Sensex Today Plunges 550 Points; Zee Entertainment Tanks 14%, MRPL 6%

After opening on a positive note, Indian share markets gave up the gains as the session progressed and ended the day lower.

Equity markets dipped sharply in late noon deals on the back of weakness in IT and power stocks on Wednesday.

At the closing bell, the BSE Sensex stood lower by 550 points (down 0.8%).

Meanwhile, the NSE Nifty closed lower by 179 points (down 0.8%).

Tata Steel, SBI, and JSW Steel were among the top gainers today.

BPCL, NTPC, and Coal India on the other hand, were among the top losers today.

The GIFT Nifty ended at 22,035 down by 200 points.

Broader markets ended the day on a negative note. The BSE Mid Cap ended 1.3% lower and the BSE Small Cap index ended 0.8% lower.

Barring the realty sector other sectoral indices are trading on a negative note, with socks IT sector, oil & gas sector, and power sector witnessing most buying.

Shares of MRF, TVS Holdings, and Apollo Hospitals hit their respective 52-week highs today.

The rupee is trading at 82.96 against the US$.

Gold prices for the latest contract on MCX are trading marginally higher at Rs 62,235 per 10 grams.

Meanwhile, silver prices are trading marginally lower at Rs 71,152 per 1 kg.

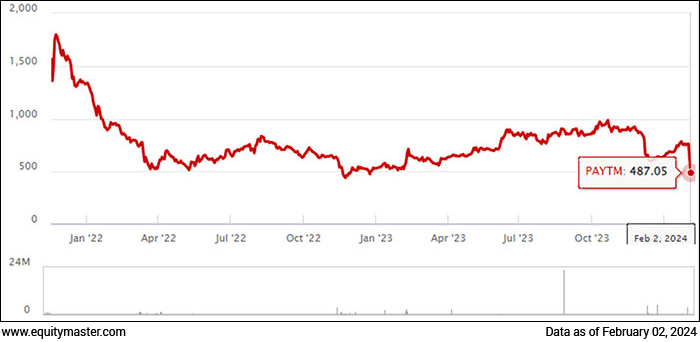

Paytm Hits Upper Circuit

In news from the fintech sector, Paytm shares continued to recover on 21 February, hitting a 5% upper circuit for the third straight session.

Paytm stock took a hit after 31 January when RBI imposed strict restrictions on Paytm Payments Bank Ltd (PPBL).

The surge in Paytm share price over the last three sessions can be attributed to several factors, including the RBI extending the deadline to 15 March, positive comments from management, and recent developments such as the Enforcement Directorate (ED) finding no violation under the Foreign Exchange Management Act (FEMA).

Paytm is India's leading financial services company that offers payments and financial solutions to consumers.

It's an Indian-based mobile internet company and a subsidiary of One97 Communications Limited.

India's leading Fintech company, Paytm, has been embroiled in a regulatory hurdle amid RBI's directive.

DLF Hits 52-Week High. Here's why

Moving on to news from the realty sector, shares of DLF rallied over 3% to hit a fresh 52-week high of Rs 891.6 per share on 21 February after its wholly-owned subsidiary DLF Home Developers entered into a private treaty with Axis Trustee Services and IREO Private to acquire land parcel in Gurugram for Rs 12.4 bn.

DLF's arm will acquire land in Gurugram, Haryana, under the provisions of SARFAESI Act, and the total development potential of this land will be based on all eligible floor area ratio (FAR), which would be 7.5 million square feet.

Out of the 28.5 acres of land, registration and transfer of the first tranche, which is 19.3 acres of land parcels, has been completed against DLF Home Developers for Rs 8.6 bn.

In Q3FY24, DLF clocked the highest quarterly sales booking of Rs 90.5 bn, backed by multiple launches during the quarter, while net profit rose 26% year-on-year (YoY) to Rs 6.5 bn.

Raymond's First Project Launch

Moving on to news from the textile sector, Raymond's share price rose over 7% on 21 February, a day after the group's real estate arm, Raymond Realty announced the launch of its first project outside Thane 'The Address by GS, Bandra'.

The move followed the company's plan for expansion beyond Thane through joint development agreements (JDAs) in the Mumbai Metropolitan Region (MMR).

As the name suggests, this development is inspired by the tremendous success of Thane's flagship project 'The Address by GS' which has emerged as Thane's bestseller in the premium category and is set to be delivered two years ahead of its timeline.

'The Address by GS, Bandra' project spreads over an area of 2.74 acres, offering a gated community in Bandra East with connectivity to locations like Bandra-Kurla Complex and Bandra-Worli Sea link along with the rest of the city.

The project will offer a mix of 2, 3, and 4 BHK apartments. This project promises substantial economic returns, with projections indicating a revenue generation of over Rs 20 bn.

The Raymond Group entered the real estate space with Raymond Realty, a venture exclusively headed by Group Chairman and Managing Director Gautam Singhania.

Raymond had a humble start. But today, it is a well-diversified business with a strong presence across different verticals.

The company's suits segment holds a 65% market share, establishing itself as the largest branded player in the shirt fabric space. Moreover, its apparel segment ranks among the top three players in the menswear industry.

More By This Author:

Sensex Today Trades Higher; Nifty Hits Fresh HighSensex Today Ends 350 Points Higher; Nifty Ends at Record High

Sensex Today Trades Lower; Coal India & Eicher Motors Top Losers

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more