances reach 1,177 Moz, for an estimated mine production of 850 Moz and a demand of 1,148 Moz. It is high time that silver prices finally reflected this reality.

This is what all the politicians—China, the United States, the G7—have apparently decided to do.

More By This Author:

Big Picture Silver Charts Point To Triple-Digit PricesFrom Monetary Metals To Strategic Metals: The End Of A World Based On Trust

Luke Gromen: “The United States Is Heading Toward An Inflationary Crisis”

Disclosure: GoldBroker.com, all rights reserved.