Sharp Declines In Chinese Stocks

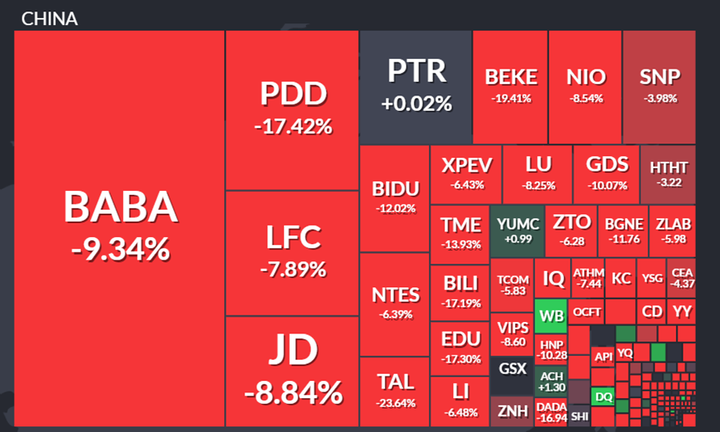

In the last week, we have been able to observe how the Chinese stock market is falling strongly, as we can see in the following table, which shows the evolution of the last week.

Source: Finviz

In this table, we can see widespread declines in virtually all sectors with falls of 8.54% in NIO, 6.43% in Xpeng, 12.02% in Bidu or 9.34% in Alibaba.

These declines are fuelled by moves by the Chinese government against overseas-listed companies based in China, after Beijing indicated it will step up its supervision of these companies to crack down on illegal activity and punish fraudulent issuance of securities.

These measures are particularly affecting technology companies, as the ability to raise funds abroad is being diminished.

Today, China announced a new round of fines for large companies in the technology sector reaching 500,000 yuan, of which six of them have gone to the e-commerce giant Alibaba.

If we look at the daily chart of this company, we can see that after marking historical highs on October 27, 2020, the price has followed a strong downward trend that has led it to lose more than $100 per share.

In the last week, the price has bounced lower with a sharp fall close to 10%, which has led it to look again for its important support level in the annual lows, represented by the red band.

The loss of this support level could open the door to a further correction that could lead the price to lose $200 per share.

(Click on image to enlarge)

Source: Admiral Markets MetaTrader 5. Alibaba’s daily chart. Data range: February 25, 2020 to July 8, 2021. Prepared on July 8, 2021 at 11:45 a.m. CEST. Please note that past returns do not guarantee future returns.

Evolution in the last 5 years:

- 2020: 9.73%

- 2019: 54.74%

- 2018: -20.51%

- 2017: 96.37%

- 2016: 8.05%

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter ...

more