Sensex Today Trades Marginally Higher; Nifty Above 23,100

Stocks in Asia got off to an uneven start in the wake of a US rally fueled by optimism over artificial intelligence spending.

A rally in big tech and a batch of earnings from corporate heavyweights drove US stocks to the brink of all-time highs in a continuation of the advance fueled by the strength of Corporate America.

Here's a table showing how US stocks performed on Wednesday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 200.03 | 0.40 | 0.20% | 202.12 | 199.20 | 203.84 | 131.55 |

| Apple | 223.83 | 1.19 | 0.53% | 224.12 | 219.79 | 260.09 | 164.08 |

| Meta | 623.50 | 7.04 | 1.14% | 624.80 | 621.10 | 638.40 | 381.20 |

| Tesla | 415.11 | -8.96 | -2.11% | 428.00 | 414.59 | 488.54 | 138.80 |

| Netflix | 953.99 | 84.31 | 9.69% | 999.00 | 950.76 | 999.00 | 481.40 |

| Amazon | 235.01 | 4.30 | 1.86% | 235.44 | 231.19 | 235.44 | 151.61 |

| Microsoft | 446.20 | 17.70 | 4.13% | 447.27 | 436.00 | 468.35 | 385.58 |

| Dow Jones | 44156.73 | 130.92 | 0.30% | 44208.34 | 44042.11 | 45073.63 | 37611.56 |

| Nasdaq | 21853.00 | 286.49 | 1.33% | 21943.04 | 21756.23 | 22133.22 | 16973.94 |

Source: Equitymaster

At present, the BSE Sensex is trading 66 points higher and NSE Nifty is trading 12 points higher.

Wipro, Tech Mahindra and Trent among the top gainers today.

HUL, BPCL and SBI hand are among the top losers today.

The BSE Midcap index is trading 0.6% higher and the BSE Smallcap index are trading 0.3% higher.

Sectoral indices are trading mixed today with stocks in media sector and IT sector witnessing buying. Meanwhile stocks in energy sector and oil & gas sector witnessing selling pressure.

The rupee is trading at Rs 86.42 against the US dollar.

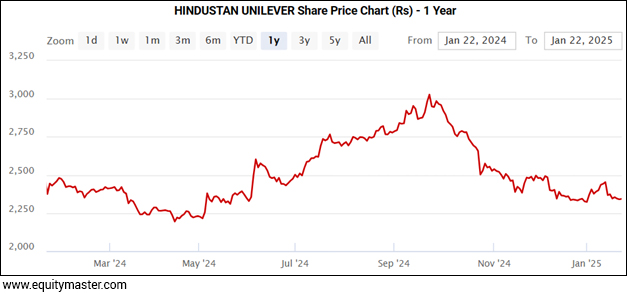

HUL Demerger

The Board of FMCG major Hindustan Unilever (HUL) on Wednesday, 22 January, approved the demerger of its ice cream business, Kwality Walls into a separate listed entity.

The resulting company following the demerger of the ice cream business will be listed on the BSE and the NSE.

As per the demerger terms, every HUL shareholder would get one KWIL share against each HUL share owned.

Following the demerger and listing of Kwality Wall's (India) Ltd., the entire shareholding of KWIL will be held directly by HUL shareholders.

The FMCG major said that the business will continue to be equipped with the portfolio, brand, and innovation expertise of the largest global ice cream business, enabling it to keep winning in the marketplace.

HUL will also acquire 90.5% stake in Minimalist through secondary buy-outs at a pre-money enterprise value of Rs 29.6 bn and primary infusion.

Here's how shares of company have performed in past 1 year.

Coforge Q3 Results

Coforge reported revenue growth for the December 2024 quarter. The company has also announced a dividend and another acquisition. However, there was a marginal miss on the margin front.

Revenue in constant currency terms grew by 8.4% on a sequential basis for Coforge.

In US Dollar terms, Coforge's topline grew by 7.5% on a quarter-on-quarter basis to US$ 397 million, while in rupee terms, revenue growth stood at 8.4% from the previous quarter to Rs 33.2 bn.

Earnings Before Interest and Tax stood at Rs 3.2 bn from Rs 2.9 bn last quarter, while EBIT margin, as per the company's P&L account, stood at 9.5% from 9.4% in the previous quarter.

Net profit for the period increased by 6.6% to Rs 2.2 bn.

Persistent Systems Q3 Profit Grows 30%

Mid-tier IT services firm Persistent Systems on 22 January reported a 30.4% year-on-year jump in net profit at Rs 3.4 bn for the third quarter ended 31 December 2024, compared to the same quarter in the previous fiscal year.

This was driven by the company's AI-led, platform-driven services strategy, despite being a seasonally weak quarter for the IT sector.

Consolidated revenue for Q3 grew 22.6% YoY and stood at Rs 30.6 bn. Sequentially, it increased by 5.7%.

The company's operating margin improved by 90 basis points to 14.9% after two consecutive quarters of flat 14% margins.

The company's Board of Directors declared an interim dividend of Rs 20 per share on the face value of Rs 5 each for the Financial Year 2024-2025.

The order booking for the quarter was at US$ 594.1 million (m) in Total Contract Value (TCV) and at US$ 428.3 m in Annual Contract Value (ACV) terms.

These were driven by deals won in the BFSI, Healthcare and life sciences, emerging industries, software and hi-tech sectors.

Pidilite Industries Revenue Jumps 8%

Pidilite Industries on 22 January reported a 9% jump in net profit at Rs 557.08 crore in the December ended quarter of the current financial year, compared to Rs 5.1 bn in the year-ago period.

In the September quarter, the company had posted a net profit of Rs 5.4 bn.

The firm's revenue from operations also recorded a growth of 7.6% at Rs 33.7 bn in the reported quarter over Rs 31.3 bn in the same period of the previous financial year.

The revenue stood at Rs 32.3 bn in the September quarter, the manufacturer of adhesives, sealants and construction chemicals said in the statement.

More By This Author:

Sensex Today Rallies 567 Points; Nifty Above 23,150Sensex Today Tanks 1,235 Points; Nifty Ends Below 23,100

Sensex Today Trades Marginally Lower

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more