Sensex Today Trades Higher; Hindalco & Axis Bank Top Gainers

Asian stocks climbed, buoyed by renewed optimism over China's economy and US data that eased recession concerns. Japanese equity benchmarks outperformed with gains topping 1%, while shares in Australia and South Korea also advanced.

US stocks are holding steadier Monday in a slowdown from their scary roller-coaster ride in recent weeks.

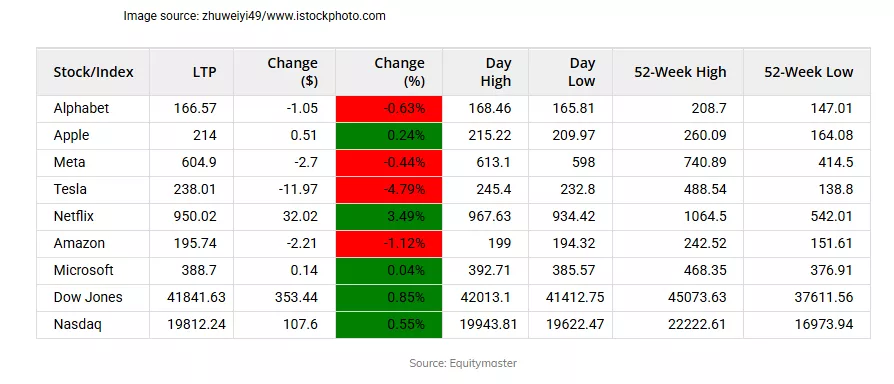

Here's a table showing how US stocks performed on Monday:

At present, the BSE Sensex is trading 450 points higher and NSE Nifty is trading 137 points higher.

M&M, Axis Bank, and Hindalco are among the top gainers today.

ONGC, Infosys, and HCL Tech on the other hand are among the top losers today.

The BSE Midcap index is trading 0.7% higher and the BSE Smallcap index is trading 1.2% higher.

Sectoral indices are trading higher today with stocks in the realty sector, banking sector, and FMCG sector witnessing buying.

The rupee is trading at Rs 86.8 against the US dollar.

HUL to Acquire Minimalist

The Competition Commission of India (CCI) has approved Hindustan Unilever's (HUL) acquisition of Uprising Science, the parent company of beauty and personal care brand Minimalist. Jaipur-based Uprising Science specializes in manufacturing and selling skincare, baby care, and hair care products under the Minimalist brand.

As part of the deal, HUL will acquire a 90.5% stake in Uprising Science, with plans to purchase the remaining 9.5% within two years, as outlined in the share purchase and subscription agreement.

HUL, a leading FMCG company with a diverse portfolio of over 50 brands, including Lakme, Lux, Knorr, Kwality Wall's, and Surf Excel, continues to expand its presence in the beauty and personal care segment.

The transaction, announced in January, involves a secondary buyout for Rs 26.7 bn at a pre-money enterprise valuation of Rs 29.6 bn. Additionally, HUL will make a primary infusion of Rs 45 crore, reinforcing its commitment to the growth and expansion of Minimalist.

IRCON International Shares in Focus

IRCON International's share price is poised to rebound on March 18 after the company, in a joint venture with Badri Rai and Company (BRC), secured an EPC contract worth Rs 10.9 billion.

The contract, awarded by the Directorate of Urban Affairs, Government of Meghalaya, involves the construction of a new secretariat complex with campus infrastructure in New Shillong City.

The project, structured on an engineering, procurement, and construction (EPC) basis, is set to be completed within 36 months.

IRCON holds a 26% stake in the project, amounting to Rs 2.9 bn of the total contract value of Rs 10.9 bn. Despite this positive development, the company reported a 65% decline in net profit, falling to Rs 860 m from Rs 2.4 bn in the corresponding period last year. Revenue also saw a 10% year-on-year drop to Rs 26.1 bn, down from Rs 29.3 bn.

Vedanta Spin-offs Target US$ 100 Billion Growth

Vedanta Ltd Chairman Anil Agarwal reaffirmed the company's commitment to unlocking value, stating that the four newly demerged companies have the potential to grow into US$ 100 billion (bn) businesses each.

The proposed demerger will establish independent natural resource-focused entities, each with its own management structure, capital framework, and strategic priorities.

In a letter to shareholders, Agarwal emphasized the advantages of pure-play businesses and how the restructuring aligns with Vedanta's long-term vision.

The demerger aims to simplify the group's structure and improve debt management.

The mining conglomerate initiated this restructuring in 2023 after a failed attempt to take Vedanta private in 2020.

Under the demerger plan, every Vedanta shareholder will receive one additional share in each of the four newly formed companies upon completion of the process.

The newly created entities include Vedanta Aluminium, one of the world's largest aluminium producers; Vedanta Oil & Gas, India's leading private crude oil producer; Vedanta Power, a major power generator; and Vedanta Iron & Steel, a company with a highly scalable ferrous portfolio.

Vedanta Limited will continue to operate as a powerhouse, retaining a 63.4% stake in Hindustan Zinc, the world's second-largest integrated zinc producer and third-largest silver producer, along with Zinc International, which possesses even greater mineral resources than Hindustan Zinc.

More By This Author:

Sensex Today Ends 341 Points Higher; Nifty Above 22,500Sensex Today Trades Higher; Nifty Above 22,500

Sensex Today Ended 201 Points Lower; Nifty Below 22,400

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more