Sensex Ends 53 Points Lower, Nifty Settles Below 15,750; Hindalco And Tata Steel Among Top Losers

Indian share markets witnessed volatile trading activity throughout the day today and ended lower.

Benchmark indices slipped after a positive start in today's session, tracking mixed global cues, dragged mainly by metal and banking stocks.

At the closing bell, the BSE Sensex stood lower by 53 points (down 0.1%).

Meanwhile, the NSE Nifty closed lower by 12 points (down 0.1%).

Tata Motor and Tech Mahindra were among the top gainers today.

Hindalco and Tata Steel, on the other hand, were among the top losers today.

The SGX Nifty was trading at 15,774, down by 6 points, at the time of writing.

The BSE MidCap index and the BSE SmallCap index ended up by 0.4% and 1%, respectively.

Sectoral indices ended on a mixed note with stocks in the metal sector, banking sector, and finance sector witnessing most of the selling pressure.

Telecom and IT stocks, on the other hand, witnessed buying interest.

Shares of Piramal Enterprises and Crisil hit their respective 52-week highs today.

Asian stock markets ended on a negative note today.

The Hang Seng ended on flat note today, while the Shanghai Composite ended down by 0.5%.

The Nikkei ended down by 0.2% in today's session.

US stock futures are trading on a negative note today with the Dow Futures trading down by 90 points.

The rupee is trading at 72.89 against the US$.

Gold prices for the latest contract on MCX are trading down by 0.1% at Rs 49,080 per 10 grams.

In news from the pharma sector, Laurus Labs was among the top buzzing stocks today.

Shares of Laurus Labs continued their upward journey in today's session to hit a new high of Rs 642 per share, up 12.2% on the BSE, in an otherwise subdued market.

The stock was quoting higher for the eighth straight trading day.

In the past three months, the stock of Laurus Labs has outperformed the market by surging 73% after the company's promoters released most of the pledged shares by selling their stake.

In comparison, the BSE Sensex was up 3.7% during the same period.

As of 31 March 2021, around 1.2% of the total promoters' holding were pledged, compared to 15.8% of the holding pledged at the end of the December 2020 quarter, the shareholding pattern data shows.

On 4 March 2021, Dr Satyanarayana Chava, Founder Promoter, CEO, and ED, and Nagarani Chava, one of the promoters of the company, had collectively sold a combined 7 m shares worth Rs 2.6 bn in the open market.

That apart, the management guided at a Capex (capital expenditure) of Rs 15 bn over the next two years.

About 50%, 30%, and 20% of Capex is to be invested in the active pharmaceutical ingredients (API), finished dosage formulations (FDF), and contract development & manufacturing organization (CDMO) segments, respectively.

It is confident of sustaining a 30% EBITDA margin in the financial year 2022.

The debottlenecking exercise in FDF has been completed in March 2021 and the commercial benefit will accrue from the first half of the fiscal year (H1FY22) onwards.

The new manufacturing block will be commercialized by September 2021.

The company is adding capacity in non-ARV API (antiretroviral) products, which would be commercialized by FY22 end, aiding meaningful growth from FY23 onwards.

From the financial year 2023 onwards, growth in the synthesis business (11% of sales) would outpace growth in the API/FDF segment, based on active projects and capacity addition.

Laurus Labs is gaining due to its focus on growth areas such as APIs, FDFs, ingredients, and synthesis. The company is reaping rich dividends of its research and R&D (research and development) spends in the early stages.

Laurus Labs' share price ended the day up by 6.4% on the BSE.

Moving on to news from the steel sector...

Jindal Steel Production Jumps 31% During April and May

Jindal Steel and Power has reported a 31% year-on-year (YoY) jump in its steel production to 1.4 m tonnes during April and May.

The total production was 6.8 lakh tonnes in April and 6.9 lakh tonnes in May as compared to 1 m tonnes in the same period last year.

Steel sales also increased by 7% to 1.1 m tonnes (April 5.6 lakh tonnes and May 5 lakh tonnes).

However, the slowdown in domestic construction activities due to COVID-19 and logistical challenges faced owing to congestion at ports due to adverse weather conditions resulted in sales growth lagging production growth.

Jindal power said it continues to take measures to offset the impact of the slowdown in domestic demand by exporting in lucrative global markets.

The exports accounted for 21% of sales volumes in April with the share rising further to 36% in May.

To support government efforts in combating the pandemic, the company has supplied 3,500 tonnes of liquid medical oxygen.

The company is also running a 300 beds modern hospital in Raigarh and a newly-built intensive COVID care center at Angul in Odisha.

Jindal Steel and Power is one of India's major steel producers with a significant presence in sectors like mining, power generation, and infrastructure.

Jindal Steel and Power share price ended the day down by 0.7% on the BSE.

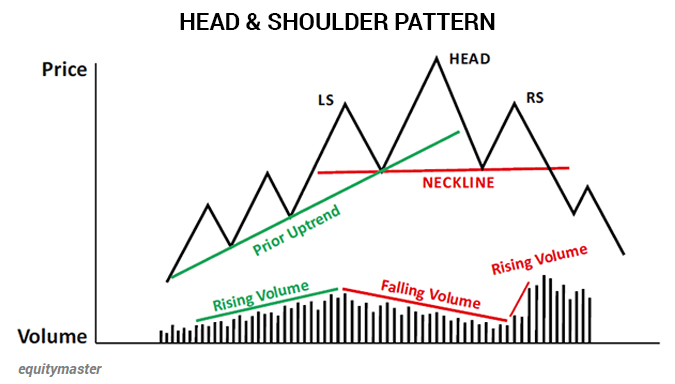

Speaking of stocks, here's a pattern that if you see, you must sell your position. After all, exits are more important than entries.

In the chart below, we can see the head and shoulder pattern - the stock goes up, makes a high, falls a little bit, goes up to a higher high, does not make a higher low, rallies again fails to make a new high, and then starts to break down.

This usually happens in a situation where a stock or index has typically been in a bull trend for a while. Spotting this correctly can help you save money.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more