Sensex Trades Lower, Tata Steel, Titan & Asian Paints Top Losers

Major Asian share markets are lower today, extending Wall Street falls on news of another Covid-19 surge in China as investors awaited US inflation data later in the week.

The Nikkei fell by 1.7% while the Hang Seng fell by 0.3%. The Shanghai Composite is up 0.2%.

US stocks lost ground on Monday as a lack of catalysts left market participants warily embarking on a weak backend loaded with crucial economic data and the unofficial beginning of the second-quarter earnings season.

The Dow Jones was down 0.5% while the tech-heavy Nasdaq was lower by 2.3%.

Back home, Indian share markets are trading on a negative note.

Benchmark indices opened on a negative note tracking the trend on SGX Nifty and extended losses as the session progressed.

At present, the BSE Sensex is trading lower by 177 points. Meanwhile, the NSE Nifty is trading lower by 63 points.

TCS & Bharti Airtel are among the top gainers today.

Tata Steel and Titan are among the top losers today.

Bharti Airtel's share price is falling as the Adani group announced its foray into the telecom sector.

Broader markets are also trading on mixed. The BSE Mid Cap index is flat while the BSE Small Cap index is trading higher by 0.2%.

Sectoral indices are trading mixed. Stocks in the utilities and power sector witnessed most of the buying.

Stocks in the metal sector are witnessing heavy selling.

Shares of Siemens and Voltamp Transformers hit their 52-week highs.

In the commodity markets, gold prices see a marginal rise. Today, prices are up by Rs 21, trading at Rs 50,665 per 10 grams.

Note that gold prices have fallen and have taken quite a knock in recent weeks.

Meanwhile, silver prices are trading lower at Rs 56,622 per kg.

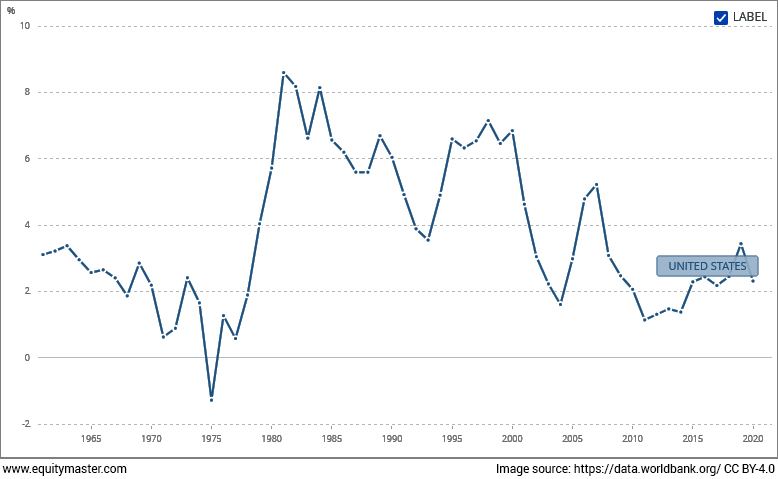

Rising interest rates have taken the share market to the cleaners. A similar rise in interest rates was also seen in 1989.

1989 and 2022 both have disappointed investors resultantly pushing them away. But ace investor Warren Buffett says,

"Be fearful when others are greedy and be greedy when others are fearful,"

Warren Buffett has taught what he preached. In 1989 when everyone was running from the stock market, he invested a huge amount in Wells Fargo - an American financial company.

Over the years Fargo has gone far up and generated handsome returns for Buffett.

This begs the question: is it the right time to invest in banking stocks?

In news from the construction sector, Larsen and Toubro come up with big news.

The buildings & factories vertical of L&T Construction has secured "significant" contracts. The company defines orders worth Rs 10 bn to Rs 25 bn as significant.

Among the orders is one from a data center service provider to construct data centers with a total capacity of 10.8 MW at Mumbai and Navi Mumbai within stringent timelines.

Another order is for constructing a commercial office space of an approximate built-up area of 1 m sq. ft in Hyderabad.

The Business has also secured an order for the engineering, procurement & construction of the 'Statue of Oneness' from Madhya Pradesh State Tourism Development Corporation. The project is scheduled to be completed in 15 months.

L&T's share price is trading up by 0.2% today.

In news from the banking sector, the Bank of Baroda has raised the marginal cost of funding.

State-owned Bank of Baroda has raised the marginal cost of funds-based lending rate by up to 0.15% for a select tenor of loans with effect from Tuesday.

The bank has approved the revision in Marginal Cost of funds based on Lending Rate (MCLR) with effect from 12 July 2022.

The one-year MCLR, the benchmark for most consumer loans such as auto, home, and personal loans, has been revised upwards to 7.65% from the existing 7.50%.

The three-month and six-month tenor loans will have new MCLRs at 7.35% and 7.45%, respectively, up by 0.10% each.

Moving on to news from the IT sector, Nomura Singapore buys shares of BLS International Services.

Global financial services firm Nomura Singapore on Monday purchased 12.5 lakh shares of technology services provider BLS International Services Ltd for Rs 270 m through an open market transaction.

According to bulk deal data available with the National Stock Exchange (NSE), Nomura Singapore Ltd bought 12,50,000 shares of the company at an average price of Rs 214 per share, aggregating to Rs 267.5 m.

More By This Author:

Sensex Snaps 3-Day Winning Streak, Ends 87 Points Lower, Bharti Airtel, HCL Tech, & TCS Top LosersSensex Trades Lower, Bharti Airtel & TCS Slump 5%

Sensex Continues Momentum for Third Straight Day, Ends 303 Points Higher, Power Grid, Tata Motors, L&T Top Gainers

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more