Romanian Inflation Continues To Soften

Image source: Pixabay

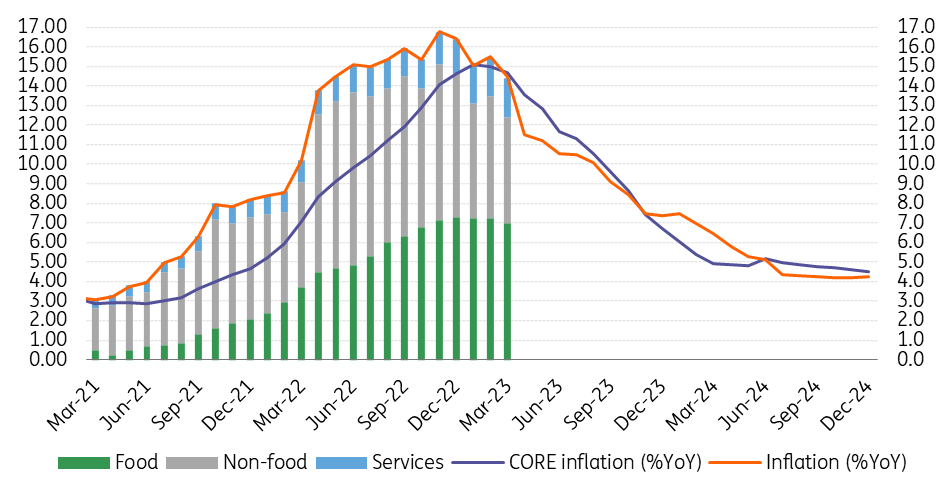

At 14.5%, March inflation printed a tad above the market’s 14.4% consensus and our 14.2% estimate. This doesn’t change the bigger disinflationary picture as we expect an approximate 3pp drop in April inflation and single-digit inflation by September. The central bank should be on hold for the rest of the year.

When it comes to our forecast error, this can be entirely put down to the category of “other vegetables and tinned vegetables”, where prices increased by a whopping 11.2% versus the previous month. This is by far the most rapid price increase since 2005 when our data series began. This item aside, inflationary developments in March were much in line with our expectations. Food prices were up 1.9% in monthly terms, non-food 0.4%, and services 1.1%.

Core inflation inched lower as well, toward 14.7% (from 15.1% in February) and we expect it to remain slightly above the headline for most of 2023.

Inflation (YoY%) and components (ppt)

Image Source: NSI, ING

For April, strong base effects are at play, and we estimate that headline inflation will drop by approximately 3 percentage points, to around 11.5%. The base effects refer mainly to energy prices which, back in April 2022, increased by a monthly 28.6% for electricity and 26.5% for natural gas. These increases will drop off the statistical base from this month. While this should be not a surprise to anyone, the magnitude of the inflation drop could still impress some market participants.

We maintain our December 2023 inflation forecast of 7.4% and 4.1% for the end of 2024.

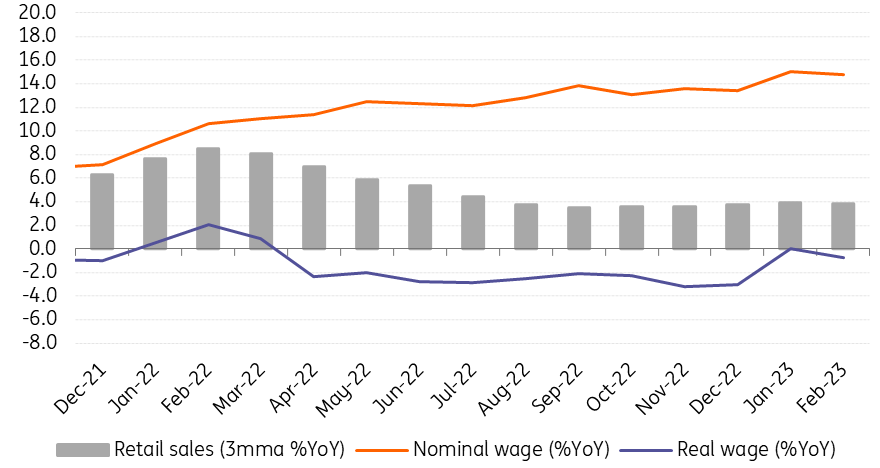

The labor market still looks impressively strong

As already underlined in our previous note, we remain slightly puzzled by the strength of wage growth in Romania. After advancing by 15.0% in January, the average net wage growth remains resilient at relatively high levels, printing at 14.8% in February. As the real wage growth remains marginally negative, one could say that inflationary pressures stemming from here are limited. While we (still) largely agree, it remains a somewhat tricky assumption if we corroborate the wage momentum with the descending inflationary profile and the approaching electoral year.

Wages holding up well

Image Source: NSI, ING

We expect the National Bank of Romania (NBR) to stay on hold for the rest of 2023. We expect the next move to be a rate cut in early 2024. In essence, the central bank has already switched to a looser policy stance by tolerating historically high liquidity surplus in the money market. This has been pushing market rates below the key rate even for tenors of up to 1 year and made the 6.00% deposit facility more relevant than the 7.00% key rate. This is not necessarily unusual from a historical perspective, as the local rates have often been decoupled from the key rate, but it is somewhat unexpected.

Since the highs of 2022, the relevant 3-month rate has gradually dropped by well over 100 basis points, with largely similar moves taking place in the FX swap market as well. This is quite noticeable policy easing which, given the descending inflation profile, looks more likely to be maintained than reversed. On the other hand, should any upward pressure on EUR/RON re-emerge, the liquidity situation could change rather quickly and cause a spike in short-term rates.

More By This Author:

FX Daily: Dollar Softening Through Some Big Psychological Levels

USD/JPY: Bracing For The Second Half U.S. Recession

Encouraging Signs In US CPI, But Fed Still Set To Hike In May

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more