Sensex Crashes 1,000 Points, Nifty Tumbles Below 15,900, IndusInd Bank & Hindalco Drop 4%

Asian share markets fell in early trade today after an overnight drop on Wall Street as investors fret over inflation and looming recession.

The Nikkei is down 1.4% while the Shanghai Composite is flat.

In US stock markets, Wall Street indices closed sharply lower in Wednesday's volatile session as crude oil prices rallied and investors worried about the potential for an economic slowdown.

The Dow Jones fell 1% while the Nasdaq tumbled over 3%.

Back home, Indian share markets are trading deep in the red. Benchmark indices staged a gap-down opening today amid weak global sentiment.

Market participants are tracking shares of Siemens, Tata Motors, L&T and RBL Bank as these companies will announce their March quarter results later today.

The BSE Sensex is trading down by 910 points. Meanwhile, the NSE Nifty is trading lower by 277 points.

TCS is among the top gainers today. UltraTech Cement and IndusInd Bank, on the other hand, are among the top losers today.

The BSE Mid Cap index is down 1.9% while the BSE Small Cap index is trading lower by 1.7%.

All sectoral indices are trading in red with stocks in the metal sector, banking sector, and auto sector witnessing most of the selling.

Shares of Mehta Housing and Abhinav Cap hit their 52-week highs today.

The rupee is trading at 77.55 against the US$.

Gold prices are trading up by 0.1% at Rs 50,875 per 10 grams.

Meanwhile, silver prices fell 0.3% and are trading at Rs 60,570 per kg.

Crude oil prices fell today, taking a pause after rising more than 5% in the previous session following new Russian sanctions on some European gas companies.

Cryptocurrency prices crashed with Bitcoin falling to its lowest level since January 2021. The world's largest crypto plunged more than 9% to US$28,400 levels.

In news from the automobile sector, the Tata Group is planning to launch a battery company in India and abroad, the group chairman N Chandrasekaran said on Wednesday.

The above move is aimed at deepening its push to build electric vehicles (EVs).

At an industry event, Chandrasekaran said the group is making a transition towards sustainability across businesses which includes a clean mobility push at Tata Motors and its British luxury unit Jaguar Land Rover.

Tata Motors has plans to launch 10 electric models by 2025, whereas Jaguar Land Rover's luxury Jaguar brand will be entirely electric by 2025 and the carmaker will launch e-models of its entire lineup by 2030.

The battery "blueprint" is part of a broader plan to be "future-ready" by investing in renewable energy, green hydrogen, storage solutions, and the circular economy, Chandrasekaran added.

We will keep you updated on the latest developments in this space. Stay tuned.

Moving on to news from the insurance space, shares of Life Insurance Corporation (LIC) have slipped below their issue price in the unofficial grey market, said people in the know.

According to people tracking the shares in the unofficial market, shares of the insurance giant are changing hands between Rs 940 and Rs 945 in the grey market.

Shares of LIC are expected to make their stock market debut on Tuesday next week. If grey market activity is to go by, the stock could list at a discount.

Individual investors might still end up making some gains as LIC had offered a discount. For retail and policyholders, the application price was Rs 905 and Rs 889, respectively.

The Centre has offered a discount of Rs 45 to retail investors and employees of LIC, while policyholders are offered a discount of Rs 60 per share.

LIC's IPO, which closed on Monday, received bids of over Rs 440 bn from over 7 million applications, the highest for an IPO in the domestic market.

How the shares perform on listing day remains to be seen.

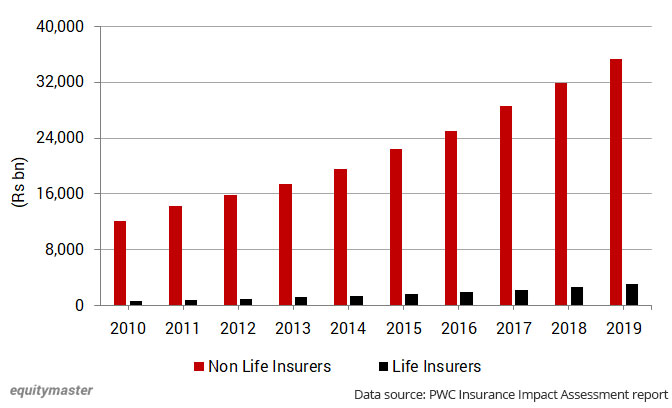

Speaking of the insurance sector, have a look at the chart below which shows the investment assets of non-life insurers and life insurers over the past 10 years:

Investment Assets of Non-Life Insurers 11x That of Life Insurers

Moving on to stock-specific news...

Hindalco is among the top buzzing stocks today.

Novelis Inc., Hindalco's unit, is planning to build a US$2.5 bn low-carbon aluminum recycling and rolling plant in the US to cater to the growing demand for beverage can sheets and the automotive market.

The facility, which will be built in Alabama, will have a capacity of 600,000 tons of finished goods a year initially, the unit of Hindalco Industries said in a statement.

Work at the site is underway and the company expects to begin operations by the middle of 2025.

Note that this will be Aditya Birla Group's largest global greenfield expansion project and will take the group's total investment in the US across businesses to over US$14 bn.

The Mumbai-based company has been on an expansion spree buoyed by strong demand prospects and higher prices of the metal.

Hindalco said in March that it will spend as much as US$7.2 bn to expand its aluminum business over the next five years, mainly across India and North America.

Earlier this year, Novelis had announced an investment of US$365 m to build a recycling plant in Kentucky.

Hindalco's share price is currently trading down by 4.3%.

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity research ...

more