Sensex Today Trades Higher; Nifty Above 25,000

Asian equities were mixed Thursday after a rally on Wall Street drove stocks and bonds higher, as a drop in producer prices supported bets the Federal Reserve will resume cutting interest rates next week.

Shares in Australia fell while those in Japan swung between gains and losses in early trading.

US stock market ended mixed on Wednesday, with the S&P 500 and Nasdaq notching record-high closes, after cooler-than-expected inflation data supported expectations that the US Federal Reserve will cut interest rates next week.

Here's a table showing how US stocks performed on Wednesday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 239.56 | -0.38 | -0.16% | 242.08 | 238.11 | 242.08 | 142.66 |

| Apple | 226.79 | -7.56 | -3.23% | 232.42 | 225.95 | 260.09 | 169.21 |

| Meta | 751.98 | -13.72 | -1.79% | 765.70 | 751.00 | 796.25 | 479.80 |

| Tesla | 347.79 | 0.82 | 0.24% | 356.33 | 346.07 | 488.54 | 212.11 |

| Netflix | 1247.71 | -15.54 | -1.23% | 1267.00 | 1246.36 | 1341.15 | 660.81 |

| Amazon | 230.33 | -7.91 | -3.32% | 237.68 | 229.10 | 242.52 | 161.38 |

| Microsoft | 500.37 | 1.96 | 0.39% | 503.23 | 496.72 | 555.45 | 344.79 |

| Dow Jones | 45490.92 | -220.42 | -0.48% | 45731.50 | 45380.06 | 45770.20 | 36611.78 |

| Nasdaq | 23849.27 | 9.47 | 0.04% | 23958.54 | 23760.10 | 23969.28 | 16542.20 |

Source: Equitymaster

At present, the BSE Sensex is trading 111 points higher, and the NSE Nifty is trading 29 points higher.

NTPC, ONGC and SBI are among the top gainers today.

Tech Mahindra, Hero MotoCorp and Trent are among the top losers today.

The BSE Midcap index is trading 0.3% higher and the BSE Smallcap index is trading 0.4%higher.

Barring the IT sector, all other sectors are trading positively, with stocks in the power sector, oil & gas and energy sector witnessing buying.

The rupee is trading at Rs 88.2 against the US dollar.

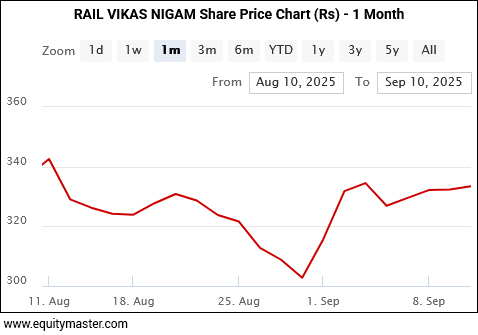

RVNL To Be In Focus Today

Rail Vikas Nigam (RVNL) shares are likely to remain in focus on September 10 after the company emerged as the lowest bidder for a West Central Railway project valued at Rs 169.49 crore, to be completed within 540 days.

In July, RVNL secured a Letter of Award (LOA) from Southern Railway for the upgradation of the electric traction system to meet the 3000 MT loading target. Around the same time, it also received an LOA from Delhi Metro Rail Corporation (DMRC) for a project worth Rs 447.42 crore.

In the previous session, RVNL shares closed marginally higher by 0.06 percent, up Rs 0.20, at Rs 332.35.

Mazagon Dock Initiates Negotiations

Mazagon Dock Shipbuilders Ltd announced on September 10 that it has initiated negotiations with the Indian Navy for the long-pending submarine programme, Project P-75(I).

This development follows the Ministry of Defence's approval in August, allowing the state-run shipbuilder to begin cost discussions with Germany's Thyssenkrupp Marine Systems for the construction of six conventional submarines under a deal estimated at nearly Rs 70,000 crore.

The contract is expected to be awarded to Mazagon Dock and Thyssenkrupp around six months after the successful conclusion of negotiations.

Mazagon Dock and Thyssenkrupp had signed a memorandum of understanding in June 2023, under which the German firm will manage engineering and design, while Mazagon Dock will handle construction and delivery of the submarines to the Indian Navy.

Mazagon Dock is the only shipyard company to have received Navratna status.

Mazagon Dock Shipbuilders Limited (MDL) is one of India's leading shipbuilding yards, headquartered in Mumbai and operating as a premier government-owned entity under the Ministry of Defence.

Vedanta to Acquire Land

Vedanta Ltd is in the process of acquiring land in Dhenkanal, Odisha, for its proposed 3 million tonnes per annum (MTPA) aluminium smelter. The move is part of the company's broader strategy to expand its overall aluminium capacity from the current 3 MTPA to 6 MTPA.

Vedanta, a leading manufacturer and exporter of billets for the extrusion industry, has already been investing in billet capacity, which currently stands at 580 kilo tonnes and is being doubled.

The planned greenfield smelter project is expected to require significant investment, given the capital-intensive nature of the aluminium industry, and will likely take three to four years to be commissioned.

In addition to the smelter, Vedanta is also planning to set up an aluminium park in Jharsuguda, Odisha, to attract downstream manufacturers to establish their units within the facility.

Vedanta is a major Indian multinational natural resources and diversified conglomerate. It operates primarily in mining, oil and gas, metals, and power sectors.

The company's portfolio includes production of zinc, lead, silver, aluminium, iron ore, steel, copper, nickel, and has significant oil and gas operations through its Cairn Oil & Gas division

More By This Author:

Sensex Today Ends 323 Points Higher; Nifty Above 24,950Nifty Above 24,900; Welspun Living Up 8%

Sensex Today Ends 314 Points Higher; Nifty Above 24,850

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more