Sensex Today Trades Marginally Lower; OMC Stocks Drag

Friday's trading saw a decline in the Asian Stock market live following the surprise 0.6% growth in producer prices in the United States in February.

US stocks slid on Thursday following the release of another hotter-than-expected inflation print. The reading served as one of the last pieces of data that could sway the Federal Reserve at its policy meeting next week.

Here's a table showing how US stocks performed on Thursday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 144.34 | 3.57 | 2.54% | 144.73 | 141.49 | 155.2 | 93.04 |

| Apple | 173 | 1.87 | 1.09% | 174.31 | 172.05 | 199.62 | 149.92 |

| Meta | 491.83 | -3.74 | -0.75% | 501.35 | 488.16 | 523.57 | 190.84 |

| Tesla | 162.5 | -6.98 | -4.12% | 171.17 | 160.51 | 299.29 | 152.37 |

| Netflix | 613.01 | 3.56 | 0.58% | 620.8 | 607.35 | 624.42 | 292.28 |

| Amazon | 178.75 | 2.2 | 1.24% | 179.53 | 176.47 | 180.14 | 93.07 |

| Microsoft | 425.22 | 10.12 | 2.44% | 427.82 | 417.99 | 427.82 | 259.21 |

| Dow Jones | 38905.66 | -137.66 | -0.35% | 39160.25 | 38704.36 | 39282.28 | 31429.82 |

| Nasdaq | 18014.81 | -53.66 | -0.30% | 18142.9 | 17913.63 | 18416.73 | 12026.18 |

Source: Equitymaster

At present, the BSE Sensex is trading 137 points lower and NSE Nifty is trading 39 points lower.

Adani Enterprises, Adani Ports, and UPL are among the top gainers today.

BPCL, Infosys, and M&M on the other hand are among the top losers today.

Broader markets are trading on a positive note. The BSE Midcap index is trading 0.3% higher and the BSE Small Cap index is trading 0.9% higher.

Sectoral indices are trading mixed, with socks in the telecom sector, and the telecom sector is witnessing buying. Meanwhile, stocks in the oil & gas sector and energy sector are witnessing selling pressure.

The rupee is trading at Rs 82.94 against the US dollar.

In commodity markets, gold prices are trading 0.2% higher at Rs 65,700 per 10 grams today.

Meanwhile, silver prices are trading 0.4% higher at Rs 75,511 per 1 kg.

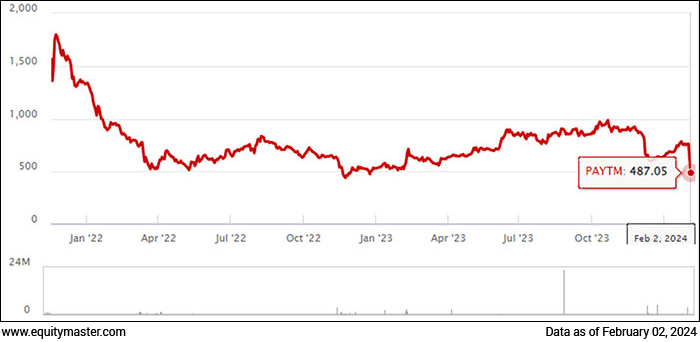

Paytm Approved as Third-Party UPI

The National Payments Corporation of India (NPCI) has approved One97 Communications Limited (OCL), Paytm's parent entity, to participate in UPI services as a Third-Party Application Provider (TPAP) under the multi-bank model.

The much-awaited license would allow Paytm to continue offering Unified Payments Interface (UPI) services to its app users after its banking unit Paytm Payment Bank Limited (PPBL) ceases operations post-March 15 following regulatory action.

Under the new model, Paytm will now provide the payment service in partnership with four new banks, Axis Bank, HDFC Bank, State Bank of India, and Yes Bank, which will act as its Payment System Provider (PSP).

A PSP is a bank that helps the UPI app to connect with the banking channel. Only banks can act as PSPs.

Previously, the fintech was powering this service via PPBL, which held the TPAP license. Since Paytm had a bank of its own, it did not need to be a separate TPAP license, unlike its rival apps such as Google Pay, PhonePe, Cred, and Amazon Pay.

Further, Yes Bank will act as the merchant acquiring bank for Paytm's existing and new UPI merchants.

With this, the Paytm handle would also be redirected to Yes Bank. This will enable existing users and merchants to continue to do UPI transactions and AutoPay mandates seamlessly and uninterruptedly.

Wipro Partners Desjardins

Wipro announced that it has been selected by Desjardins to transform its credit solutions for members and clients.

Wipro Gallagher Solutions (WGS), a subsidiary of Wipro Company and a leading provider of cloud-based Loan Origination Systems (LOS), will integrate and manage Desjardins' multiple in-house and legacy systems.

This integration will bring all their Loan Origination Systems into one platform, which will result in improved customer experience, efficiency gains, and cost savings. WGS' flagship NetOxygen solution will be used to carry out the integration.

This transformation program will provide Desjardins members and clients with a convenient digital lending experience that is accessible anytime, anywhere, and on any device.

It will also eliminate operational tasks through automation, enabling Desjardins employees to focus on advisory services and handling more complex transactions.

Biocon Biologics to Sell India Branded Formulations

Eris Lifesciences, a chronic therapy-focused drug firm, has acquired the India-branded formulation business of Biocon Biologics, a subsidiary of Biocon, for Rs 12.4 bn. This includes portfolios in insulin, oncology, and critical care.

The transaction value represents an accretive multiple of 3.4 times revenue and 18 times earnings before interest, tax, depreciation, and amortisation.

As part of the deal, over 430 employees associated with the business are expected to transition to Eris.

The deal would enable Eris to enter the Rs 300 bn injectable market, positioning it as a major player in the insulin segment with the acquisition of Biocon Biologics' Basalog and Insugen.

It also marks Eris' entry into oncology and critical care.

He added that following this acquisition, Eris would have a debt of Rs 300 bn on its balance sheet, and it is comfortably positioned to service the debt and make principal repayments through its strong cash flows.

The portfolio size is in the region of Rs 3.6 bn.

More By This Author:

Sensex Today Ends 335 Points Higher; Nifty Above 22,100Sensex Today Trades Flat; Steel Stocks Drag

Sensex Today Tanks 906 Points; BSE Smallcap Index Slides 5%

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more