Semis Slaughtered As September Starts Off With Carnage Everywhere

Yesterday, when we observed that the Labor Day holiday had spared US markets from a selloff that spread across the rest of the world on the first trading day of September, we said that we had a bad feeling about today.

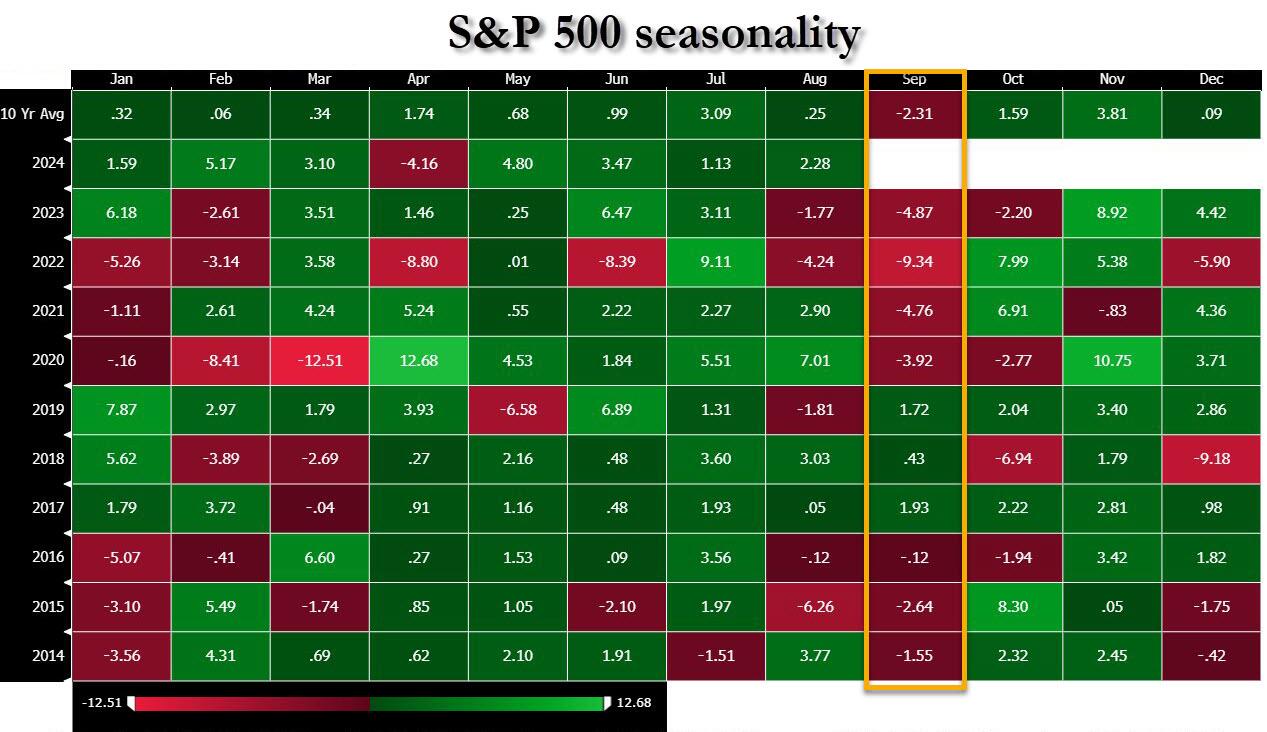

And boy were we right: traditionally the worst month for stocks, bonds, gold and bitcoin, September started off with a bang - not a whimper - which saw the S&P plunge 2.4%, its biggest drop since the August 5 meltdown and the worst start to a month since May 2024 when the S&P plunged 2.8%.

And while the move in the VIX was not nearly as stunning as the Aug 5 Volmageddon 2.0 event, the 7 vol spike from 15 to a session high of 21.99 - also the highest since August 5 - has left quite a few volatility sellers suffering another round of huge margin calls less than a month since the last one.

It wasn't just the S&P: the Dow (which has become a meaningless index) also tumbled back under 41,000, but the biggest loser by far was the increasingly fragile Nasdaq, which crashed more than 3%, its biggest drop also since the August 5 collapse, and the 3rd biggest one-day drop in the past year...

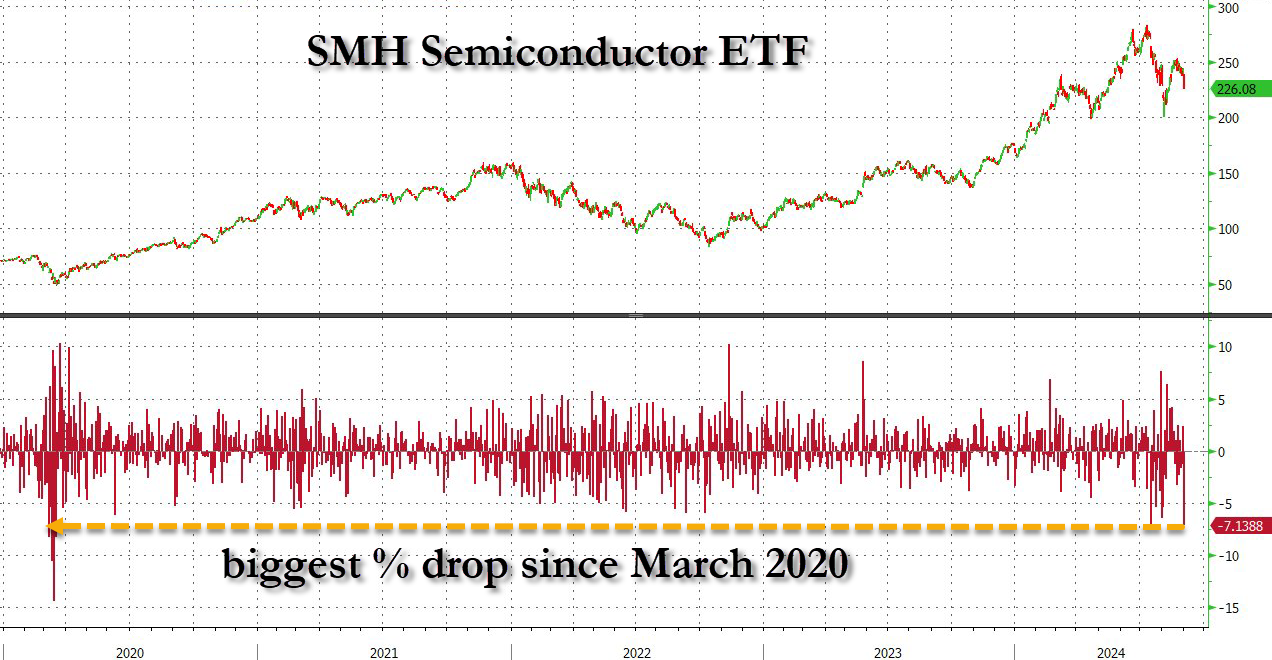

... thanks to a sudden liquidation of the momentum leaders of 2024, the Mag7 which was most apparent in today's performance of semiconductor stocks, which suffered their biggest drop since March 2020.

And while it is unclear what exactly sparked today's rout (see "What's Behind Today's Tech Carnage: Goldman's Trading Desk Explains") that won't cheer NVDA longs who are watching their favorite stock plunge a massive 10% and a whopping 18% in just the past week...

... wiping out more than $280 billion in value, which makes it the biggest one-day market cap loss in history, surpassing META's previous record of $251BN in market cap lost after its February 2022 earnings report.

And while the tech sector was crushed, there was no rotation out of it today, with small caps plunging 3%, their biggest drop also since August 5...

... and while it's not a small cap just yet, the 8% plunge in Boeing - on merely a downgrade (from Wells Fargo of all banks) - shows just how truly jittery the market has become.

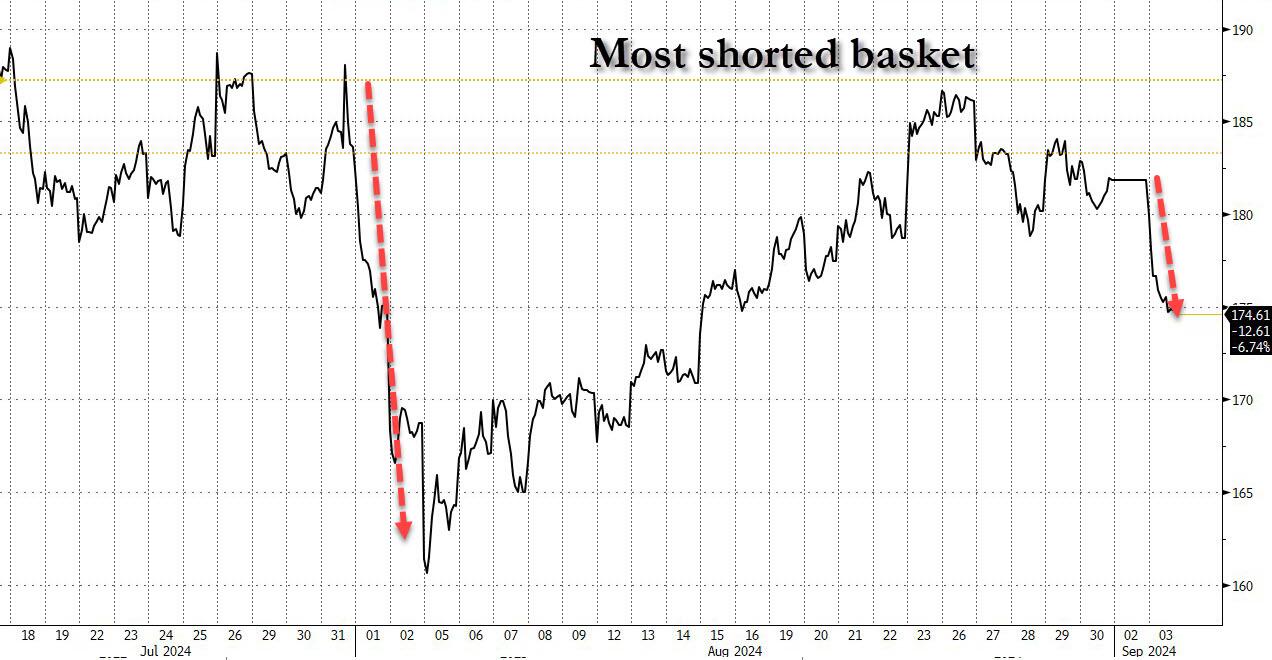

While normally on days like today - when favorite names are getting blown out - the most shorted names rise, not even that worked today, and in a repeat of the Aug 5 plunge, the Goldman most shorted basket tumbled 4% erasing almost half the gains from the past month.

Notably, today's carnage wasn't confined to stocks: commodities were also hammered, with Brent tumbling almost 5%, back under $74, and wiping out all 2024 gains, as WTI flirted with $70/barrel...

... on fears China's economy will pass recession and proceed straight to depression just as Libya restarts its own oil supply firehose, while seemingly nobody cares at all about potential geopolitical risk factors around the world.

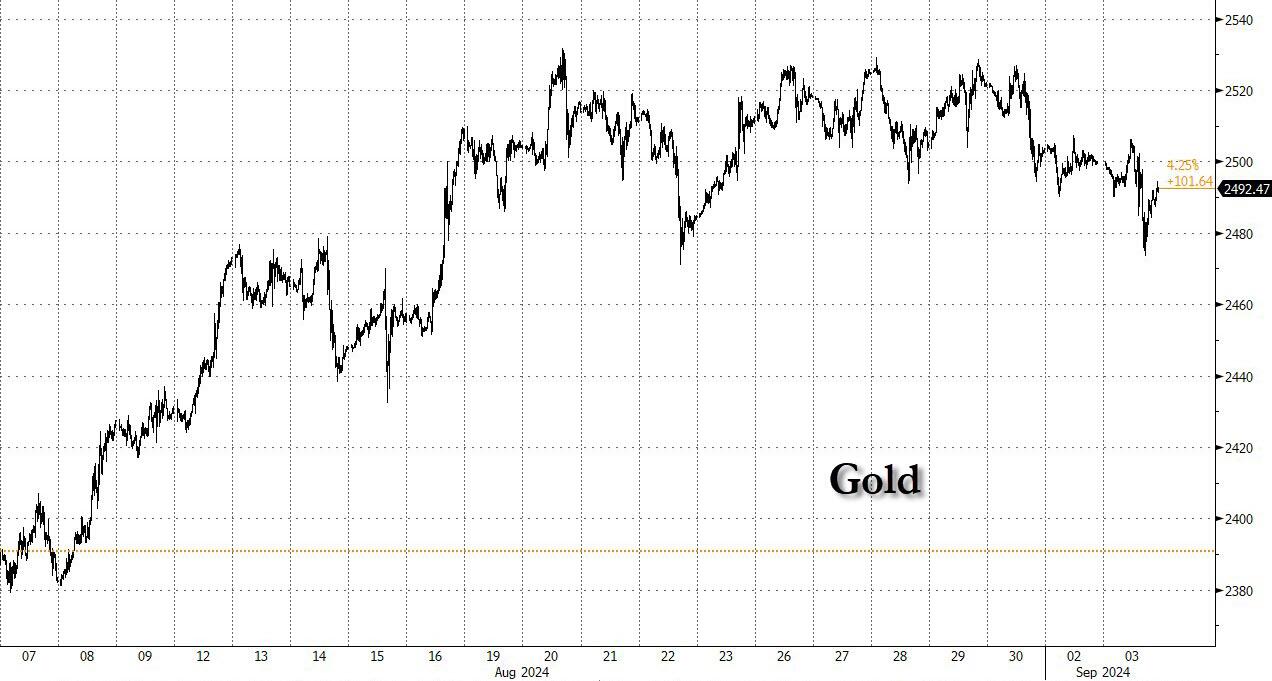

Even gold, that stalwart outperformer in 2024 and the best performing asset of the year, wasn't immune from today's selloff, and after trading above $2500 for much of of the past 2 weeks, the yellow metal dipped back under.

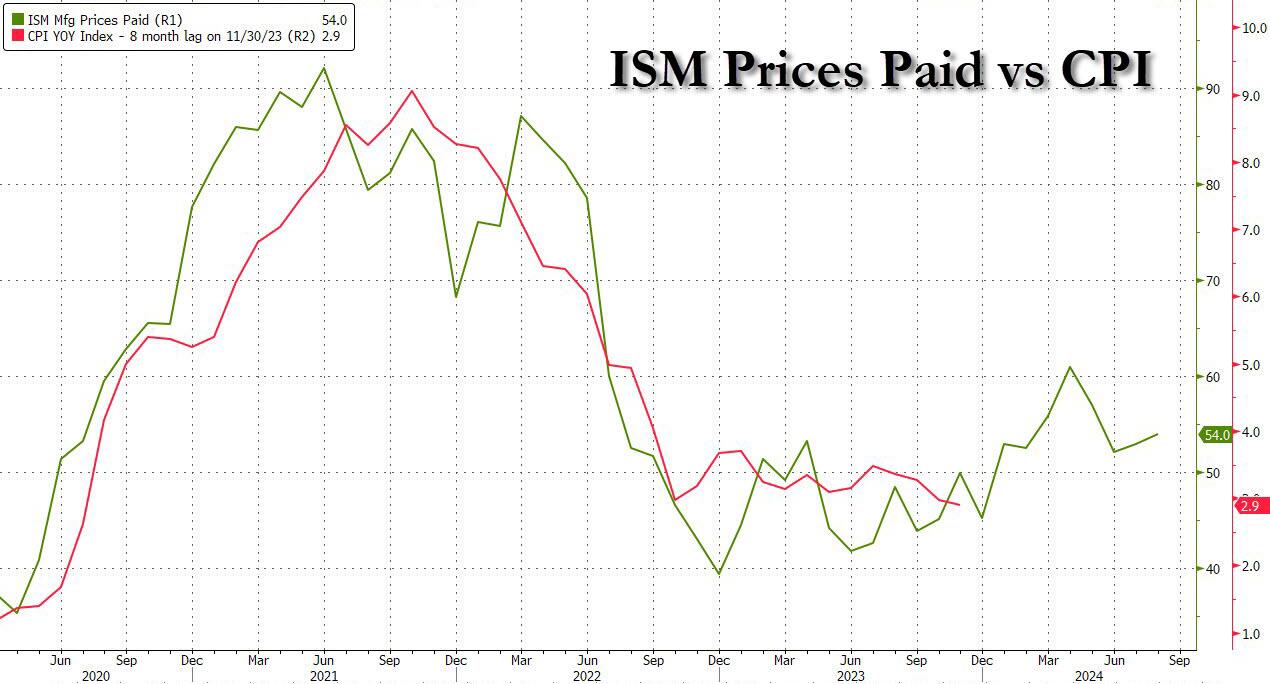

Amid this carnage, which was at least in part sparked by the a stagflationary ISM print, which saw employment and new orders tumble...

... while prices paid jumped, and hinted at a rebound in the CPI...

... coupled with absolutely devastating commentary from the US PMI report, which hinted not so much at a recession as a manufacturing depression...

“A further downward lurch in the PMI points to the manufacturing sector acting as an increased drag on the economy midway through the third quarter. Forward looking indicators suggest this drag could intensify in the coming months.

“Slower than expected sales are causing warehouses to fill with unsold stock, and a dearth of new orders has prompted factories to cut production for the first time since January. Producers are also reducing payroll numbers for the first time this year and buying fewer inputs amid concerns about excess capacity.

“The combination of falling orders and rising inventory sends the gloomiest forward-indication of production trends seen for one and a half years, and one of the most worrying signals witnessed since the global financial crisis.

“Although falling demand for raw materials has taken pressure off supply chains, rising wages and high shipping rates continue to be widely reported as factors pushing up input costs, which are now rising at the fastest pace since April of last year.”

... the one thing that actually did work was treasuries, with 10Y yields sliding almost 10bps and back to where they were just after the Aug 5 crash.

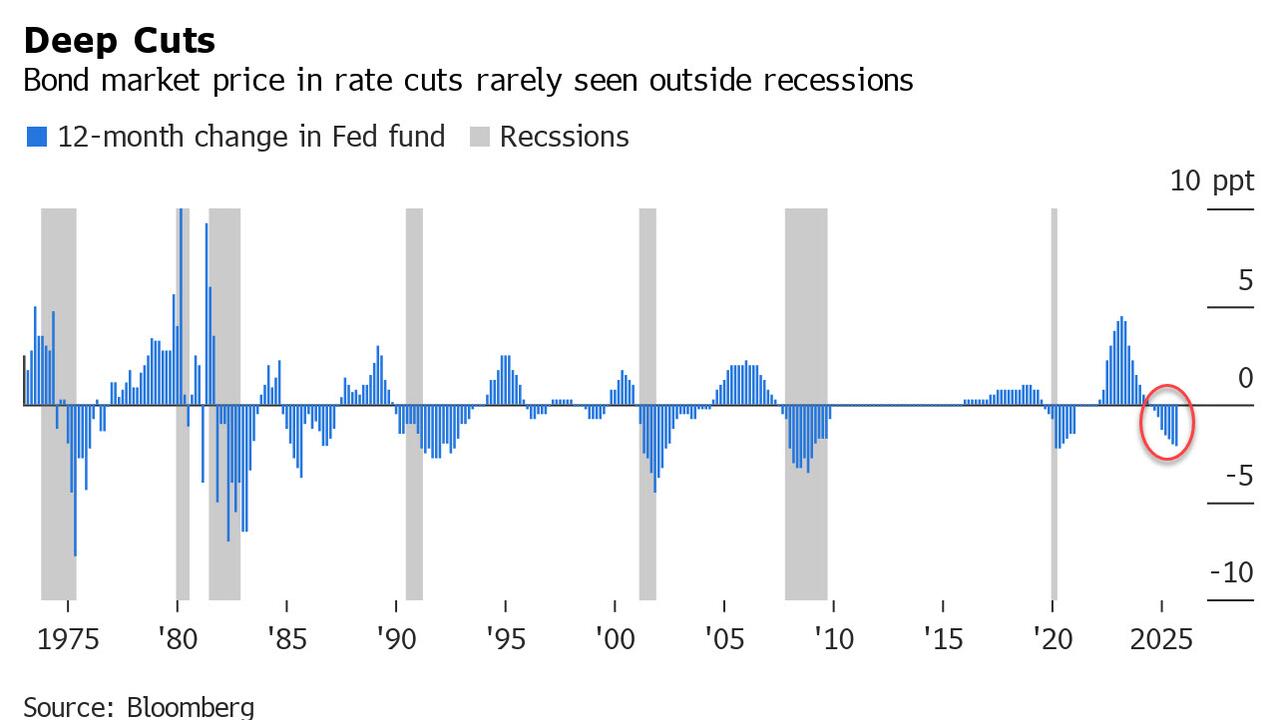

Yet while stocks - and bonds - have fully priced in more than 200bps of Fed rate cuts over the next 12 months, a pace of easing that is unheard of outside recessions, the risk or rather reality, is that on Friday the Kamala BLS will report a much stronger jobs number than most expect... and why not: the BLS already kitchen-sinked just how ugly the jobs market was with its 818K downward revision, so it can once again start making up numbers.

Putting it all together: today was brutal for most, but with the Nasdaq wiping out 3.1% or about 75% of its average September loss from the past decade in one trading day, it is likely that much of the pain is already in the history books. And we are confident that the BTFD crew will be up early tomorrow ready to start buying it all right back up...

More By This Author:

"Copper Rally Delayed": Goldman Slashes Forecast By $5,000 For Base Metal Amid China WoesUS Manufacturing ISM Signals Accelerating Stagflation As PMI Turns Downright Apocalyptic

Customers Are "Falling Out Of Love" With Airbnb

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more