Seasonal Opportunities In The Dax

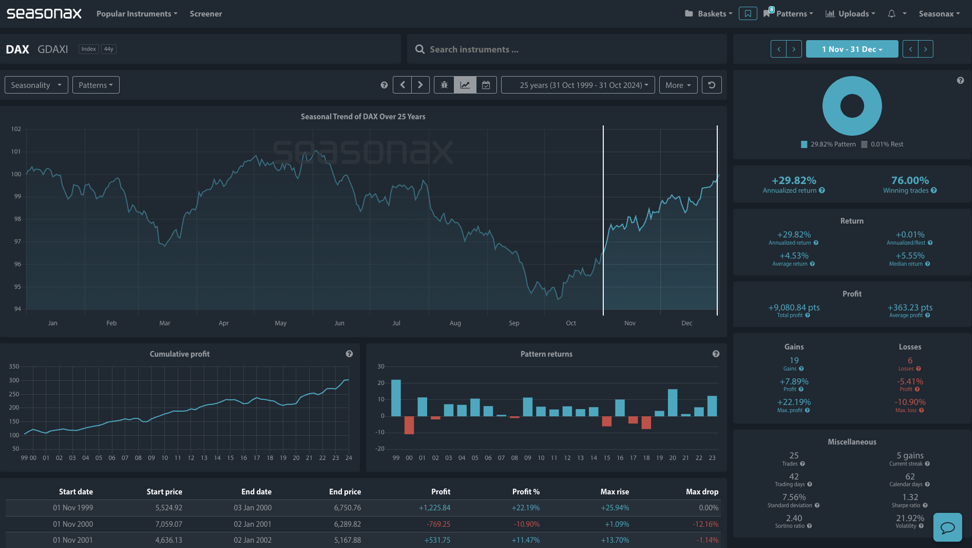

Analyzing the seasonal trend of Germany’s DAX index over a 25-year period, a clear pattern emerges, suggesting a strong, and well-known, seasonal opportunity from November to December. During this period, the DAX has demonstrated an impressive annualized return of 29.82%, with a 76% success rate in winning trades, which indicates the index has risen in 19 years during this period out of the last 25 years. So, it is a repeated seasonal pattern that canny investors are well aware of. The pattern also shows an ability to withstand some volatility, as shown by a maximum drawdown of 10.9% in some years. However, the maximum gains during this period have reached as high as 22.19%, which compensates for the downside risks.

(Click on image to enlarge)

So, once the US election risk on Tuesday this week is out of the way will we see the Dax take a rebound? Or if we see Donald Trump reach a second term will we see the DAX take another leg lower on US protectionist policies fear? Could that provide a deeper level for the DAX to find buyers?

Technically the Dax has a large support level at 18,000 which would be a key area for dip buyers to step in. It currently sits around 6.20% away from current prices, so that would still be a decent dip lower if price moves down there. It would also offer a good place to manage risk with a break below indicating the potential for more downside.

(Click on image to enlarge)

This analysis underscores a promising seasonal window in the DAX, particularly favourable for investors and traders seeking reliable patterns in equity markets. Given the solid historical performance, November and December may offer a strategic entry point for capitalising on this seasonal trend. If you trade the DAX, this is one seasonal pattern you need to be aware of.

Trade risks

While the seasonal outlook is favourable, risks remain. The US election is ahead and that is the most significant risk to this outlook. Remember, seasonal patterns do not repeat themselves every year.

More By This Author:

Will The Dollar Rise After The US Election?Remember, Remember The First Days Of November

The U.S. Dollar Index Reaction To Non-Farm Payroll Reports

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more