Sensex Today Trades Marginally Higher; Nifty Above 22,300

A global bond selloff accelerated in Asia on Thursday, pushing Japanese benchmark yields to the highest in more than a decade after heavy selling in German bunds spread across fixed income markets.

US stocks rose Wednesday following two days of steep declines. The rally came after the Trump administration announced a one-month reprieve on auto tariffs for Canada and Mexico, easing investor concerns about a global trade war.

Here's a table showing how US stocks performed on Wednesday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 174.99 | 2.38 | 1.38% | 175.75 | 170.93 | 208.7 | 131.95 |

| Apple | 235.74 | -0.19 | -0.08% | 236.55 | 229.23 | 260.09 | 164.08 |

| Meta | 656.47 | 16.47 | 2.57% | 659.5 | 637.66 | 740.89 | 414.5 |

| Tesla | 279.1 | 7.06 | 2.60% | 279.55 | 267.71 | 488.54 | 138.8 |

| Netflix | 990.92 | 18.34 | 1.89% | 995.6 | 969.48 | 1064.5 | 542.01 |

| Amazon | 208.36 | 4.56 | 2.24% | 209.98 | 203.26 | 242.52 | 151.61 |

| Microsoft | 401.02 | 12.41 | 3.19% | 401.67 | 388.81 | 468.35 | 381 |

| Dow Jones | 43006.59 | 485.6 | 1.14% | 43135.92 | 42418.73 | 45073.63 | 37611.56 |

| Nasdaq | 20628.47 | 275.94 | 1.36% | 20688.72 | 20182.57 | 22222.61 | 16973.94 |

Source: Equitymaster

At present, the BSE Sensex is trading 55 points higher and NSE Nifty is trading 26 points higher.

BPCL, Cipla, and Tata Steel among the top gainers today.

Trent, ITC and Maruti Suzuki on other hand are among the top losers today.

The BSE Midcap index is trading 0.9% higher and the BSE Smallcap index are trading 1.7% higher.

Barring auto stocks all other sectoral indices are trading on positive note today with stocks in energy sector, metal sector and oil & gas sector witnessing buying.

The rupee is trading at Rs 87.2 against the US dollar.

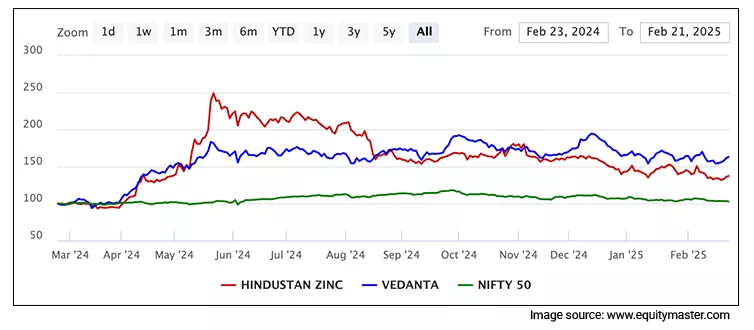

Vedanta Demerger Faces Setback

The National Company Law Tribunal (NCLT) has rejected the demerger scheme filed by Talwandi Sabo Power Ltd (TSPL) following objections raised by SEPCO, a creditor of TSPL, regarding Vedanta's restructuring.

In its ruling, the Mumbai bench of NCLT stated that the scheme presented under Section 230 of the Companies Act was not suitable for approval. The tribunal further observed that the applicant company had failed to disclose material facts, thereby violating Section 230(2)(a) of the Companies Act, 2013, which could adversely impact public interest.

The decision follows objections from China-based SEPCO Electric Power Construction Corporation, which alleged that TSPL had deliberately omitted an outstanding debt of Rs 1,251 crore from its list of creditors. SEPCO claimed that the concealment of crucial financial information led to the rejection of the demerger scheme.

TCS Partners Vantage Towers

Tata Consultancy Services (TCS) has announced a partnership with Vantage Towers, Europe's second-largest telecom tower operator, to launch a digital service platform aimed at enhancing the experience of property owners leasing land for telecom tower installations.

The platform is designed to streamline service processes, improve property owner retention, and strengthen telecom site partnerships across Europe. As part of the collaboration, TCS will deploy TCS Crystallus for telecom, an industry-specific solution that accelerates digital transformation for telecom infrastructure providers.

Through this initiative, property owners across eight European markets will gain round-the-clock personalised access to customer support via their preferred channels. This approach not only empowers landlords but also enables Vantage Towers' agents and stakeholders to seamlessly access critical information through a unified platform.

The partnership builds on the long-standing relationship between TCS and Vantage Towers, further deepening collaboration to drive value through technology-driven solutions.

IRFC Lending to Non-railway Projects

Indian Railway Finance Corporation (IRFC), which earned Navratna status from the government, on Wednesday said it is exploring lending to non-railway projects.

The IRFC, which was funding to the Indian Railways, has now got wider legroom to finance all other companies and activities. By lending non-railway projects, the company can look for improve its margin, the company CMD and CEO Manoj Kumar Dubey told media persons here.

On March 3, 2025, the government approved the upgradation of IRCTC and IRFC to Navratna Central Public Sector Enterprises.

IRFC has played a key role in funding nearly 80% of Indian Railways locos, coaches and wagons, including the Vande Bharat Express trains. He informed that the firm has funded Rs 5 lakh crore to the Indian Railways till date. At present, nearly 86 per cent of the company is owned by the Ministry of Railways and nearly 13 per cent by all diverse shareholders in the country as well as overseas, he added.

IHC's arm sells stake in Adani Enterprises

A subsidiary of Dubai-based International Holding Company (IHC) has offloaded 84.49 lakh shares in Adani Enterprises for approximately Rs 18 bn, as per a regulatory filing. The transaction was executed through two entities-Green Vitality RSC and Green Energy Investment Holding RSC.

The stake was acquired by Envestcom Holding RSC, which also holds investments in other Adani Group companies, including Adani Energy Solutions and Adani Total Gas.

As of December 2024, Envestcom Holding owned 55.2 million (m) shares in Adani Energy Solutions, representing a 4.60% stake, and 54.59 m shares in Adani Total Gas, accounting for a 4.964% stake.

As per the latest available data, Green Enterprises Investment Holding continues to hold 40.19 m shares in Adani Enterprises, representing a 3.48% stake in the company.

More By This Author:

Sensex Today Rallies 740 Points; Nifty Above 22,300Sensex Today Trades Higher; Nifty Above 22,100

Sensex Today Ended 96 Points Lower; Nifty Below 22,100

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more