Sensex Trades Flat; Energy And Oil And Gas Sector Rally

Asian share markets were trading on a mixed note this morning.

The Nikkei surged 2.4% while the Hang Seng was down by 0.1%. The Shanghai Composite was trading higher by 0.1%.

Markets had rebounded yesterday following gains on Wall Street after US economic data showed that inflation may be slowing.

Meanwhile, stock indices on Wall Street turned mixed yesterday, shedding some of their early gains following more encouraging data on inflation.

The Dow Jones was up by 0.1% while the tech-heavy Nasdaq surged by 0.6%

Back home, Indian share markets are trading on a flat note.

Benchmark indices opened flat today following the trend on SGX Nifty. And as the session progressed, slowly the gains were extended.

At present, the BSE Sensex is trading higher by 50 points. Meanwhile, the NSE Nifty is trading up by 20 points.

Tata Steel and NTPC are among the top gainers today.

Maruti Suzuki and Sun Pharma are among the top losers today.

EKI Energy's share price is falling today. Shares of the company plunged over 15% after the Lok Sabha passed the Energy Conservation (Amendment) Bill to establish the carbon credit market in India.

Broader markets are trading on a positive note. The BSE Mid Cap index is up by 0.3% while the BSE Small Cap index is trading higher by 0.6%.

Sectoral indices are trading on a positive note with the exception of the bank, healthcare, and FMCG sectors.

Meanwhile, stocks in the energy and oil and gas sector witnessed most of the buying.

Page Industries and Tata Elxsi hit their 52-week highs today.

In the commodity markets, gold prices rise. Gold prices are trading higher by Rs 64. Currently, gold prices are trading at Rs 52,400 per 10 grams.

Note that gold prices have fallen and have taken quite a knock in recent weeks.

Meanwhile, silver prices are trading lower at Rs 58,490 per kg. Silver prices have fallen a lot in recent days.

The rupee is trading at 79.7 against the US dollar.

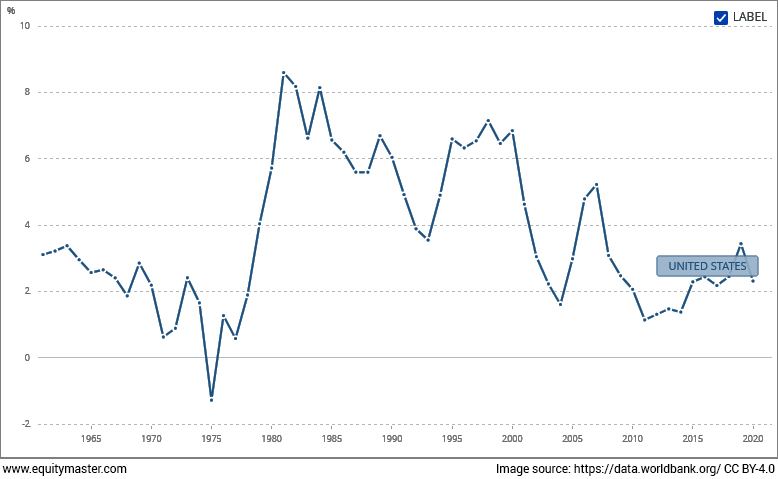

Rising interest rates have taken the share market to the cleaners. A similar rise in interest rates was also seen in 1989.

1989 and 2022 both have disappointed investors resultantly pushing them away. But ace investor Warren Buffett says,

"Be fearful when others are greedy and be greedy when others are fearful,"

Warren Buffett has taught what he preached. In 1989 when everyone was running from the stock market, he invested a huge amount in Wells Fargo - an American financial company.

Over the years, Fargo has gone far up and generated handsome returns for Buffett.

This begs the question: is it the right time to invest in banking stocks?

In news from the chemical sector, Balaji Amines' subsidiary, Balaji Speciality Chemicals, filed a draft red herring prospectus.

The proposed offer consists of a fresh issue of equity shares aggregating up to Rs 2,500 m (including share premium) and an offer for sale of up to 26 m equity shares.

Further, in news from the retail sector, Trent posted its results for the June 2022 quarter.

Trent, which operates retail stores under the Westside and Star Bazaar brand, reported a consolidated profit of Rs 1.1 bn for the quarter ended 30 June 2022.

The company had reported a net loss of Rs 1.4 bn in the year-ago period.

This was on the back of strong revenue growth. The company's consolidated revenue grew 267% YoY to Rs 18 bn.

Trent operates Westside and Zudio, apart from Trent Hypermarket, which operates in the food grocery and daily needs segment under the Star banner, and Landmark Stores.

Trent was in deep losses up until last year, but as you can see that this year it is rolling in profits. How did this happen? How did this loss-making company turn profitable?

Further in news from the tech Sector, a piece of advice for Paytm shareholders.

Institutional Investor Advisory Services India (IIAS) has advised shareholders of Paytm parent firm to vote against the reappointment of Vijay Shekhar Sharma as its chief executive as well as against his remuneration.

More By This Author:

Sensex Zooms 515 Points, Nifty Ends Above 17,600; Financial And IT Stocks RallySensex Zooms 600 Points, Nifty Tops 17,700; IT And Banking Stocks Rally

Indian Share Markets End Flat; IT And FMCG Stocks Witness Selling

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more