Sensex Today Zooms 500 Points; Zee Cracks 10% Post Merger Termination

Asian share markets are mixed today with a focus on the Bank of Japan's policy decision to be announced later in the day.

Japanese shares surged to fresh 34-year highs while the yen steadied, hoping the Bank of Japan will not rock the boat by pivoting away from its super easy policy any time soon.

Meanwhile, Chinese stocks extended declines after a brutal session.

In US markets, the S&P 500 posted a second straight record high close on Monday as tech stocks added to recent gains and investors awaited upcoming corporate reports for clues on this year's profit outlook.

Back home, Indian share markets are trading on a positive note following the trend on GIFT Nifty.

India's stock market overtook Hong Kong's for the first time in another feat.

Medi Assist Healthcare made its debut on the exchanges today. Ahead of the listing, the company's shares were trading with a premium of Rs 32-36 in the unlisted market.

At present, the BSE Sensex is trading higher by 422 points, while the NSE Nifty is trading around 21,700 levels, up 126 points.

Bharti Airtel and Sun Pharma are among the top gainers today.

HDFC Bank and Asian Paints on the other hand are among the top losers today.

Broader markets are trading on a negative note. The BSE Mid Cap index fell 0.1% and the BSE Small Cap index is trading lower by 0.2%.

Sectoral indices are trading mixed with stocks in the pharma sector, IT sector, and telecom sector witnessing buying interest.

While realty stocks and energy stocks are trading in red.

Shares of Persistent Systems and Hero MotoCorp hit their 52-week high today.

The rupee is trading at Rs 83.12 against the US dollar.

In commodity markets, gold prices are trading 0.2% higher at Rs 61,995 per 10 grams today.

Gold prices were little changed as traders cautioned to take position ahead of interest rate decisions from a number of central banks and a slew of economic data in the US.

Why Zee Entertainment's Share Price is Falling

One would have hoped that media and entertainment stocks would fare well this election season, given the historical trend.

But shareholders in Zee Entertainment (Zee) are feeling the heat after the termination of merger plans which would've created India's largest broadcasting company.

Yesterday, Sony announced its plan to end the merger of its India operations through Culver Max Entertainment with Zee, which was announced in 2021.

The deal stipulated that the merger was to be completed before 21 December 2023, including regulatory and other approvals with a grace period of one month to complete the transaction.

Upon terminating the agreement on Monday, Sony further sought $90 million in termination fees from Zee.

In a detailed retort, Zee's board of directors at their January 22 meeting, said that all steps were taken by Zee Entertainment to implement the merger scheme.

The company said it held several talks with Culver Max and BEPL to consider an extension of the merger completion timeline, but it did not materialize.

Zee Entertainment is now taking legal action against Japan-based Sony Group.

As expected, Zee shares tanked as much as 10% following the termination of the merger.

Bitcoin Falls Below US$40,000

The price of Bitcoin fell to a seven-week low, below $40,000 for the first time since the launch of 11 spot Bitcoin exchange-traded funds on 11 Jan 2024.

The largest crypto had rallied on growing excitement the US Securities and Exchange Commission (SEC) would approve bitcoin ETFs, opening up the cryptocurrency to a slew of new investors.

Bitcoin gained around 70% from August when a federal court forced the SEC to review its decision to reject Grayscale Investment's Bitcoin ETF application.

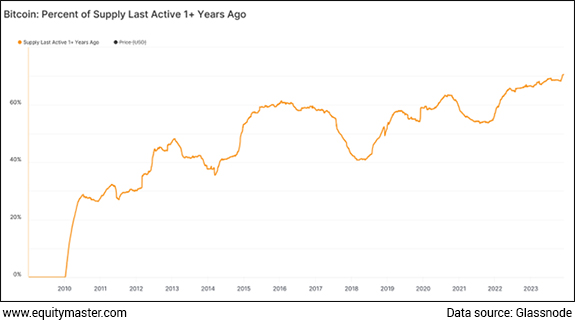

Note that the supply of freely circulating bitcoin recently hit a historic low.

The amount of bitcoin in circulation that hasn't moved in 1+ year hit a new all-time high of around 70.5%.

See this chart which might give you a fair idea.

Going forward, things could get really interesting once there's clarity on more ETF approvals and as the Bitcoin halving takes place.

Whether you like Bitcoin or hate it, it's important that you spend some time re-evaluating what is happening here.

It's not for any reason that Bitcoin is one of the best-performing assets over the last decade despite all the chaos and uncertainty surrounding it.

Cipla Spikes 5% Post Q3 Results

Pharma major Cipla on Monday reported a 32% increase in consolidated net profit at Rs 10.6 bn for the December 2023 quarter, on the back of robust sales across geographies.

The Mumbai-based company had posted a consolidated net profit of Rs 8 bn in the year-ago period.

The company's total revenue from operations rose to Rs 66 bn as compared with Rs 58.1 bn in the year-ago period.

The company's One India business grew at a healthy 12% year-on-year backed by a strong performance across branded prescription, trade generics and consumer health.

Meanwhile, its South Africa business extended momentum from last quarter by growing at 15% in local currency terms driven by strong execution across various segments like prescription and OTC.

Following strong results, shares of Cipla spiked as much as 7% in early trade today.

In the domestic market, Cipla enjoys a strong foothold in the respiratory segment.

Apart from this, their product portfolio spans complex generics as well as drugs in the anti-retroviral, urology, cardiology, anti-infective, CNS, and various other key therapeutic segments.

The business has done well in the past 5 years. While the sales have grown at a 5-year CAGR of 8.4%, the net profit has grown at 14.8%.

The RoE (Return on Equity) and the RoCE (Return on Capital Employed) have reported a 5-year average of 12.1% and 15.6%, respectively. The company has no debt on its books.

Going forward, the company is on track for growth from the big-ticket US launches and growth in its peptide injectable filings.

More By This Author:

Sensex Today Tanks 566 Points; Asian Paints & Power Grid Corporation Top LosersSensex Today Plunges 1,628 Points; HDFC Bank Sinks 8%

Sensex Today Tanks 750 Points; HDFC Bank Drops 5%

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more