Sensex Today Ends At Record Highs, Rallies 1,197 Points; Nifty Nears 23,000 Mark

After opening the day on a positive note, Indian share markets continued the momentum as the session progressed and ended on a firm footing.

The Indian stock market experienced strong buying interest on Thursday, 23 May 2024, leading to intraday gains of over 1% for both the Sensex and the Nifty 50 benchmarks.

At the closing bell, the BSE Sensex stood higher by 1,197 points (up 1.5%).

Meanwhile, the NSE Nifty closed higher by 354 points (up 1.6%).

L&T, Axis Bank, and Adani Ports were among the top gainers today.

Sun Pharma, Hindalco, and NTPC on the other hand, were among the top losers today.

The GIFT Nifty was trading at 23,024, up by 330 points, at the time of writing.

The BSE MidCap index ended 0.5% higher and the BSE SmallCap index ended 0.3% higher.

Barring healthcare and the metal sector, all other sectoral indices are trading positive with stocks in the auto sector, banking sector, and telecom sector witnessing most buying.

Shares of TVS Holdings, Siemens, and Info Edge hit their respective 52-week highs today.

The rupee is trading at 83.24 against the US$.

Gold prices for the latest contract on MCX are trading 1% lower at Rs 72,335 per 10 grams.

Meanwhile, silver prices were trading 1.8% lower at Rs 91,326 per 1 kg.

Here are three reasons why Indian Markets are rising today

#1 Easing Election-Related Jitters

Ebbing election-related jitters are keeping the market in the green zone. As the market expects political stability after the Lok Sabha elections, investors are focussing on buying quality stocks, as the medium-to long-term outlook of the market remains positive

#2 PSBS Stock Lead Post RBI's Bumper Dividend

Shares of public sector banks (PSBs), in particular, were in focus, rallying up to 3% a day after the Reserve Bank of India (RBI) announced a dividend payment of Rs 2.1 trillion for FY25.

This development is a significant macroeconomic positive for the market, with direct implications for the fiscal deficit and bond yields.

#3 Slowdown in FII Selling

Over the last few trading days, barring 21 May, selling by foreign institutional investors has slowed down. The FIIs have net sold stocks to the tune of Rs 18.1 bn in the last five trading days as against net sales of Rs 381.9 bn so far in May.

The US-10 year yield has eased to 4.4% from a high of 4.7% a month ago. Traders are expecting at least two rate cuts in the calendar year 2024.

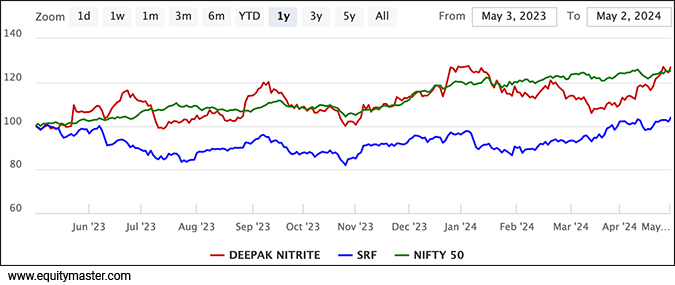

Why Deepak Nitrite Share Price is Falling

In news from the chemical sector, specialty chemicals maker Deepak Nitrite extended losses on weak Q4 results.

On 20 May 2024, Deepak Nitrite reported an 8.5% on-year rise in net profit at Rs 2.5 bn for the March quarter of the financial year 2023-24, accounting for a Rs 516 m gain from extraordinary items.

However, discounting the exceptional item which was towards claims from an insurance company, the net profit fell 14% on-year for the quarter.

Deepak Nitrite faced a challenging business environment mainly due to dumping from China at low prices, the Red Sea crisis, and general weakness in the chemical market.

The management expects performance to improve only after H1FY25, especially in the intermediates segment, which saw a 16% decline in revenue on the year.

As the 4QFY24 results illustrate, competition remains intense across both segments and besides, new phenol capacities are being commissioned in India in the next few years.

Deepak Nitrite's large capex plan also carries execution risk and entails high financial leverage, it added.

Deepak Nitrite is engaged in manufacturing chemical intermediaries, fine and specialty chemicals, products, and phenolics.

It has a wide product portfolio of over 100 products, with leadership in the majority of its products.

The company's products have several use cases, such as in colorants, petrochemicals, rubbers, agrochemicals, pharmaceuticals, paints, adhesives, personal care, thinners, ply, laminates, and foundry.

Lupin Tanks 7%. Here's Why

Moving on to news from the pharma sector, shares of pharmaceutical companies Lupin and Cipla are witnessing profit booking on Thursday. The stocks declined up to 7%, bogged down by increased competition in Albuterol Sulfate Inhalation Aerosol in the US.

This was after US-based Amphastar said that it had received approval from the United States Food and Drugs Administration.

According to IQVIA, the US sales for the branded and generic albuterol sulfate Inhalation Aerosol products were approximately US$ 1.7 billion (bn) for the 12 months that ended 31 March 2024.

The new player is expected to resort up to 10-25% price erosion to gain market share.

Amphastar plans to launch its Albuterol Sulfate Inhalation Aerosol in the third quarter of 2024.

Albuterol Sulfate is used to prevent and treat difficulty breathing, wheezing, and shortness of breath.

More By This Author:

Sensex Today Trades Higher; Smallcap Stocks Shine

Sensex Today Ends 26 Points Higher; IT Stocks Shine

Sensex Today Trades Flat; JK Tyre Rallies 8%

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more