Sensex Slumps 700 Points From Day's High To End Lower; Tata Steel & SBI Among Top Losers

Indian share markets witnessed volatile trading activity throughout the day today and ended lower.

Benchmark indices tumbled from record-high levels to snap their three-day winning run amid losses in energy, auto, and pharma stocks, despite firm global cues.

At the closing bell, the BSE Sensex stood lower by 125 points (down 0.2%).

Meanwhile, the NSE Nifty closed lower by 44 points (down 0.3%).

Kotak Mahindra Bank and HDFC Bank were among the top gainers today.

Tata Steel and Coal India, on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,592, down by 19 points, at the time of writing.

The BSE Mid Cap index and the BSE Small Cap index ended down by 1.1% and 1%, respectively.

Sectoral indices ended on a negative note with stocks in the metal sector, realty sector, and energy sector witnessing most of the selling pressure.

Banking and telecom stocks, on the other hand, witnessed buying interest.

Shares of Tata Elxsi and Polycab India hit their respective 52-week highs today.

Asian stock markets ended on a positive note today.

The Hang Seng and the Shanghai Composite ended the day up by 1% and 0.2%, respectively. The Nikkei ended up by 0.6% in today's session.

US stock futures are trading on a negative note today with the Dow Futures trading down by 56 points.

The rupee is trading at 73.48 against the US$.

Gold prices for the latest contract on MCX are trading up by 0.3% at Rs 46,208 per 10 grams.

In news from the finance sector, IDFC was among the top buzzing stocks today.

IDFC said that its board and the board of IDFC Financial Holding Company (IDFC FHCL) have approved to initiate steps to divest its mutual fund business.

IDFC AMC's average assets under management (AAUM) for the June quarter was at Rs 1.3 tn, as per AMFI data.

In a statement, the company said,

- The boards have authorized respective strategy and investment committees to take necessary steps, including the appointment of investment bankers, for the same.

The company is losing investor confidence over delay in value unlocking

At a pre-annual general meeting conference call held on 14 September 2021, investors expressed disappointment with the slow pace of progress of the disinvestment.

The announcement was made during market hours today, 17 September 2021.

IDFC's share price ended the day down by 1.7% on the BSE.

Moving on to news from the automobile sector...

TVS Motors Acquires Majority Stake in Swiss Company EGO Movement

TVS Motor, a global manufacturer of two-wheeler and three-wheeler vehicles, announced a partnership with European e-bike, EGO Movement as a majority shareholder, in an all-cash deal through its Singapore subsidiary TVS Motor (Singapore).

TVS picked up an 80% stake in EGO for US$17.9 m, according to a report in The Economic Times.

Joint Managing Director Sudarshan Venu affirmed that the deal is progress towards delivering unique e-mobility solutions

He further added,

- We are building a strategic personal e-mobility ecosystem by scaling unique brands which share our vision of delivering compelling customer experience benchmarks through cutting-edge, aspirational products.

EGO Movement has a strong presence in Europe with customer-centric products, a unique omnichannel network, and a visionary team at its helm. Together, we will address global urbanization by delivering unique e-mobility solutions with e-bicycles and mobility across a diversity of forms.

Led by the co-founder's Daniel Meyer and Marie So, EGO Movement is a Swiss technology company providing a wide range of mobility solutions through a portfolio of e-bikes, e-cargo bikes, and e-scooters. It is a profitable company with sales of about 3500 units in 2020 generating revenues of US$6 m.

This acquisition will further expand the presence of TVS Motor in Europe, post the Norton Motorcycles buy last year.

TVS Motors' share price ended the day up by 0.4% on the BSE.

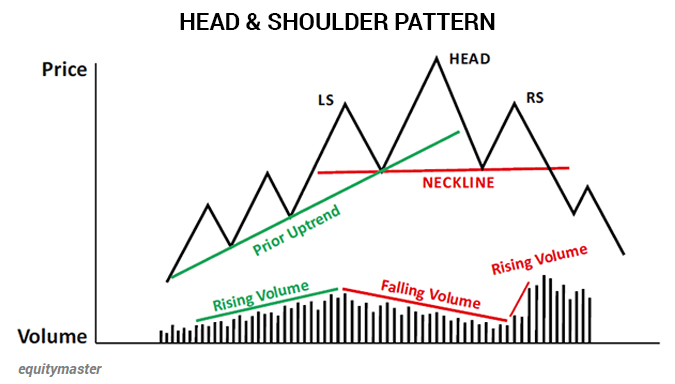

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more