Shell: Seasonal Weakness And Strategic Uncertainty Align This Summer

Image Source: Pixabay

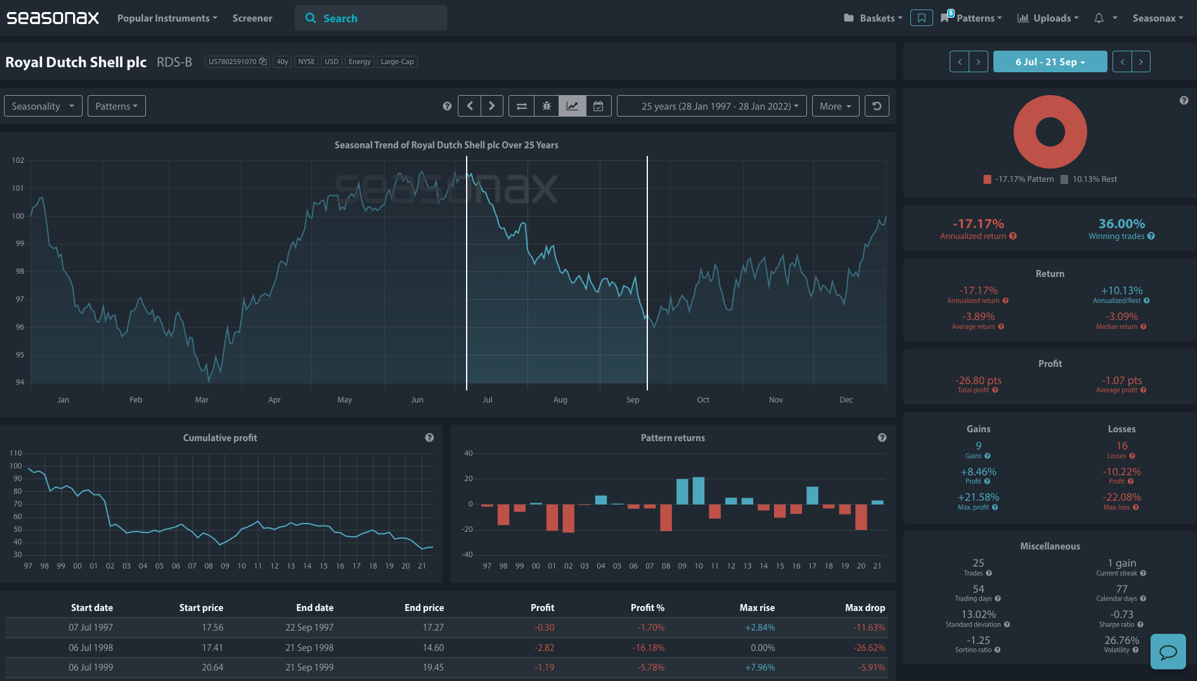

- Instrument: Royal Dutch Shell plc (RDSA)

- Timeframe: July 8 – September 25

- Average Pattern Move: –8.43%

- Winning Percentage: 32.00%

You may not realise it, but oil major Shell enters the least favourable seasonal window on its 25-year record just as questions about its long-term strategy and potential for M&A intensify.

From July 8 to September 25, Shell has historically declined by an average of –8.43%, with a win rate of just 32% and an annualised return of –33.44% over this period. The seasonal bias is both clear and persistent — with 17 out of 25 seasons finishing lower.

(Click on image to enlarge)

Let’s examine how this weakness could intersect with rising uncertainty around Shell’s strategic next steps.

A Shell in Transition?

Despite outperforming its Big Oil peers YTD (+4% apx), Shell’s rally has been modest and largely driven by cost-cutting, buybacks, and better earnings stability — not organic growth.

CEO Wael Sawan continues to focus on “performance, discipline and simplification,” but as Bloomberg’s Javier Blas noted, the question remains: what’s Shell’s vision beyond 2030?

While rumours of a BP takeover were swiftly denied, Shell may yet turn to M&A to fill its long-term production gap. And with oil prices under pressure and shale valuations adjusting, the window for bolt-on or even larger acquisitions may not remain open indefinitely.

That ambiguity — along with the seasonal headwinds — could be enough to keep Shell’s stock subdued into late Q3.

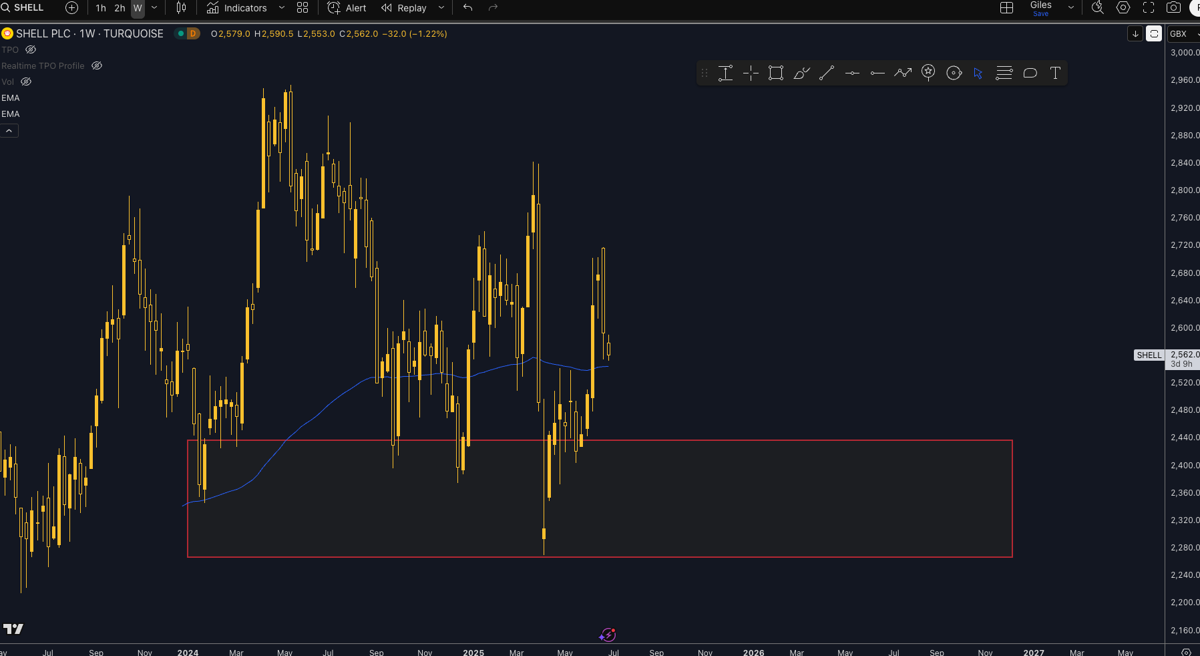

Technical Perspective: 2,400p Region is Key

Technically, Shell remains vulnerable. The price has rejected from the 200-week EMA and is now hovering below key moving averages.

- The 2,400p region marks a major support zone, tested repeatedly throughout 2024 and early 2025.

- Should seasonal weakness play out, a drop into this demand cluster could trigger accumulation interest from longer-term holders.

- However, failure to hold this zone would significantly shift the risk profile and open the door to a deeper retracement toward 2,200p.

(Click on image to enlarge)

Investors may prefer to wait for cleaner trend confirmation — or lower prices — before re-engaging.

Trade Risks

A sharp rebound in oil prices or a confirmed acquisition of strategic assets could negate seasonal weakness and Shell’s aggressive buyback programme could support the share price into dips.

More By This Author:

Silver: Will Seasonal Strength Spark A Summer Surge?Soybean Slide: Will China & U.S. Tensions Enhance The Seasonal Slump?

FTSE 100: Seasonal Weakness Collides With UK Defense Surge

Disclaimer: The information on this website is for educational purposes only and should not be considered investment advice.