Sensex Zooms 777 Points, Nifty Ends Above 17,400; Power & IT Stocks Rally

Indian share markets witnessed positive trading activity throughout the day today and ended on a strong note.

Benchmark indices witnessed heavy buying for the second consecutive session, even as world markets grappled with Omicron fears.

At the closing bell, the BSE Sensex stood higher by 777 points (up 1.4%).

Meanwhile, the NSE Nifty closed higher by 235 points (up 1.4%).

Adani Ports and Power Grid Corp were among the top gainers today.

Cipla and ICICI Bank, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,447, up by 225 points, at the time of writing.

The broader indices finished with decent gains.

The BSE Mid Cap index and the BSE Small Cap index ended up by 1% and 1.1%, respectively.

Sectoral indices ended on a positive note with stocks in the power sector, IT sector and oil& gas sector witnessing buying interest.

Shares of Tech Mahindra and Gujarat Fluorochemicals hit their respective 52-week highs today.

Asian stock markets ended on a mixed note today.

The Hang Seng ended up by 0.6%, while the Shanghai Composite ended down by 0.1%. The Nikkei ended down by 0.7% in today's session.

US stock futures are trading on a strong note today with the Dow Futures trading up by 327 points.

The rupee is trading at 75.00 against the US$.

Gold prices for the latest contract on MCX were trading up by 0.4% at Rs 47,783 per 10 grams.

Speaking of stock markets, in his latest video, Research Analyst at Equitymaster Aditya Vora analyzes which is better: Tata Motors or Maruti Suzuki?

With both companies having a strong parentage, find out which company could rule the domestic passenger car market in the next decade.

In news from the engineering sector, Larsen & Toubro was among the top buzzing stocks today.

Construction major Larsen & Toubro (L&T) and ReNew Power (ReNew) have agreed to tap the emerging green hydrogen business in India.

The companies will jointly develop, own, execute and operate green hydrogen projects in India.

Green Hydrogen can enable the world to meet its net zero emissions targets.

S N Subrahmanyan, chief executive officer and managing director of Larsen & Toubro, said the partnership is a significant milestone in the journey towards building a green energy portfolio for L&T.

It is anticipated that green hydrogen demand in India for applications such as refineries, fertilisers and city gas grids will grow up to 2 million tonne per annum by 2030 in line with the nation's green hydrogen mission. This would call for investments upward of US$60 bn.

Sumant Sinha, chairman and chief executive officer at Gurgaon-based ReNew, said:

Green hydrogen will be a key driver of the transition to cleaner sources of energy. I expect this partnership to set new benchmarks in the Indian renewable energy space and look forward to working together with L&T.

Many countries, including India (through its national hydrogen mission), have announced specific policy interventions to push for the widespread adoption of green hydrogen.

L&T share price ended the day up by 0.4% on the BSE.

Moving on to news from the IPO space...

Raymond said that its board approved listing of its engineering and auto parts business arm JK Files & Engineering (JKFEL) via initial public offering (IPO) in an aim to unlock value for its shareholders.

The IPO will comprise a pure offer for sale of up to Rs 8 bn, subject to requisite regulatory approvals and market conditions, the firm said in a notice to exchanges.

In a notice to BSE, Raymond said:

In this regard, the board of directors of the company, at its meeting held on 1 December 2021, approved the offer for sale (OFS) for Rs 8 bn subject to such variation as permitted under applicable law in the IPO through book building process which will help deleverage Raymond.

The shareholding of the company in JKFEL shall stand reduced by a such number of shares as may be tendered for sale in the OFS. However, post-IPO, JKFEL shall continue to remain a material subsidiary of the company.

The firm in its September quarter earnings said that its engineering business comprising tools and hardware and auto components have achieved the significant milestone in terms of highest sales ever in a quarter with strong growth in the exports market and well supported by sustained growth in the domestic market.

Raymond share price ended the day down by 3.5% on the BSE.

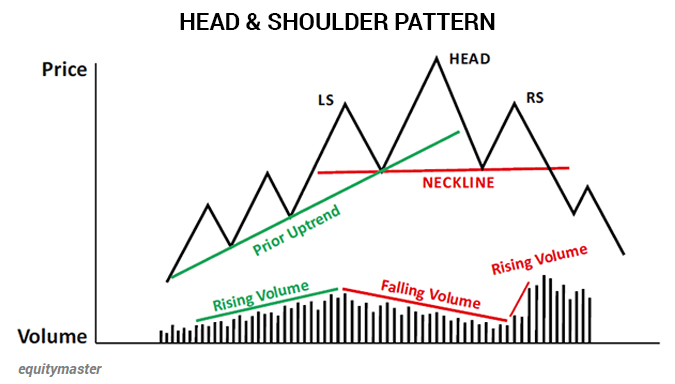

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more