Russian CPI Spike Creates Case For Another 50bp Key Rate Hike

A higher-than-expected CPI of 6.0% YoY in May amid a strong recovery in consumer activity should reinforce inflationary concerns of the central bank. We raise our year-end 2021 CPI forecast to 5.0% and 11 June key rate forecast to 5.50%. With the CBR’s macro assumptions for 2021 still intact, the most likely key rate ceiling should be in the 5.5-6.0% range.

The Central Bank of Russia headquarters in Moscow

Inflationary pressure in Russia exceeds expectations

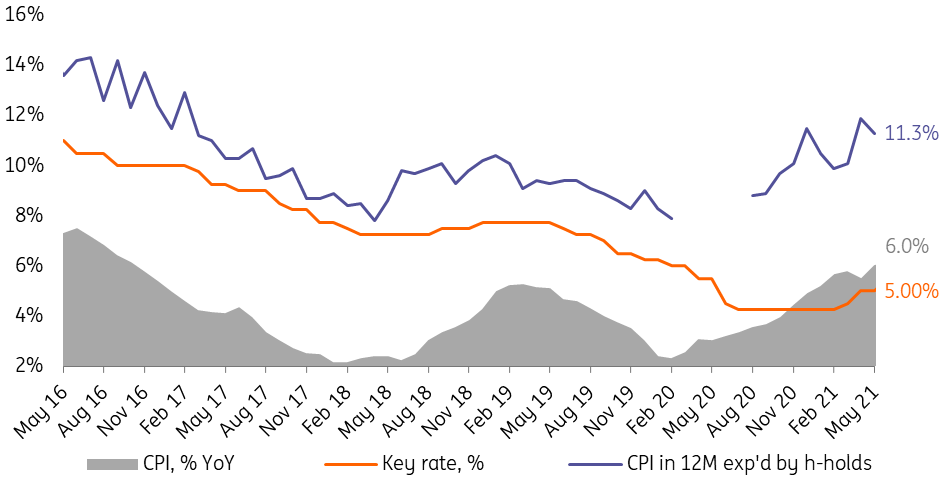

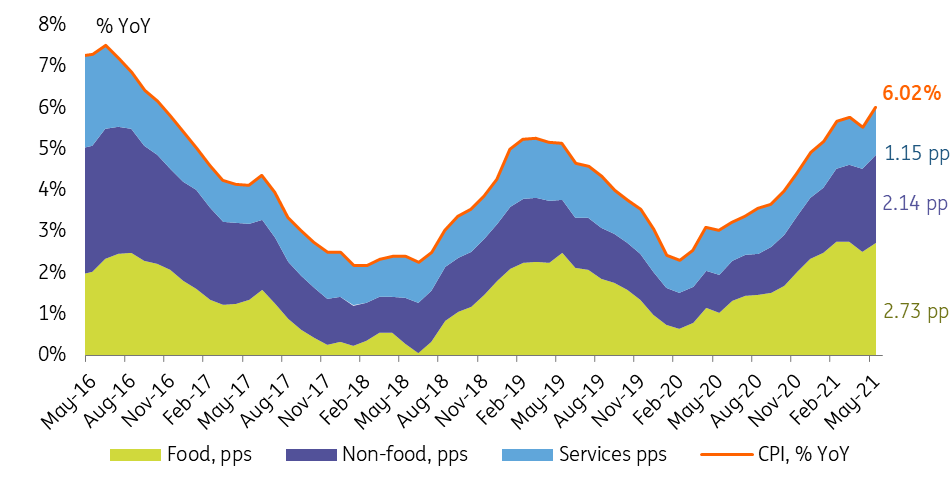

Russian CPI spiked by 0.5 percentage points to 6.0% year-on-year in May (Figure 1), which is a 4.5 year high. Last month's result exceeds the preliminary data by 0.1ppt and market expectations by 0.2ppt. The pick-up was assured not just by the lower base effect in the food segment, but also due to broad-based pressure in the non-food products segment, which contributed 2.1ppt to the overall CPI (Figure 2), the highest contribution in 4 years. The strongest price pressure was seen in construction material, related to the construction and renovation boom supported by the subsidized mortgage programme that has recently been prolonged. In addition, the services segment also saw some increased price pressure, mostly related to the local tourism expenses. The local tourism is likely to remain a pro-inflationary factor into the summer, as the outward tourism to Turkey is not available. Egypt is conjectured to be re-opening soon, which is unlikely to matter much given the off-season there.

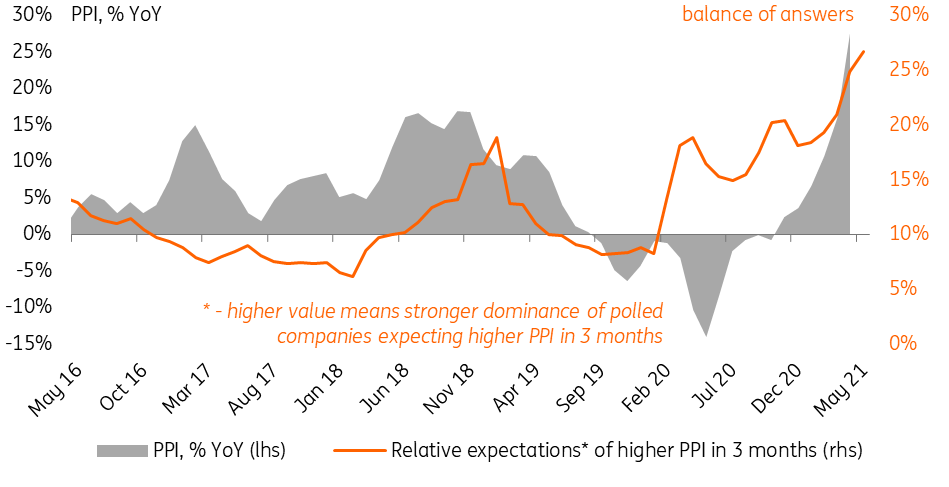

Taking into account strong local consumer recovery, spiking PPI (Figure 3), and global context of elevated inflationary expectations related to supply-side constraints (including those in semiconductor production), we raise our CPI expectations for the year-end 2021 to 5.0%.

Figure 1: CPI hit a new high of 6.0% YoY in May, consumers' inflationary expectations stable but elevated

Source: Bank of Russia, Rosstat, ING

Figure 2: Contribution of non-food CPI is the highest since 2017, suggesting broad-based pressure

Source: Bank of Russia, Rosstat, ING

Figure 3: Corporate inflationary expectations at historical highs, PPI close to 30% YoY

Source: Bank of Russia, Rosstat, ING

CBR is now probably leaning towards another 50bp hike this Friday, medium-term signal remains under question

The higher-than-expected CPI trend combined with a rebound in consumer lending growth amid still weak deposit dynamics should reinforce the Central Bank of Russia’s resignation to exit the loose monetary stance sooner rather than later. While until the end of last week we took a 25 basis point hike as our base case for the 11 June meeting, now we believe a jump to the 5.50% level in one 50bp step to be a more likely scenario.

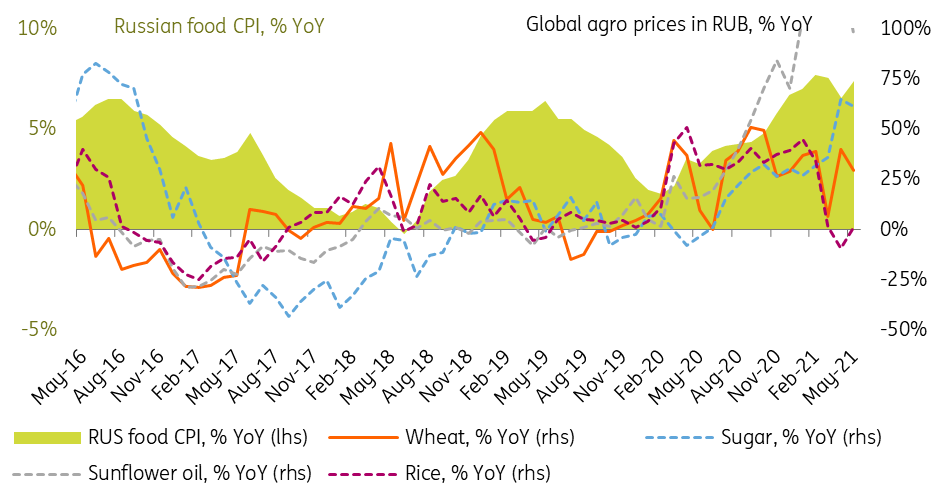

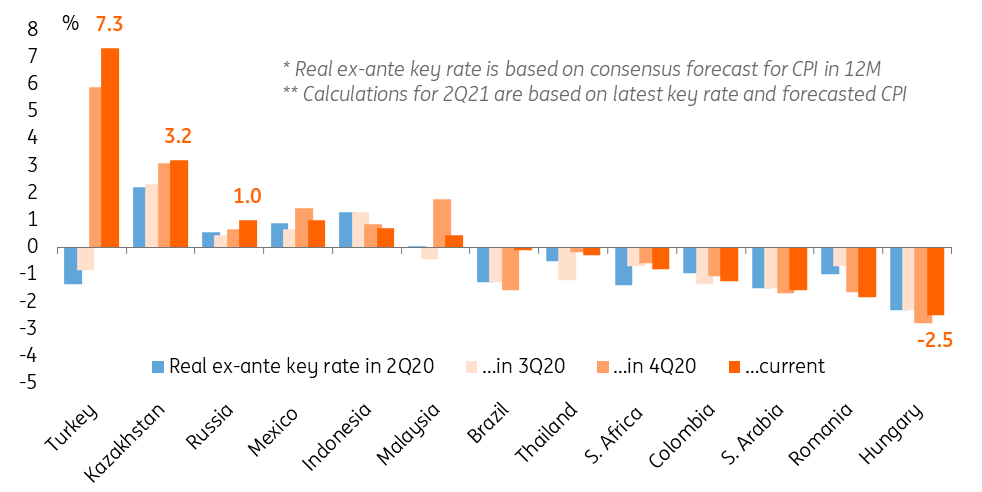

The medium-term key rate target, which we have so far seen at 5.50%, is now also under upward pressure. But we would not exclude that this Friday the CBR will accompany the rate decision with a softer medium-term signal. The current CPI and GDP dynamic is so far in line with the CBR’s forecasts for 2021 (4.7-5.2% and 3.0-4.0%, respectively), and those assume that the most likely nominal key rate ceiling for this year is within the 5.5-6.0% range. Assuming the eventual stabilization of the global agro prices (Figure 4), CPI should return to 4.0-4.5% by mid-2022, keeping the current real rate (based on expected CPI in 12 months) comfortably within the designated 1-2% range. This should keep Russian real rates among the highest in the peer space (Figure 5). Meanwhile, the balance of risks to that view is again leaning towards higher rates in case of continued negative surprises on CPI locally and in the EM space.

Figure 4: Global food price growth is still high, but is no longer accelerating

Source: Rosstat, Refinitiv, ING

Figure 5: Russian real rate is top-3 among peers, and is within the CBR’s neutral 1.0-2.0% range

Source: National sources, Refinitiv, FocusEconomics, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more