Seasonal Strength: Dax’s Strong Year-End Rally

Germany’s business outlook worsened in November, with the Ifo index dropping to 85.7, lower than expected, due to political instability and concerns over potential US trade tariffs under a Trump re-election. The country faces a second consecutive year of contraction, compounded by weak industrial and automotive sectors. However, consumption remains a bright spot. Bundesbank President Nagel warned that Trump’s tariffs could cost Germany 1% of GDP, potentially leading to further economic shrinkage in 2025. However, with so much bad news priced in for the eurozone – from Russia/Ukraine risk, domestic political concerns, and tariff fears – is the Dax vulnerable to a move higher to end the year?

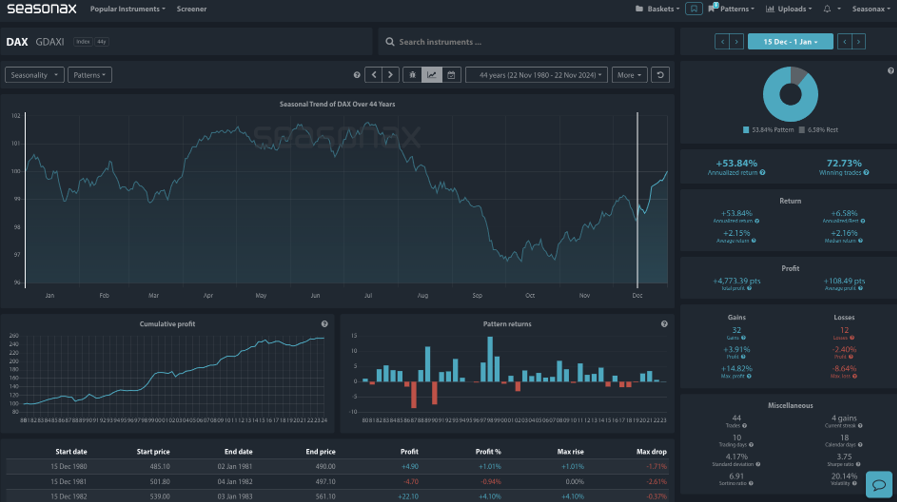

The seasonals for the DAX are certainly attractive, as indicated by the data. A 44-year historical analysis showcases a strong annualised return of +53.84% during the highlighted seasonal pattern from December 15 to January 1, with a remarkable 72.73% win rate. These figures suggest a historically favourable period for the DAX index, supported by consistent gains over this timeframe.

Key metrics include:

- Average Return: +2.15% (median: +2.16%), indicating stable and favorable outcomes.

- Profit Points: A cumulative total of +4,773.39 points over the recorded period.

- Winning Streaks and Ratios: Out of 44 trades, 32 were winners with a high gain-to-loss ratio. The maximum rise during this period is +14.82%, while the maximum drop is contained at -8.64%.

The cumulative profit chart emphasizes steady upward momentum during the highlighted seasonal window, reinforcing the index’s historical reliability in generating returns. Additionally, the volatility (20.14%) and Sharpe ratio (37.75) suggest that while the returns are attractive, risk-adjusted performance remains favorable.

(Click on image to enlarge)

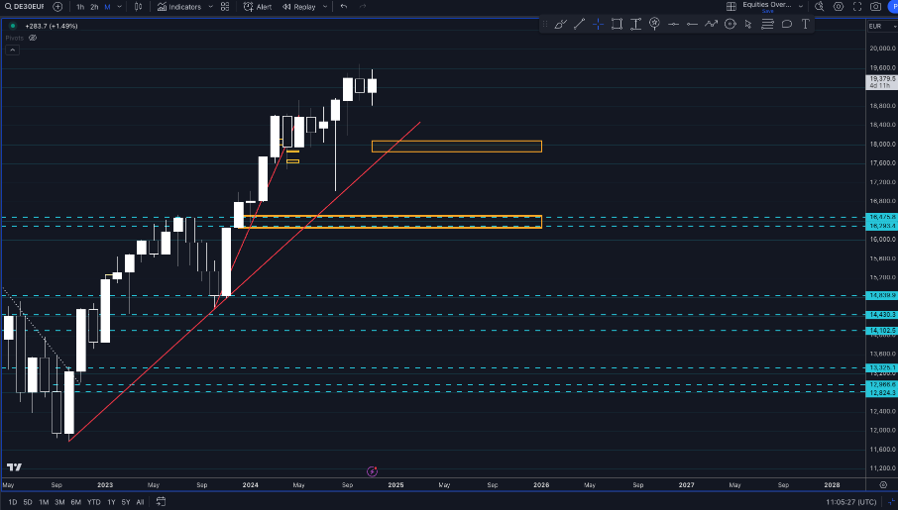

Technically, there are major support and resistance levels marked below on the DAX monthly chart which will provide natural target and turn around levels for the DAX. These are the noteworthy levels traders will be eyeing around the year end can be useful to help with targets and stop placements.

(Click on image to enlarge)

Trade risks

Past performance does not guarantee future results, and any seasonal play should be evaluated in conjunction with broader market conditions.

Video Length: 00:02:41

More By This Author:

Will NFP Increase The Case For A December Fed Rate Cut

Does The Market Say No To The Nasdaq For The Start Of December?

Is Nvidia A ‘Buy The Dip’ Post Earnings?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more