Sensex Today Trades Higher; Coal India Rises 3%, Hindalco Tanks 14%

Asian stocks inched higher and the dollar held steady on Tuesday ahead of a key US inflation report that could help shape the Federal Reserve's rates outlook and determine the timing of interest rate cuts.

The Nikkei index is trading 1.7% higher, while Hang Seng was trading 0.8% lower.

US Stocks rose to a new high on Monday as investors awaited fresh inflation and earnings data.

Here's a table showing how US stocks performed on Monday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 148.73 | -1.49 | -0.99% | 150.59 | 148.56 | 155.2 | 88.86 |

| Apple | 187.15 | -1.7 | -0.90% | 188.67 | 186.79 | 199.62 | 143.9 |

| Meta | 468.9 | 0.79 | 0.17% | 479.15 | 466.58 | 485.96 | 167.66 |

| Tesla | 188.13 | -5.44 | -2.81% | 194.73 | 187.28 | 299.29 | 152.37 |

| Netflix | 557.85 | -3.47 | -0.62% | 568.44 | 557 | 579.64 | 285.33 |

| Amazon | 172.34 | -2.11 | -1.21% | 175.39 | 171.54 | 175.39 | 88.12 |

| Microsoft | 415.26 | -5.29 | -1.26% | 420.74 | 414.75 | 420.82 | 245.61 |

| Dow Jones | 38797.38 | 125.69 | 0.33% | 38927.08 | 38628.92 | 38927.08 | 31429.82 |

| Nasdaq | 17882.66 | -79.74 | -0.44% | 18041.45 | 17859.66 | 18041.45 | 11695.41 |

Data Source: Equitymaster

At present, the BSE Sensex is trading 62 points higher and NSE Nifty is trading 14 points lower.

Hero MotoCorp, Coal India, and ICIC Bank are among the top gainers today.

Hindalco, Grasim, and JSW Steel on the other hand are among the top losers today.

Broader markets are trading marginally lower. The BSE Mid is trading 0.8% lower and the BSE Small Cap index is trading 1.7% lower.

Sectoral indices are trading mixed, with socks in the banking sector and finance sector witnessing buying. Meanwhile, stocks in the metal sector and power sector witnessed selling pressure.

The rupee is trading at Rs 83.0 against the US dollar.

In commodity markets, gold prices are trading flat at Rs 62,090 per 10 grams today.

Meanwhile, silver prices are trading marginally higher at Rs 71,049 per 1 kg.

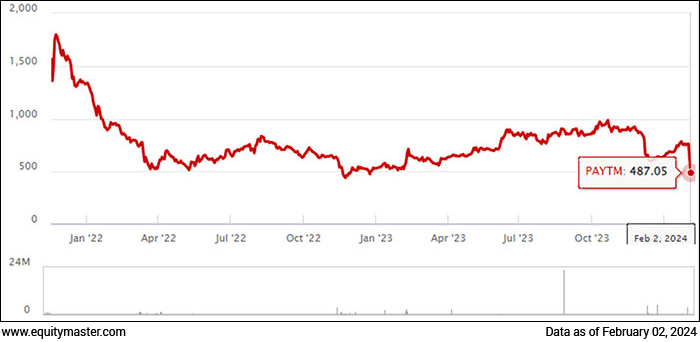

Paytm Director Resigns

Financial technology company Paytm on Monday confirmed media reports of an independent director at its banking arm having resigned.

Manju Agarwal resigned from the board of Paytm Payments Bank on 1 February due to personal commitments.

The payments firm on Friday said it would form an advisory committee on compliance and regulatory matters, a week after Reserve Bank of India (RBI) ordered Paytm Payments Bank to wind down most of its operations.

SAIL Q3 Results

Steel Authority of India (SAIL) shares will be in focus on 13 February after the state-owned steel maker reported a consolidated net profit of Rs 4.3 for the October-December period of FY24.

The profit fell 22% on-year on a high base as in Q3FY23, there was an exceptional gain of Rs 2.9 bn. Revenue from operations fell 6.8% on-year to Rs 233.5 bn for the quarter.

SAIL's revenue from its Bhilai plant stood at about Rs 65 bn, down 12.1%, while that of Rourkela and Bokaro units came in at Rs 58.6 bn and Rs 60 bn, respectively.

Crude steel production in the quarter came in at 4.75 million tonnes against 4.71 million tonnes last year. while sales volume fell to 3.81 million tonnes from 4.15 million tonnes.

The public sector unit also declared an interim dividend of Rs 1 per equity share of Rs 10 each. The record date for payment of the interim dividend is 20 February.

The Centre holds around 65% of SAIL, while FIIs and DIIs hold 4.3% and 15.5%. Of the DIIs, Life Insurance Corporation of India has a 9.2% shareholding in the company, as of the quarter ended December 2023. The remaining 15.2% of the company is owned by the public.

Over the past six months, SAIL shares have surged over 40% compared to a 12% rise in the frontline index Nifty 50 during the same period.

Railway PSU Stocks in Free Fall

Key railway stocks have seen a correction of as much as 30% from their recent highs, including yesterday's steep fall in PSU stocks.

The crackdown on railway stocks is because execution not keeping pace with growth expectations and fears of a slowdown in order inflows ahead of elections.

The railways segment has been under pressure due to a variety of reasons. One of the reasons could be due to profit booking as the stocks had been on a rally, right up till last week.

Stretched valuations have also been a concern for the segment, where the upmove in the stock prices without a similar earnings growth has made the stocks look much more expensive than the last five-year average.

While there have been a lot of order inflows for the segment, ordering the actual execution takes a lot of time. Given the order book has not been strong, some of the stocks may not be able to meet their order guidance for the year.

Also, with general elections looming on the horizon, the segment could see a sudden decline in major government orders, a factor that could impact the entire PSU bucket.

The recent budget has also added pressure to railway stocks.

More By This Author:

Sensex Today Ends 167 Points Higher; SBI & Sun Pharma Top GainersSensex Today Trades Higher; TCS & Titan Top Gainers

Sensex Today Tanks 724 Points; Paytm Plunges 10%

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more