Riksbank Opens The Door To May Rate Cut

Sweden’s central bank has left the door wide open to a May rate cut should inflation data continue to look better. We now think the Riksbank will move a month earlier than the ECB, where we expect the first cut in June. However, markets are already betting on a May move, and domestic monetary policy should remain secondary to external drivers for SEK.

The Riksbank kept rates unchanged at 4.00% today, in line with market and consensus expectations. The focus was on the tweaks in forward guidance, which were rather substantial compared to previous meetings.

Some divergence between rate path and dovish statement

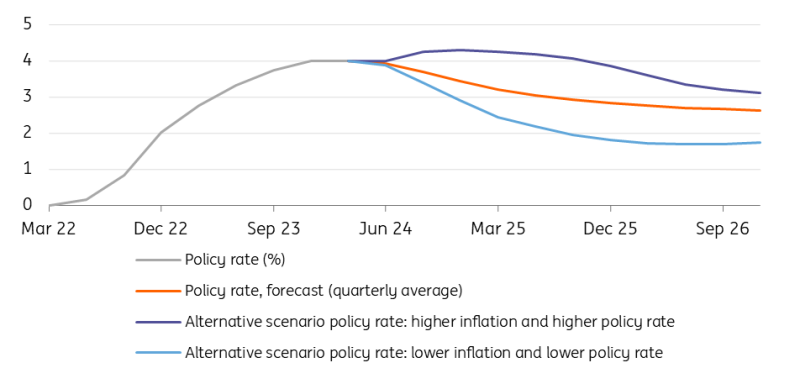

The latest Riksbank rate projections indicate a high probability of a rate cut in the second quarter and between two and three cuts overall this year. In other words, the published projections have rates averaging 3.93% in the second quarter and 3.44% in the fourth quarter, which is very close to our expectations ahead of the meeting and probably those of the wider market too. The longer-run profile is also interesting, and the central bank now has rates ending 2024 at 2.75%, a full percentage point below the November projections. The revision in the rate path did not constitute a dovish surprise by itself when compared to some already aggressive market expectations on monetary easing.

The Riksbank has also published two alternative scenarios for the rate path, with one including hikes and another with larger and faster rate cuts. That continues to signal some conditionality (i.e., inflation needs to move lower) for rate cuts moving ahead, but also that markets may remain reluctant to use these projections as anchor for rate expectations.

New rate projections - three scenarios

ING, Riksbank

The key surprise came from the statement, which clearly says “it is likely that the policy rate can be cut in May or June if inflation prospects remain favorable”. That seems to go further than the new rate projection and sounds like a more dovish message compared to the more general reference to first half cut in previous communication. That is because a potential cut in May would most likely be followed by another one in June, and 100bp in total by year-end.

No major inflation revisions, but a cut in May now increasingly likely

When it comes to other economic projections, CPIF inflation was not revised lower for 2024 (still at 2.3%) and was actually slightly higher (from 1.7% to 1.9%) for 2025. That arguably sounds a bit inconsistent with the dovish turn, even though core CPIF (excluding energy) was revised from 2.9% to 2.7% for 2024.

New economic projections

ING, Riksbank - In brackets: November projections

In short, it’s becoming clear from the dataflow that a 4% interest rate is increasingly unnecessary in Sweden. Inflation is coming down faster than expected, while the jobs market has weakened more appreciably than in the eurozone. Policymakers are acutely aware of the currency and the prospect of further weakness, which has been a major headache over the past couple of years. That helps to explain the reluctance to commit to too much easing this year in the new rate projection, and the statement lists SEK weakness among the major upside risks to inflation.

But ultimately, we think a May rate cut is now highly likely, assuming the inflation data continues to come in favorably and the currency doesn’t weaken materially. Our base case currently has four rate cuts in total in total this year and partly relies on our call for a stronger krona mostly on the back of a benign external environment.

Why SEK hasn’t taken the hit

EUR/SEK is trading at the same pre-meeting levels (11.47-11.48) at the time of writing, after a very short-lived spike to 11.50 when the statement was released. That may look a bit surprising given the more explicit dovish guidance offered by the Riksbank today, but we must consider that markets were already pricing in close to 70% implied probability of a May cut. That has been pushed to 85% (21bp) after the announcement.

Incidentally, the krona had already lost quite a lot of ground recently. Since the start of March, SEK has dropped around 2.4% against the euro and is the second-worst performing currency in G10 after CHF. Rising dovish expectations on the Riksbank have played a role, but the external environment is – and should remain – the primary driver of SEK. In our view, softer US data in the next couple of months and subsequent large Federal Reserve rate cuts pave the way for SEK appreciation down the road.

Our call remains that EUR/SEK will move below 11.00 in the second half of this year, mostly on the back of external factors (i.e., US rates). We count on the fact that the Riksbank will counter any potentially excessive pressure on SEK with a more hawkish policy or by deploying a new FX hedging program. However, in the short term – and crucially until new US and Sweden CPIF numbers are published in April – SEK continues to look rather fragile. Remember that SEK is no longer benefitting from the Riksbank hedging program that offered substantial support from September until January.

More By This Author:

Sentiment Is Slowly Improving For The Eurozone EconomyChina’s Economy Is Not In A Great Decline But A Great Transition

China: Industrial Profits Hit A 25-Month High Amid Signs Of Bottoming Out

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more