Sensex Today Ends 376 Points Higher; Natco Pharma Zooms 16%

After opening on a positive note, Indian share markets gained momentum as the session progressed and ended the day higher.

The equity benchmark indices held firm gains on Friday tracking strength in global markets.

At the closing bell, the BSE Sensex stood higher by 376 points (up 0.5%).

Meanwhile, the NSE Nifty closed higher by 129 points (up 0.6%).

Wipro, M&M, and L&T were among the top gainers today.

ONGC, Reliance Industries, and SBI on the other hand, were among the top losers today.

The GIFT Nifty ended at 22,093 up by 65 points.

Broader markets ended the day higher. The BSE Mid Cap ended 0.7% higher and the BSE Small Cap index ended 0.6% higher.

Sectoral indices are trading mixed, with the socks auto sector, realty sector, and IT sector witnessing the most buying. Meanwhile, stocks in the power sector and oil & gas sector witnessed selling pressure.

Shares of Maruti Suzuki, Bajaj Auto, and CRISIL hit their respective 52-week highs today.

The rupee is trading at 83.02 against the US$.

Gold prices for the latest contract on MCX are trading flat at Rs 61,683 per 10 grams.

Meanwhile, silver prices are trading 0.2% higher at Rs 71,282 per 1 kg.

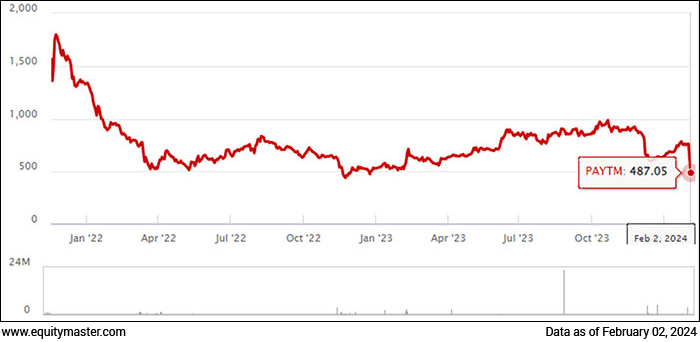

Paytm Hits Upper Circuit. Here's why

In news from the fintech space, Paytm shares recovered from the record low of Rs 318.05, hit earlier in the day, to trade at 5% upper circuit of 5% in afternoon trade on 16 February.

The rise comes even after the Enforcement Directorate reportedly questioned Paytm company executives and took submission of documents from them following the recent RBI action of barring Paytm Payments Bank Ltd (PPBL) from accepting deposits or top-ups in any customer account.

Paytm has lost about Rs 270 billion (bn) or 57% of its value in the last 11 trading days since the trouble began after the RBI crackdown on the Paytm Payments Bank, which also houses Paytm Wallet over persistent non-compliances and continued material supervisory concerns.

The regulator found major irregularities in KYC, which exposed the customers, depositors, and wallet holders to serious risks. It found that in thousands of cases, the same PAN was linked to more than 100 customers and, in some cases, the number went above 1,000.

The total value of transactions, running into crores of rupees, is much beyond the regulatory limits in minimum KYC pre-paid instruments, raising money-laundering concerns.

ITC Sinks to a 10-month low

Moving on to news from the FMCG sector, ITC shares briefly slipped below the psychological Rs 400 mark to a 10-month low as the market worries about the impending 4% stake sale by British American Tobacco (BAT), the largest shareholder in the company.

BAT is looking to raise Rs 210 billion (bn) (US$ 2.5 bn) by selling a 3.5 to 4% stake in the Indian tobacco-to-consumer goods conglomerate.

As of December 2023 disclosures, BAT holds the largest share in ITC, with ownership exceeding 29%

The British tobacco seller has held stakes in India's ITC since the early 1900s and is the largest shareholder in the company, having more than 29% stakes.

The floating stock in the system will increase after the stake sale, as some of the new investors would look to sell the stock at the first opportunity if they get a dent in profit.

A key challenge BAT faces in offloading a 4% stake in ITC is navigating the regulatory hurdles imposed by the Reserve Bank of India on foreign ownership in tobacco firms, which limits who can buy those shares.

Looking ahead, ITC Foods, the branded packaged foods division of ITC, envisions a resurgence in demand for the dairy and beverage sector within the next six to nine months. This optimistic outlook is driven by expectations of a warm summer and favorable dairy conditions.

GAIL Eyes LNG At Competitive Rates

Moving on to news from the energy sector, State-run GAIL (India) is seeking competitive pricing for liquefied natural gas (LNG) as consumers in India are highly price-sensitive.

Affordable gas pricing is the only way to ensure that consumers in India do not switch to other fuels. In the last month, India's largest gas distributor has finalized two long-term LNG import deals, one with UAE's ADNOC Gas and another with global commodity trader Vitol.

The Indian government plans to increase the share of natural gas in the country's energy basket to 15% from 6% now, and the recent deals signed by GAIL and Petronet LNG are expected to boost gas consumption. On 6 February, Petronet LNG, too, extended its LNG deal with Qatar by another 20 years until 2048.

In a big blow to GAIL, LNG supplies from Russia's Gazprom were suspended in 2022 due to the war between Russia and Ukraine.

As a result, GAIL had to cut supplies to its customers and was forced to buy expensive LNG from the short-term market. Though supplies resumed in March 2023, GAIL has initiated arbitration against Gazprom in London.

More By This Author:

Sensex Today Trades Higher; Nifty Above 21,950Sensex Today Trades Flat; Nifty Above 21,900

Sensex Today Ends 278 Points Higher; Nifty Above 21,800

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more