Sensex Today Rallies 1,293 Points; Nifty Tops 24,800 Mark

After opening the day on a positive note, Indian share markets continued the momentum as the session progressed and ended on a firm footing.

The equity market bulls were back on Dalal Street. The S&P BSE Sensex soared more than 1,000 points, while the Nifty 50 index rallied over 350 points.

At the closing bell, the BSE Sensex stood higher by 1,293 points (up 1.6%).

Meanwhile, the NSE Nifty closed higher by 428 points (up 1.8%).

Cipla, Bharti Airtel, and Apollo Hospital were among the top gainers today.

ONGC, Nestle, and Tata Consumer Products on the other hand, were among the top losers today.

The GIFT Nifty was trading at 24,938 up by 483 points, at the time of writing.

The BSE MidCap index ended 2% higher and the BSE SmallCap index ended 1% higher.

All other Sectoral indices are trading on a positive note with stocks in the telecom sector, metal sector, and IT sector witnessing most buying.

Shares of Lupin, Infosys, and TVS Motors hit their respective 52-week highs today.

The rupee is trading at 83.72 against the US$.

Gold prices for the latest contract on MCX are trading 0.5% higher at Rs 67,818 per 10 grams.

Meanwhile, silver prices were trading 0.1% higher at Rs 81,399 per 1 kg.

Here are three reasons why Indian Markets are rising today

#1 Recovery from Union Budget Anxiety

Investors had been booking profit in large-cap stocks, and preferred to stay on the sidelines ahead of the Union Budget presentation on July 23. Between July 18 and July 25, benchmark indices, BSE Sensex and the Nifty50, slipped over a percent each. Specifically, the BSE Sensex shed around 1,300 points in these five sessions.

With Budget-related anxiety behind investors, coupled with the expiry of July F&O series, they seem to be taking fresh positions in the market.

#2 Sectoral Gains

The Nifty IT index surged by 2.54 percent to reach a new record high of 41,073.65, buoyed by expectations of a Federal Reserve rate cut following stronger-than-expected US GDP data. This optimism, combined with positive results from Indian IT companies, spurred the rally.

#3 Rupee Rises

The Indian rupee rose 9 paise to 83.69 against the US dollar in early trade. The dollar index, which tracks the movement of the greenback against a basket of six major world currencies, declined 0.07% to 104.28 level.

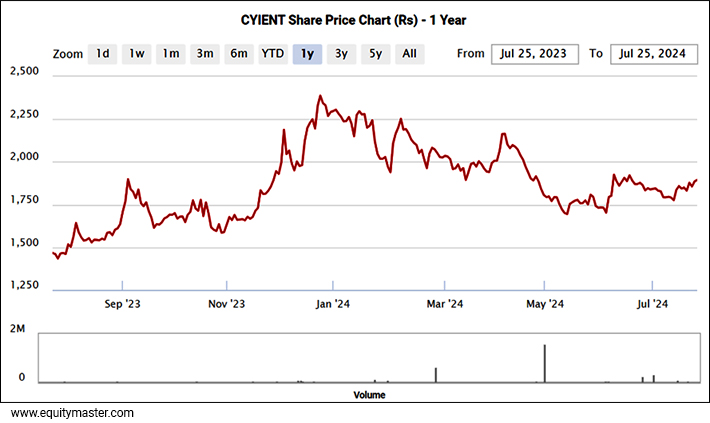

Cyient Plummets 9%. Here's Why

In news from the AI sector, shares of Cyient fell over 9% on 26 July as investors were left disappointed with the company's first quarter (Q1FY25) earnings for fiscal 2024-2025. The IT firm reported revenue and margin, which were far lower than analyst estimates.

Additionally, the management also lowered its FY25 DET (digital, engineering and technology) revenue growth guidance sharply to flat YoY from high single digits growth, with the second half of the year expected to be better than the first.

The company reported a 23.8% sequential drop in its first-quarter net profit at Rs 1.4 bn. On a year-on-year (YoY) basis, the profit for the Hyderabad-based firm declined 18.6%.

Unlike the previous quarter when the firm saw deal wins from Airbus and Deutsche Aircraft, the ER&D (engineering and research and development) firm's revenue was impacted by greater-than-anticipated delays and right shifts in project execution in the connectivity segment.

Its Q1 revenue was down 0.6% YoY and 9.9% sequentially at Rs 16.8 bn.

The company's DET (Digital, Engineering, and Technology) segment, which accounts for more than 80% of the firm's revenue, clocked Rs 14.1 bn in revenue, down 5% quarter on quarter (QoQ) and 2.8% YoY.

Mphasis Hits 52-week High

Moving on to news from the software sector, Mphasis stock surged over 8% to a 52-week high of Rs 3,077.9 on 26 July, as investors cheered the management's upbeat commentary following its April-June quarter results.

The information services company's net profit grew 3% on quarter to Rs 404 in Q1 of FY25 while revenue was flattish at Rs 34.2 bn. On a constant currency basis, the topline grew 0.1% sequentially. Meanwhile, the company's EBIT margin in the quarter gone by stood at 11%.

Furthermore, the management shared an optimistic outlook for the company as it rolled out its FY25 margin guidance of 14.6-16%.

On top of that, the company's deal pipeline also grew 17% sequentially. The total contract value (TCV) stood at US$ 319 m, of which 84% were accounted for by new-generation services.

Mphasis is a global information technology services company that specialises in application development and maintenance services, along with infrastructure outsourcing services, and business process outsourcing (BPO) solutions.

The company's core servicing sectors include BFSI, technology and media, and logistics and transportation.

More By This Author:

Sensex Today Trades Higher; SJVN Rallies 10%, MMTC 6%Sensex Today Ends 109 Points Lower; Nifty Below 24,450

Sensex Today Trades Lower; Nifty Below 24,350

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more