Sensex Today Trades Lower; Nifty Below 23,000

Asian markets traded flat ahead of key economic data from China. Japan's Nikkei 225 rose 0.03, while the Topix gained 0.62%.

US stock market ended lower on Friday dragged by technology stocks amid mixed economic data and earnings reports.

Here's a table showing how US stocks performed on Friday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 201.90 | 2.32 | 1.16% | 202.57 | 199.78 | 203.84 | 131.55 |

| Apple | 222.78 | -0.88 | -0.39% | 225.63 | 221.41 | 260.09 | 164.08 |

| Meta | 646.10 | -1.40 | -0.20% | 652.00 | 634.20 | 652.00 | 387.10 |

| Tesla | 406.58 | -5.80 | -1.41% | 418.88 | 405.78 | 488.54 | 138.80 |

| Netflix | 977.59 | -7.27 | -0.74% | 986.28 | 967.68 | 999.00 | 542.01 |

| Amazon | 234.85 | -0.57 | -0.24% | 236.40 | 232.93 | 236.40 | 151.61 |

| Microsoft | 444.06 | -2.65 | -0.59% | 446.65 | 441.40 | 468.35 | 385.58 |

| Dow Jones | 44424.25 | -140.82 | -0.32% | 44545.52 | 44332.22 | 45073.63 | 37611.56 |

| Nasdaq | 21774.01 | -126.92 | -0.58% | 21945.48 | 21709.06 | 22133.22 | 16973.94 |

Source: Equitymaster

At present, the BSE Sensex is trading 385 points lower and NSE Nifty is trading 125 points lower.

HUL, ICICI Bank, and Asian Paints are among the top gainers today.

IndusInd Bank, Tata Motors, and Shriram Finance on the other hand are among the top losers today.

The BSE Midcap index is trading 1.6% lower and the BSE Smallcap index is trading 2.6% lower.

Sectoral indices are trading on a negative note today with stocks in pthe ower sector, telecom sector and metal sector witnessing selling pressure.

The rupee is trading at Rs 86.38 against the US dollar.

ICICI Bank Q3 Results

ICICI Bank reported a 14.8% year-on-year increase in standalone net profit for Q3 FY25, reaching Rs 117.9 bn.

The private lender's net interest income (NII) rose by 9.1% YoY to Rs 203.7 bn during the December quarter.

The net interest margin (NIM) for the quarter stood at 4.25%, marginally lower than 4.27% in Q2 FY25 and 4.43% in Q3 FY24.

The net NPA ratio remained steady at 0.42% compared to the previous quarter, while the provisioning coverage ratio for non-performing loans stood at 78.2% as of December-end.

Fee income saw a robust 16.3% YoY growth, climbing to Rs 61.8 bn in Q3 FY25 from Rs 53.1 bn in the corresponding period last year. Retail, rural, and business banking customers contributed approximately 78% of the total fees during the quarter.

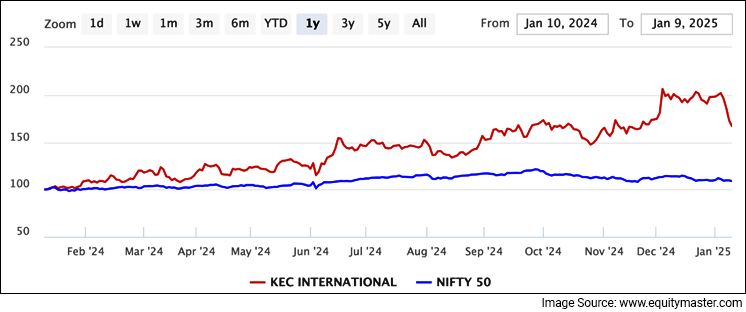

KEC International's New Order Win

KEC International Ltd, a prominent infrastructure company, announced on Friday, 24 January, that it has secured new orders worth Rs 14.5 bn for Transmission & Distribution (T&D) projects in India.

Among these, the company has been awarded major contracts for the construction of ±800 kV HVDC and 400 kV transmission lines by the Power Grid Corporation of India Limited (PGCIL).

According to Vimal Kejriwal, Managing Director and CEO of KEC International, the significant order wins, particularly in the HVDC segment, mark a major achievement for the company.

He highlighted that this order further strengthens KEC's position in the HVDC market, where it is already executing a terminal station project for a leading private client.

The company expressed optimism about the growth prospects of the India T&D business, which is driven by rising power demand and the Indian government's focus on expanding renewable energy initiatives.

With the addition of these new orders, KEC International's year-to-date order intake has exceeded Rs 220 bn, representing an impressive growth of over 70% compared to the previous year.

Jubilant Ingrevia Commissions New Facility

Jubilant Ingrevia on Saturday, 25 January, said it is commissioning its new cGMP compliant facility at Bharuch, Gujarat and it will manufacture nutraceuticals and dietary-active ingredients for human consumption.

The facility is an extension of the company's USFDA-approved plant that is already supplying to the US, Europe, Japan and other markets. It will be fully-equipped to cater to the needs of the bgigest marquee customers in the food, nutrition and cosmetics space.

The company's CEO and managing director Deepak Jain said the new facility for niacinamide aimed at food, nutrition and cosmetic applications is an important milestone and the company aims to become the global leader in Vitamin B3 in the coming years.

The facility has a capacity of 5,000 metric tonne and is part of a fully-green supply chain within the nutrition and health ingredients business and is among the most advanced units within the company's operations.

JK Cement enters' a JV

JK Cement has dramatically expanded its strategic footprint, signing a landmark deal to acquire a majority stake in Saifco Cements, a calculated move to penetrate the Jammu and Kashmir regional market.

JK Cement Limited has announced the acquisition of a 60% equity stake in Saifco Cement Private Limited. This acquisition, valued at approximately Rs 1.7 bn, was approved during the board meeting held on 25 January.

Strategically located in Khunmoh, Srinagar, Saifco brings an integrated manufacturing unit with clinker and grinding capacities that perfectly complement JK Cement's expansion strategy.

With a recent annual turnover hovering around Rs 860 m, the acquisition represents more than a financial transaction - it's a territorial chess move in India's competitive cement landscape.

More By This Author:

Sensex Today Ends 330 Points Lower; Nifty Below 23,100Sensex Today Trades Marginally Higher; Nifty Above 23,200

Sensex Today Ends 115 Points Higher; Nifty Above 23,200

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more