Sensex Today Falls 400 Points; Adani Group Stocks Crash 20%

Asian share markets fell today, reflecting a muted mood on Wall Street overnight that was amplified by Nvidia's lackluster revenue forecast.

In US markets, Wall Street's main indexes ended flat on Wednesday, as investors awaited AI giant Nvidia's quarterly results, while also eyeing rising geopolitical tensions between Russia and Ukraine.

The Dow Jones Industrial Average rose 27 points while the S&P ended flat. The Nasdaq fell 0.1%.

Back home, Indian share markets are trading on a negative note tracking global cues.

Benchmark indices fell today as all the Adani group stocks came under pressure following a big charge on Gautam Adani.

Market participants are tracking shares of Bharti Airtel as Nokia has received a multi-billion 5G extension deal from Bharti Airtel for its India operations with 4G and 5G contract extensions.

Meanwhile, Adani Enterprises is also in focus as Adani Infrastructure has announced an open offer to acquire an additional 26% stake in PSP Projects.

At present, the BSE Sensex is trading lower by 380 points, while the NSE Nifty is trading around 23,400 levels, down 132 points.

Infosys, TCS, and Power Grid are among the top gainers today.

Adani Ports and SBI, on the other hand, are among the top losers today.

Broader markets are trading on a negative note. The BSE Mid Cap index fell 0.5% while the BSE Small Cap index declined 0.6%.

Barring IT and realty, all sectoral indices are trading in red with stocks in the energy sector, utilities sector, and power sector witnessing most of the selling.

Shares of Indian Hotels, SPS Finquest, and Panacea Biotech hit their 52-week high today.

The rupee is trading at Rs 84.41 against the US dollar.

In commodity markets, gold prices are trading at Rs 76,224 per 10 grams today.

Bitcoin Breaks Above $95K

In the latest developments from the crypto space, the price of Bitcoin hit a record high today, topping $95,000 for the first time as it benefits from expectations that President-elect Donald Trump will push through measures to ease regulation of the unit.

Traders have been piling into Bitcoin ever since Trump was elected at the start of the month, pushing it up almost 40% since the vote.

To say this month was good for crypto investors would be an understatement...

- Bitcoin: +35%

- Ethereum: +17%

- Dogecoin: +170%

- MicroStrategy: +96%

With this sharp run-up, Bitcoin has now become the best performing asset of the decade. This is not a typo... Bitcoin has achieved a CAGR of 100%!

These numbers are wild to think about.

So, what next from here on? Will the CAGR of bitcoin slow down or accelerate? Well, the easy answer is that an asset's CAGR will drop as it gets bigger.

But one thing is getting clear every passing day. Bitcoin has shown strong potential as a long-term asset, and many experts anticipate significant growth in its value over the coming years.

An investment like a Bitcoin should not be where you park your maximum savings. They should be the high risk-high return part of your overall corpus.

Our "fundamental" take on cryptos is in line with the approach anyone should have when dabbling in a space one does not understand. Invest in only what you can afford to lose and nothing more.

What's the Latest Charge on Gautam Adani?

Moving on, Gautam Adani, the chief of Adani Group, and seven others face charges in the US in a multibillion-dollar bribery and fraud scheme, according to news agencies.

Prosecutors announced the charges on Wednesday, alleging that the group bribed Indian officials to secure solar energy contracts.

Adani announced an investment in green energy yesterday. The announcement came as the company's chairman congratulated US President-elect Donald Trump on his election victory.

This news also comes amidst the development that Trump has promised to simplify regulations for energy companies, making it easier for them to drill on federal land and construct pipelines.

As per the case made out by the US Securities and Exchange Commission, Gautam Adani has been charged with allegedly "defrauding American investors and bribing officials".

Adani, his nephew Sagar Adani, executives of Adani Green Energy, and Cyril Cabanes, an executive of Azure Power Global Ltd were charged with "conspiracy to commit securities and wire fraud, as well as substantive securities fraud, for their roles in a multi-billion-dollar scheme to obtain funds from investors.

Following these developments, the Adani Group has scrapped its $600 million dollar bond. The group's existing US-currency notes also plunged in Asian trading.

The Adani group decided not to proceed with the offering in view of recent press releases from Department of Justice and the Securities and Exchange Commission.

It remains to be seen how the above developments pan out.

BPCL's Big Bang Project

Moving on to latest developments from the oil & gas sector, Andhra Pradesh is set to get an oil refinery and a petrochemical hub at Ramayapatnam in Nellore district that entails an investment of Rs 60,000 crore.

Bharat Petroleum Corp. Ltd (BPCL) will establish the refinery and hub on 1,000 acres of land.

Note that the refinery project is a big win for Naidu, whose Telugu Desam Party (TDP) provides crucial support to the Bharatiya Janata Party-led National Democratic Alliance (NDA) government at the Centre.

LG Electronics Ready to Bet Big on India

South Korean electronics maker LG Electronics and its parts suppliers plan to invest a total of Rs 7,000 crore to build the company's third factory and create a vendor base in Andhra Pradesh, India.

According to reports, LG Electronics will invest Rs 5,000 crore, and its Korean and Chinese parts suppliers the remainder.

LG, India's largest home appliances maker by sales, has sought 300 acres from the Andhra Pradesh government for the project which will generate over 1,500 direct jobs.

LG plans to produce air-conditioners, refrigerators, washing machines and televisions in the new facility for the Indian market and exports.

Note that LG is also considering an India IPO. It will likely use the IPO proceeds for the new factory.

The public issue is likely to be launched early 2025 and it may see the company raise up to $1.5 billion.

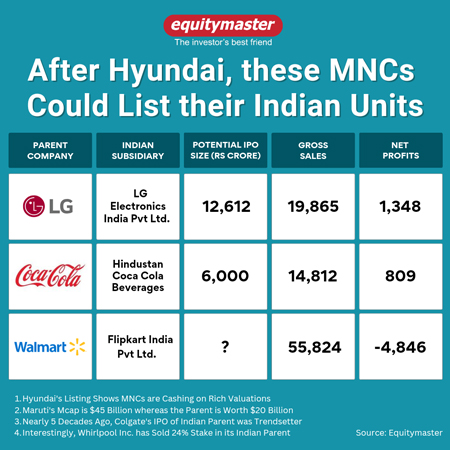

We wrote to you about this IPO last month and highlighted a few other MNCs that may also opt for an India offering.

Although LG has not yet determined a valuation, it will be interesting to see how the company fits this IPO in the ever evolving electronics landscape in India.

More By This Author:

Sensex Today Ends 239 Points Higher; Nifty Above 23,500Sensex Today Zooms 800 Points; Auto & IT Stocks Surge

Sensex Today Falls 241 Points; Nifty Ends Near 23,450

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more